Exercise of tradeable rights and buyer protection

Buyer protection is a process whereby a buyer who has yet to receive the underlying securities from an elective corporate action, instructs the seller to receive the outturn of their choice.

The German market has decided not to introduce an automated buyer protection infrastructure. Instead, buyer protection is handled bilaterally in Germany. As a result, only market participants need to comply with T2S corporate actions standards on manual buyer protection.

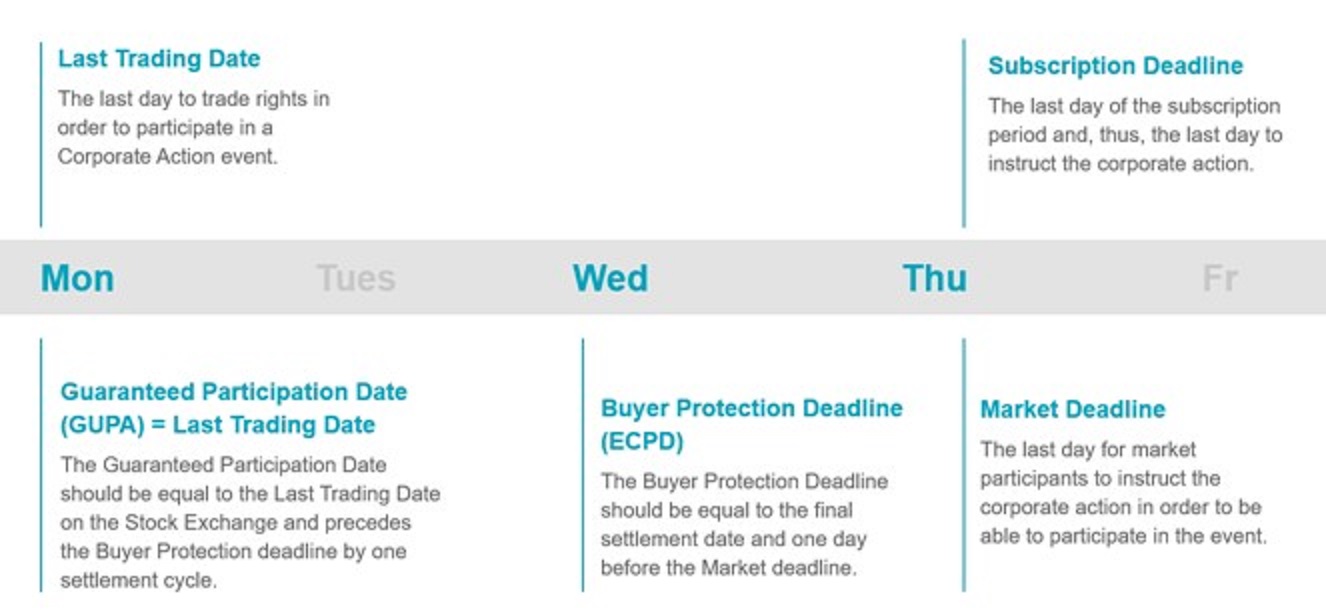

Part of this standard is the Buyer Protection Deadline, defined as being equal to the final settlement date and one day before the market deadline.

The typical German rights event has rights trading permissible until two days prior to the subscription deadline. Which means the Buyer Protection Deadline falls on or after the market deadline, contradicting the Corporate Action Joint Working Group (CAJWG) Standard.

That means the existing German market practice does not allow for CAJGW-compliant buyer protection deadlines.

Involving the German Market, Clearstream Banking has decided together with the Market Practice Committee, to further enhance the harmonisation activities and improve the compliance to the CAJWG and T2S Standards. Therefore, the time range between trading deadline and subscription deadline has been extended to three bank days.

Click to enlarge image

This allows for CAJGW-compliant Buyer Protection deadlines and will reduce operational risk associated with the last settlement date coinciding with the subscription deadline.

Clearstream Banking asks all issuers and agents to comply with the new standard German market practice.

This means that the respective event data must be set up as shown above, considering the legal minimum duration of the subscription period (14 calendar days).

Publication of the dates in the market should also be made accordingly.

If there are questions, please contact your Relationship Manager.