T2S and CBF Releases – Information on the production launch in June 2025 – Update IV

Note: This Announcement, originally published on 19 December 2024 and updated on 21 February 2025, 3 April 2025 and 26 May 2025, has been further updated because of the implementation of CR T2S-0797-SYS. Changes have been highlighted.

Clearstream Banking AG, Frankfurt1 informs clients about the TARGET2-Securities (T2S R2025.JUN) and the CBF Release in June 2025. According to the T2S Release Concept, the releases will be deployed on

the weekend 14 and 15 June 2025

for business day, Monday, 16 June 2025

T2S Release R2025.JUN – Scope

With the T2S Release in June 2025, nine Change Requests (CRs) will be introduced in production. They have already been approved at T2S Steering Level. In the event of urgency and if priority is given, further functional updates might be authorised by the Operational Managers Group (OMG). If such changes are announced by T2S, CBF will inform clients in due time.

With this Announcement, CBF informs clients about the scope elements for T2S Release R2025.JUN and indicates if the modification might impact CBF clients acting in ICP and/or DCP mode:

- Overview T2S Change Requests

The report attached shows nine approved T2S Change Requests (CRs). More details on these CRs can be found in the related ECB documentation2. - Problem Tickets (PBIs)

CBF regularly reviews the lists of pending PBIs provided by T2S. The analysis of the list published beginning-May 2025 shows that currently three T2S Problem Tickets (PBIs) might impact CBF’s clients operating in ICP or DCP mode. Another PBI affecting ICPs and DCPs has been postponed to be implemented with the T2S R2025.SEP release. Two further PBI can affect DCPs only. CBF recommends clients to check the PBI list attached. - Transition plan

The installation of the T2S Release into production is planned for the second weekend in June 2025. The deployment will be executed via the “Release Weekend Schedule”. In line with the deployment approach of previous T2S Releases, the schedule of the T2S Operational Day will be modified due to the implementation activities. The deployment will start once the end of day procedure (“T2S End of Day”) on Friday, 13 June 2025, has been completed. Beginning of June 2025, CBF aims to provide an indicative timeline for changes in the operational day during the deployment weekend.

The table below provides an overview of the important T2S milestones within the next months:

T2S Service Transition Plan

Activity for T2S Release in June 2025 | Date |

End of testing of R2025.JUN scope elements in Pre-Production | Tuesday, 27 May 2025 |

Market Infrastructure Board (MIB) approves the R2025.JUN deployment to Production | Tuesday, 3 June 2025 |

Deployment of R2025.JUN to Production | Saturday, 14 June 2025 |

T2S Release in June 2025 - Implementation timeline

T2S CR with potential client impact

The following CR complements the current scope of services and will be available to CBF clients after the implementation of T2S Release R2025.JUN. These changes do not require any software modifications in CBF's client-facing systems. However, CBF recommends clients to review the changes for any necessary adjustments in their operational procedures.

T2S-0797-SYS “T2S should support cross-border settlement via alternative Security CSD Links”

T2S aims to be a platform which facilitates cross-border settlement throughout all participating markets. However, T2S Actors can still not settle any security issued in one T2S CSD with any counterparty in other T2S CSDs. T2S-0797-SYS was designed to create new additional Security CSD Links for alternative settlement solutions where a direct settlement is not possible today because the security is made available via external intermediaries such as external CSDs, ICSDs or custodians.

T2S-0797-SYS has no impact on intra-CSD movements with all parties involved being clients to one T2S CSD (deliverer and receiver both CBF clients for instance). Only cross-border transactions are affected, especially those which still cannot be settled.

For one security, a T2S In-CSD can act in three different roles (see current Target2-Securities User Detailed Functional Specifications, p. 70ff.):

- As Issuer CSD that sets up and distributes the financial instrument on behalf of the issuer.

The Issuer CSD maintains the security in T2S CRDM (T2S static data system). Issuer CSDs are also responsible for the configuration of all links between Investor CSDs and Technical Issuer CSDs. - As Investor CSD that makes the security eligible for settlement in its home market. An Investor CSD may set up additional market-specific attributes to the security in T2S CRDM. Investor CSDs have an omnibus account with the Issuer CSD or another Investor CSD where it holds its position in the eligible security.

- As Technical Issuer CSD is an Issuer or Investor CSD chosen by another Investor CSD as omnibus account maintaining CSD for a security eligible for settlement in the Investor CSDs’ markets.

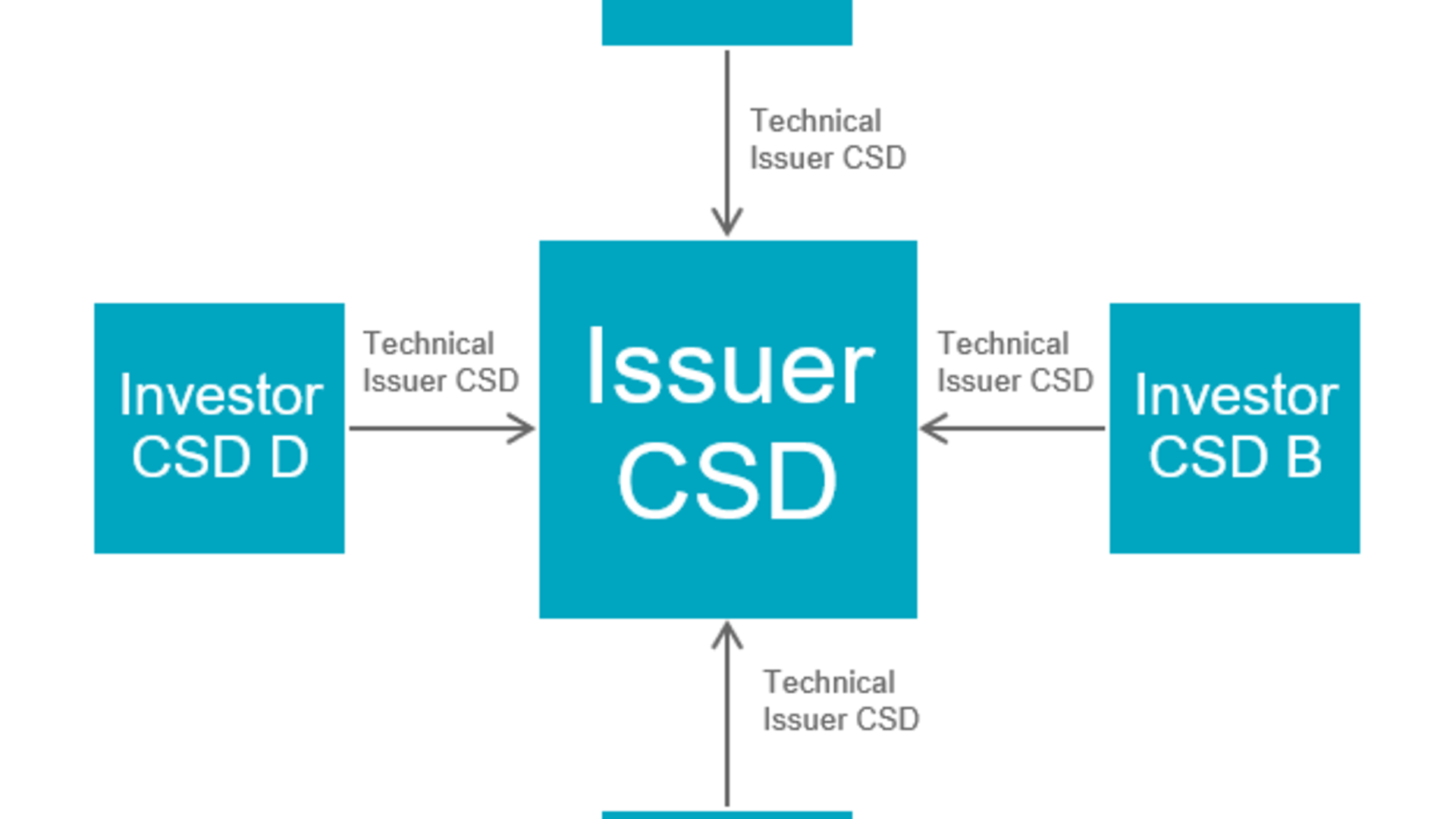

Today’s T2S cross-border settlement works well as long as all involved participants maintain a (relayed) link to the Issuer CSD for the security a transaction is to be settled in:

Direct link | Relayed link |

The Issuer CSD is the Technical Issuer CSD for all Investor CSDs. | The Investor CSD chooses another Investor CSD as the Technical Issuer CSD. |

|

|

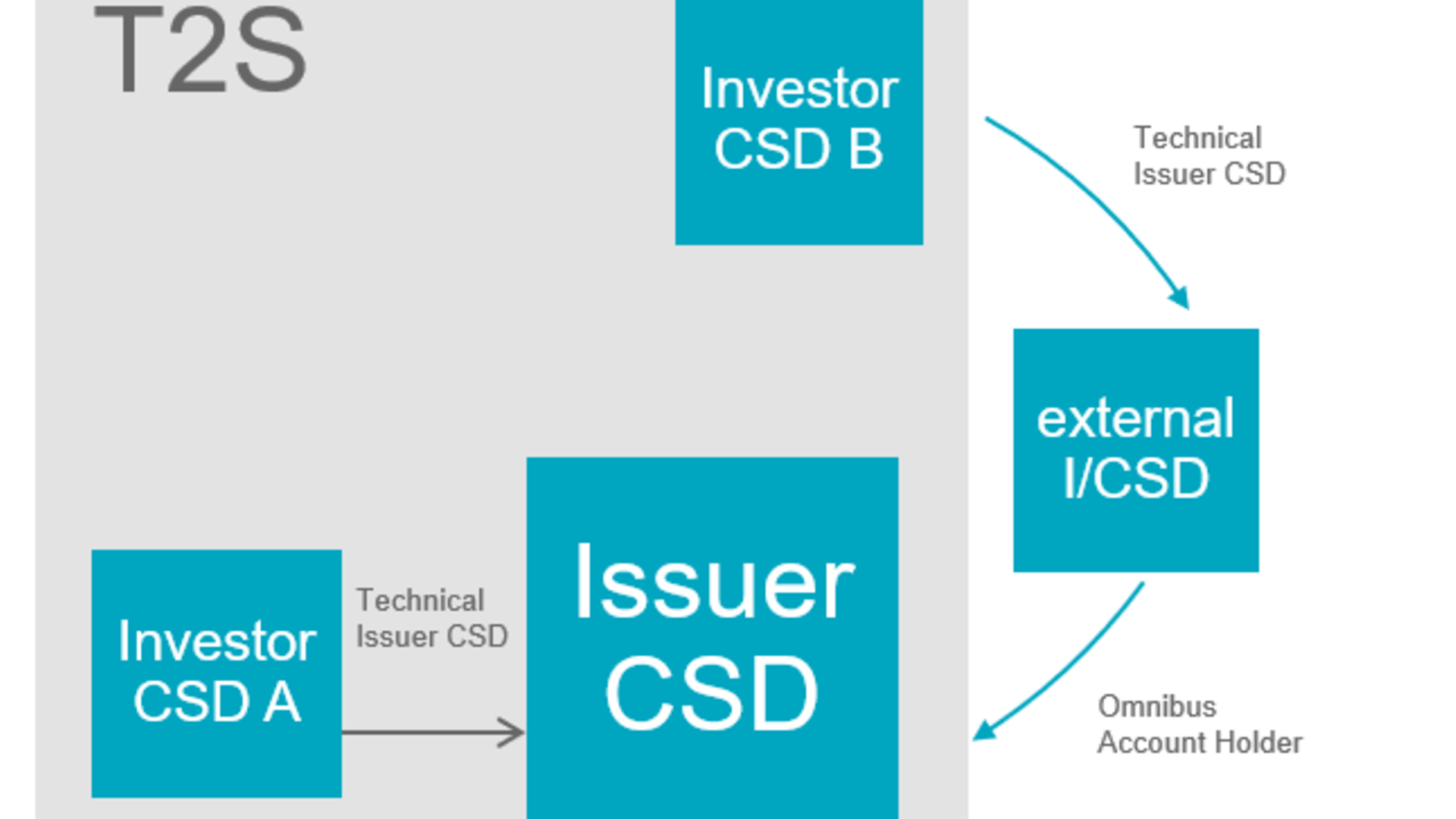

However, as soon as one of the Investor CSDs settles exclusively through an external CSD, ICSD or custodian and is not linked to the Issuer CSD, settlement between Investor CSDs is currently only possible with highly complex instruction details:

Examples are Italian or Austrian equities that Euroclear France settles through Euroclear Bank as an external ICSD. For these securities, Euroclear France has no link to Euronext Milan or OeKB CSD as Issuer CSDs of these equities.

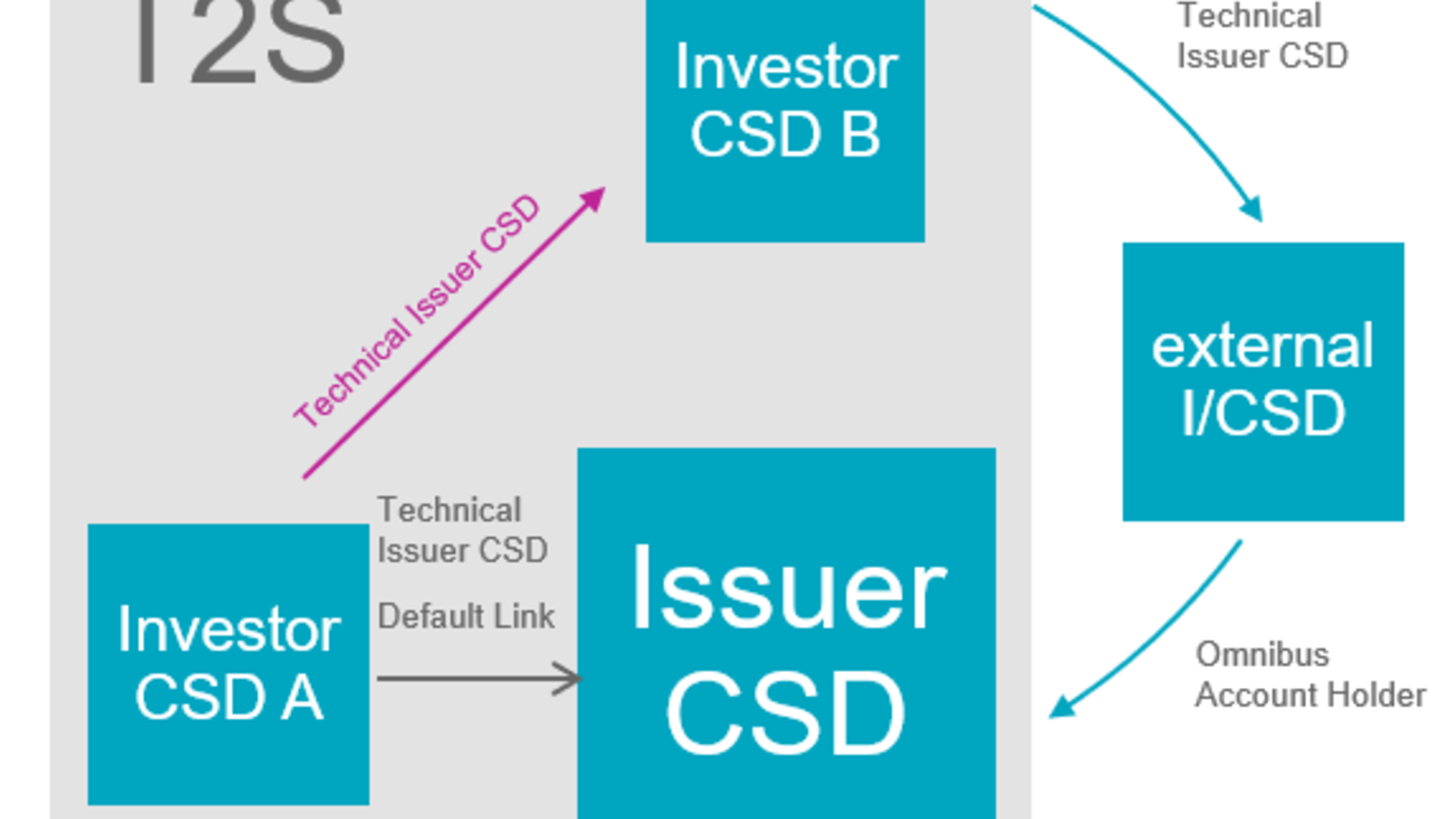

With this CR, T2S intends to allow Investor CSDs to choose more than one Technical Issuer CSD under the condition that they define one of the links to a Technical Issuer CSD as the default link.

In the case of a cross-border settlement, T2S will identify the CSD of the counterparty, verify whether a Security CSD Link to this Technical Issuer CSD exists, and then perform cross-border settlement via this Security CSD link. If no Investor type Security CSD Link with the CSD of the counterparty as Technical Issuer CSD exists, cross-border settlement continues not being possible.

Following the example above, parties of Investor CSD A will be able to settle transactions with parties of Investor CSD B and the Issuer CSD:

CBF will introduce with the Release in June 2025 a first pilot alternative Security CSD Link. From the release in June, the following Italian shares can be settled between CBF and Euroclear France via T2S:

Name | ISIN | WKN |

AZ LEASING S.P.A. EO -,50 | IT0004812258 | A2ABUP |

EDILIZIAACROBATIC | IT0005351504 | A2N9LC |

GLASS TO POWER A | IT0005454167 | A3DGYR |

SIPARIO MOVIES S.P.A. | IT0005380602 | A2PPZH |

INNOVATIVE-RFK S.P.A. EO1 | IT0005391161 | A2PXTQ |

ITALY INNOVAZIONI | IT0005336521 | A2PD8M |

MEXEDIA S.P.A. | IT0005450819 | A3C33K |

RACING FORCE SPA | IT0005466963 | A3C67T |

SOCIETA EDIT.IL FATTO | IT0005353484 | A2PFU6 |

SEMPLICEMENTE S.P.A. | IT0005072811 | A2AF37 |

TATATU SPA EO -,10 | IT0005507857 | A3DV0S |

CBF has implemented CR T2S-0797-SYS with the 2025 June release. However, the functionality will not be activated immediately due to ongoing discussions on tax issues with Euroclear France. Clients will be informed when the functionality becomes available.

CBF Release

CASCADE-RS: Internal Registered Shares (RS) Account Transfers (AA01P) in OneClearstream reporting

With the June 2025 release, CBF will introduce the reporting of Internal RS Account Transfers (ISO transaction code OWNE, instruction type AA01P, identical deliver and receipt account, not settled in T2S) in the OneClearstream reporting.

External RS Account Transfers (ISO transaction code OWNE, instruction type AA01P, different deliver and receipt account) and RS Position Transfers (ISO transactions code OWNI, instruction type AA01 B) are settled through T2S and are already today part of the OneClearstream reporting.

Transfer type | |||

Characteristics | Position transfer | External account transfer | Internal account transfer |

Transfer reason | Unregistering a position (to position type AWAS) | Beneficiary transferring to another bank | Change of reference within a bank |

ISO Transaction Code in CASCADE-RS | OWNI | OWNE | OWNE |

CASCADE instruction type | AA01 B | AA01 P | AA01 P |

Settlement in T2S | Yes | Yes | No |

Delivery and receipt account | Same delivery and receipt account | Different delivery and receipt account | Same delivery and receipt account |

Bookings in CASCADE-RS or in OneClearstream Reporting | One booking in CASCADE-RS, delivery and receipt in OneClearstream | Delivery and receipt in CASCADE-RS as well as in OneClearstream | One booking in CASCADE-RS, delivery and receipt in OneClearstream |

Table 1: CASCADE RS transaction types3

Whereas the CASCADE-RS reporting shows position and internal account transfers in one booking, the OneClearstream reporting displays a delivery and a receipt for each transfer.

Xact Web Portal

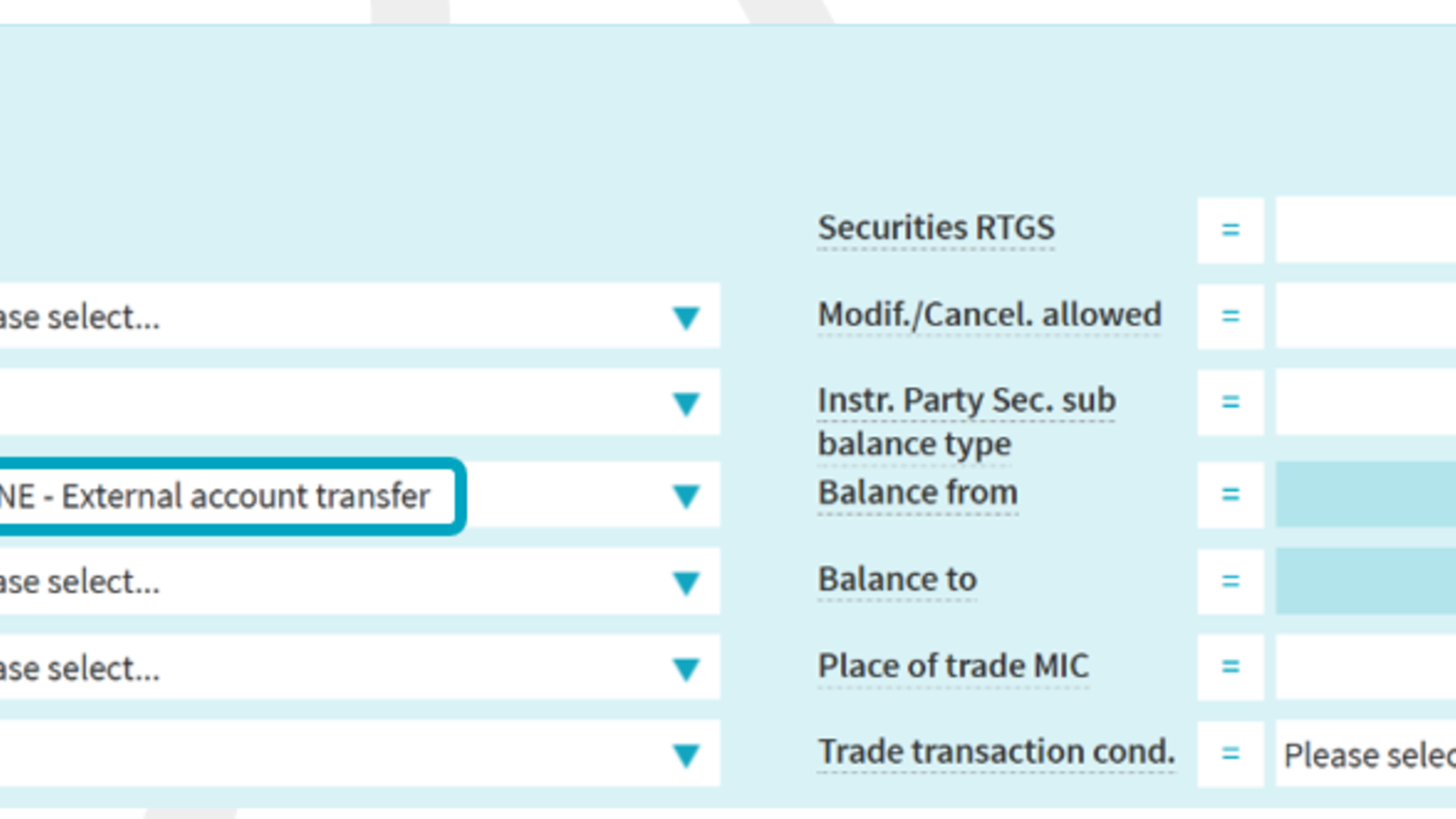

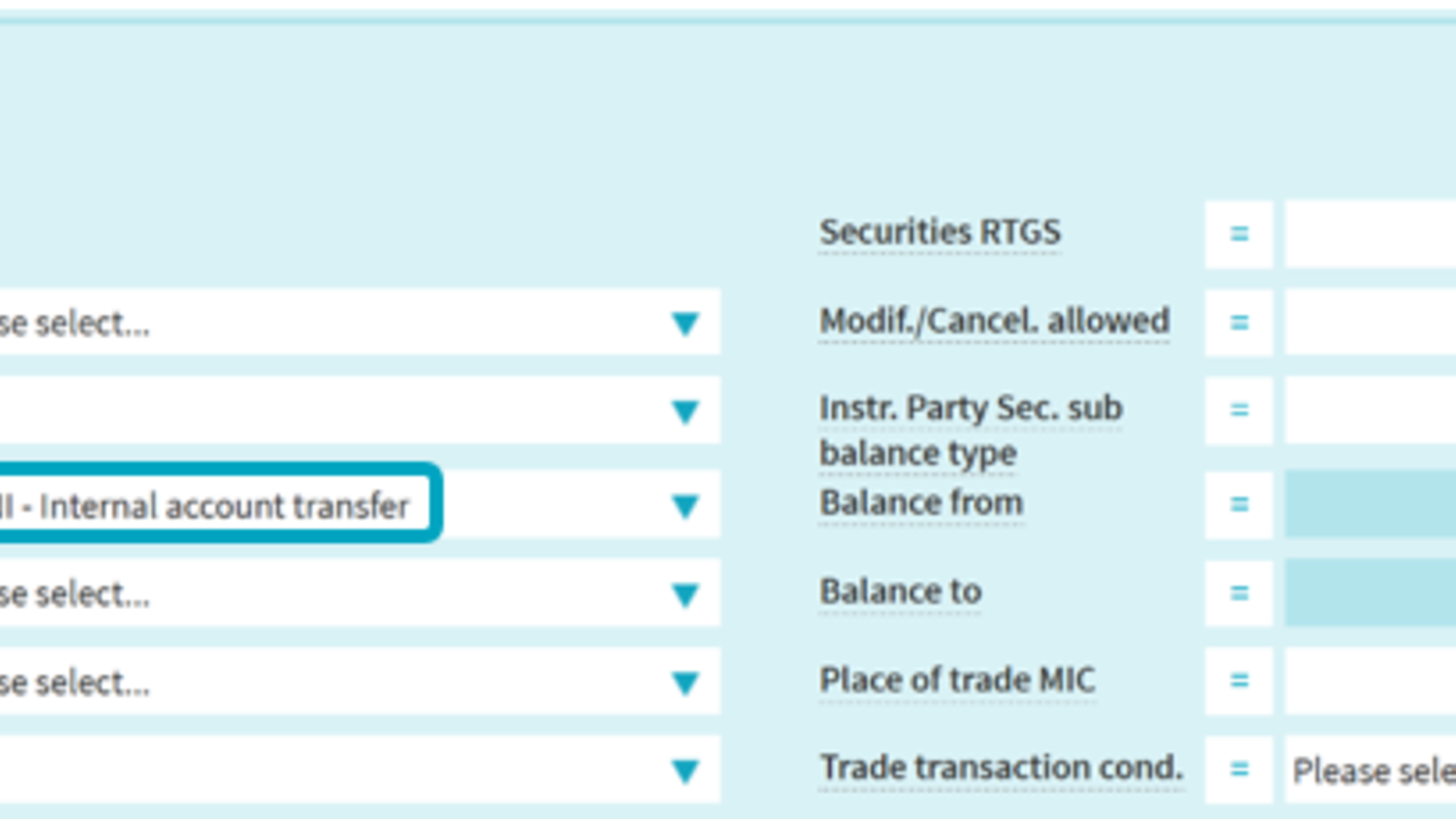

CASCADE-RS account transfers can be retrieved in Xact Web Portal with the selection criteria Sec. transaction type "OWNE - External account transfer" and as already matched:

The transaction type OWNE lists external as well as internal RS account transfers. CBF clients can identify the internal account transfers by the identical delivery and receipt account (GUT-Konto and LAST-Konto).

CASCADE-RS Position transfers can be retrieved in Xact Web Portal with the selection criteria Sec. transaction type "OWNI - Internal account transfer" and as already matched:4

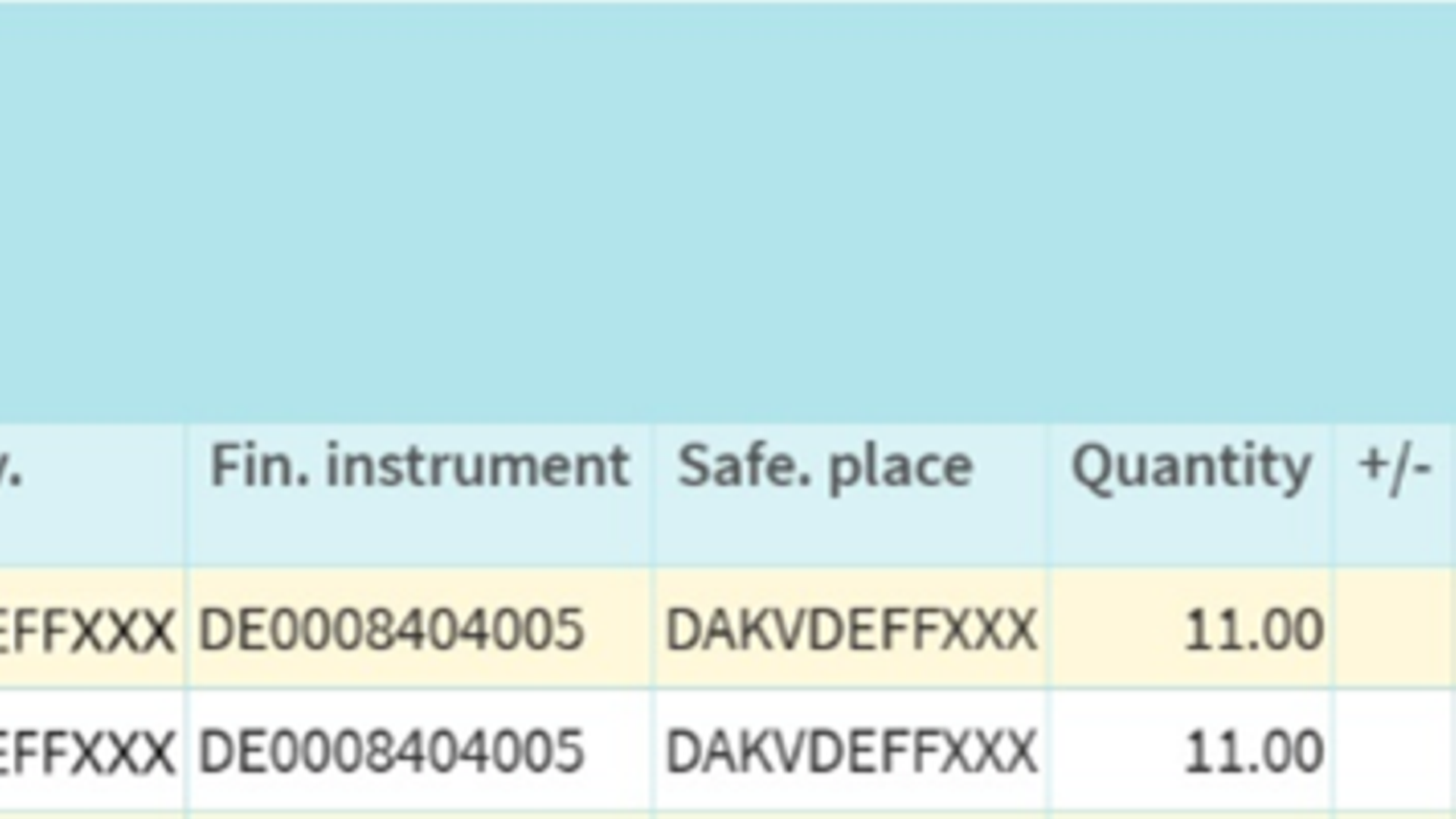

Example of a CASCADE-RS transfer with a delivery and a receipt for each transfer:

OneClearstream Settlement-Reporting ISO 15022 (MT54X)

CASCADE-RS account and position transfers can be identified by the following fields:

- :22F::SETR//OWNE or OWNI in Sequence E “Settlement Details”; and

- :13B::LINK/DAKV/DAKVDEFFXXX in the Subsequence A1 „Linkages“.

Just as in Xact Web Portal, subscribed clients receive for position and internal transfers a transaction confirmation for receipt and delivery, whereas the LIMA ISO15022 reporting for CASCADE-RS displays these transfers in one booking.

CARAD

Updated field name "Valuta-Datum" (Value Date) in the CSV files

With the release in June 2025, CBF will change a field name in the header of ordered CSV files.

The "Druckdatum" (Print Date) field will be renamed to "Valuta-Datum" (Value Date) because the CSV files are rarely printed. The date displayed in this field is in any case the value date of the listed stocks and not the creation date of the CSV file.

The content of the field will not change.

Termination of the „Bogenerneuerung“ (Coupon Sheet Renewal) service (TA270)

Last October, the “Wertpapier-Mitteilungen” (WM) froze the fields for the “Bogenerneuerung” (coupon sheet renewal). As a result, CBF dismisses the processing of the associated “Terminart” (corporate event type) TA270.

Taxbox: Changes to two data fields

The discussion in the Taxbox committee has shown that it is necessary to change fields 25 and 26 in the general part of the data structure as follows:

- In field 25 („Kennzeichen zur Feststellung verliehener Wertpapierpositionen“ – flag to indicate lent positions), the value NB („nicht bekannt“ – unknown) will not be available anymore; and

- Field 26 („Nominal der verliehenen Position“ – nominal of the lent position) will be completely removed.

Client simulation

In the light of the service update in the T2S functionality, clients may decide to enter regression test cases in the CBF Client Simulation environment (IMS23) in the period from 12 May to 13 June 2025. The already established static data for CBF accounts and the related connectivity settings in IMS23 remain unchanged. For regression testing, send an email to t2s-support@clearstream.com to be registered as tester and to receive more details about the simulation requirements.

The updated software for T2S Release R2025.JUN will be installed on Tuesday, 29 April 2025, in the T2S Pre-Production Environment (UTEST). A dedicated web page provides information on the availability of the CBF client simulation environment.

Further information

For further information, clients may contact Clearstream Banking Client Services or their Relationship Officer. Questions related to the technical connection can be addressed to Connectivity Support. Particular questions related to the production launch in June 2025 will be routed to and answered by the experts of the T2S Release Management.

------------------------------------------

1. This Announcement is published by Clearstream Banking AG (CBF), registered office at Mergenthalerallee 61, 65760 Eschborn, Germany, registered with the Commercial Register of the District Court in Frankfurt am Main, Germany, under number HRB 7500.

2. Details about the scope elements of the T2S Release are published on the ECB’s website. Currently, the list available reflects the status of July 2024.

3. For distinction details see Praxisführer für Namensaktien in CASCADE-RS Teil I (available only in German).

4. The query is not limited to CASCADE-RS as it will retrieve all instructions containing the OWNE or OWNI flag.