T2S and CBF Releases: Information on the production launches in November 2024 - Update II

Note: This Announcement, originally published on 3 June 2024 and updated on 29 July 2024, has been further updated to inform about the extended scope of the CBF release. Changes have been highlighted.

Clearstream Banking AG, Frankfurt,1 informs clients about the TARGET2-Securities (T2S) R2024.NOV and the CBF release in November 2024. According to the T2S Release Concept, the releases will be deployed on

the weekend 16 and 17 November 2024

for business day, Monday, 18 November 2024

T2S R2024.NOV – Scope

With the T2S Release R2024.NOV, five Change Requests (CRs) will be introduced in production. They have already been approved at T2S Steering Level. One CR (T2S-0804-SYS: „T2S Billing - amendments stemming from audit report“) has been withdrawn. In addition, the release will fix various malfunctions and close the related T2S Problem Tickets (PBIs). In the event of urgency and if priority is given, further functional updates might be authorised by the Operational Managers Group (OMG). If such changes are announced by T2S, CBF will inform clients in due time.

The following overview presents the scope elements for T2S Release R2024.NOV and indicates if the modification might have impact on CBF clients acting in Indirect Participant (ICP) and/or Direct Participant (DCP) mode:

- T2S Change Requests

At present, five CRs are scheduled for implementation by T2S. Please find all approved T2S Change Requests (CRs) in the list attached.

Based on the functional description provided by T2S, CBF identified the system requirements for November Release 2024. CBF aims to absorb the impact on clients acting in ICP mode as much as possible.

In the attached list, clients acting in (Cash) DCP mode will find additional information. More details on these requirements can be found in the related ECB documentation2. - Problem Tickets (PBIs)

CBF’s review of the latest list of pending PBIs, provided by T2S (as of end-October 2024), has identified eight tickets that might have impact on CBF’s clients operating in (cash) DCP mode. Three further PBIs can affect CBF clients operating in ICP or DCP mode (see attachment).

CBF’s assessment for these Problem Tickets shows that the fixes will not require software changes in CBF. Clients are recommended to validate these scope elements and check whether operational and/or functional modifications in their procedures are required. - Transition plan

The installation of T2S Release R2024.NOV into production is planned for the third weekend in November 2024. The deployment will be executed via the “Release Weekend Schedule”. As with the introduction of the previous T2S Releases, the schedule of the T2S Operational Day will be modified according to the implementation activities. The deployment will start once the end of day procedure (“T2S End of Day”) on Friday, 15 November 2024, has been completed. In the week before the implementation, CBF aims to provide an indicative timeline for changes in the operational day during the deployment weekend.

The table below provides an overview of the important T2S milestones within the next months:

T2S Service Transition Plan

Activity for T2S Release R2024.NOV | Date |

MIB approves the R2024.NOV deployment to Production | Tuesday, 5 November 2024 |

Deployment of R2024.NOV to Production | Saturday, 16 November 2024 |

T2S Release R2024.NOV - implementation timeline

T2S CR with potential client impact

The following CR complements the current scope of services and will be available to CBF clients after the implementation of T2S Release R2024.NOV. The changes do not require any software modifications in CBF’s client-facing systems. However, CBF recommends clients to review the changes for any necessary adjustments in their operational procedures.

T2S-0789-URD “Handling automatic cancellation for T2S External Transactions”

With the release 4.2 in November 2020, T2S implemented with CR T2S-0691-URD (“Recycling period of 60 business days for matched instructions”) an automatic cancellation of all pending settlement transactions after 60 business days have passed since their Intended Settlement Day (ISD) or the last status change (see Announcement D20010).

The rule applies to transactions with T2S Out-CSDs as well, even if those CSDs do not follow the same cancellation rules. In rare cases, this causes reconciliation problems:

- Transactions still pending with the T2S Out-CSD, but already cancelled in T2S, may cause penalties that the affected party cannot assign to a transaction in T2S.

- Transactions settled with the T2S Out-CSD, but already cancelled in T2S, cannot be settled in T2S anymore.

With CR T2S-0789-URD, the automatic cancellation process for matched settlement transactions after 60 business days since the ISD or the last status change, will be adapted to not cancel transactions of T2S Out-CSDs qualified as non-compliant to this rule and being the Issuer CSD of the security concerned.

Currently, CBF settles instructions for three T2S Out-CSDs:

1. CBL (Clearstream Banking Luxembourg)

Currently, CBL:

- Offers CBF clients with the link to CBL through account 4496 (BIC CEDELLULLCPI) the opportunity to settle instructions in selected Eurobonds and Finnish securities against CBL and Euroclear (EOC) counterparties (see International).

- Receives a cancellation advice from CBF, once T2S has sent a corresponding cancellation message to CBF to announce a T2S automatic cancellation. In these markets, CBL cancels only if confirmed by the affected CBL/CBF-i client.

- Allows matched instructions to settle beyond 60 days of pending on client confirmation.

CBL will be defined as a T2S Out-CSD non-compliant to the T2S rule for a recycling period of 60 business days for matched instructions. Consequently,

- T2S will not automatically cancel after 60 business days pending matched CBF instructions against CBL or EOC counterparties via account 4496 anymore.

- CBF transactions against CBL or EOC counterparties via account 4496 will only be cancelled by T2S upon cancellation requests of both parties involved.

2. DTCC (Depository Trust and Clearing Corporation, U.S. CSD)

Currently, DTCC transactions:

- Are settled in DTCC without matching ("dumps") if the receiving party does not reject them ("DK – don’t know"). In T2S, transactions are matched based on a counter-instruction generated by CBF.

- With the DTCC participant as receiver of the shares and matched in T2S, but not settled because of being on hold (function PREA) or a lack of deliverable securities, are automatically cancelled by T2S after 60 business days.

- With the DTCC participant as deliverer of shares and left open in T2S, are cancelled by CBF with the CASCADE end of day process.

- Against CDS (Canadian central depository, so-called north- or southbound flips) have extended reclaim rights and can remain open in CDS.

DTCC will be defined as a T2S Out-CSD non-compliant to the T2S rule for a recycling period of 60 business days for matched instructions. Consequently,

- T2S will not cancel pending matched DTCC instructions after 60 business days anymore.

- DTCC transactions with T2S will only be cancelled upon cancellation request received from the instructing party (DTCC or CBF client).

3. SIX SIS (Swiss Infrastructure and Exchange & Swiss Invest Selection, Swiss CSD)

Currently, SIX SIS:

- Acts as T2S Out-CSD only for transactions in Swiss securities against Swiss Francs (CHF) or optionally free of payment.

- Leaves as T2S Out-CSD pending matched OTC deliveries open until cancelled by one instructing party or automatically by T2S, whereas receipts are automatically cancelled twenty calendar days after the requested settlement date (ISD).

- Receives a cancellation advice from CBF, once T2S has sent a corresponding message to CBF for a T2S automatic cancellation.

SIX SIS will be defined as a T2S Out-CSD compliant to the T2S rule for a recycling period of 60 business days for matched instructions. Consequently, the current procedure will not change with the implementation of CR T2S-0789-URD.

CBF Release

Enhancements of the OTC Recycling Procedure

With the CBF release in November 2018, the recycling process for non-CCP stock exchange transactions (see D17011), which automatically resends instructions to T2S previously rejected due to missing securities master data, was extended to OTC instructions.

With the CBF release in November 2024, the recycling process will be simplified as follows:

The OTC recycling process is applied to instructions that:

- are not linked to any other instruction; and

- are sent via Swift, MQ or File Transfer and show the flag TRAD in field 22F (Type of Settlement Transaction Indicator, :22F::SETR//TRAD); or

- via Xact with "Securities Transaction Type" TRAD; or

- via CASCADE Host with TRAD or without ISO transaction code; or

- via D7 and show the flag ISSU in field 22F (Type of Settlement Transaction Indicator, :22F::SETR//ISSU).

Settlement reporting of the original reference

After the release in November, CBF will transmit to T2S the own references self-assigned by the initiators in ICP mode in the Swift field :20C::SEME// or as AUFTRAGSREFERENZ in CASCADE Host in an additional field. All OTC instructions are affected (including CCP instructions).

Nothing changes in the CBF Legacy reporting via LIMA. CBF clients can still find their original reference in the Swift field :20C::RELA/. However, since this field is used for other purposes in the OneClearstream reporting, the order reference will appear there in the following fields:

Xact Web Portal

or

OneClearstream Settlement Reporting ISO 15022

- MT548 (Settlement Status and Processing Advice)

Sequence B1: :20C::PROC// of the MT548 for Party SEQ B1::95a::DEAG or

Sequence B1: :20C::PROC// of the MT548 for Party SEQ B1::95a::REAG - MT54X (Settlement Confirmation)

Sequence E1: :20C::PROC// of the MT54x for Party SEQ E1::95a::DEAG or

Sequence E1: :20C::PROC// of the MT54x for Party SEQ E1::95a::REAG

CBF clients who receive their reporting in DCP mode will find their original reference in the following fields of the T2S reporting:

- Instruction (copy) (sese.023)

SctiesSttlmTxInstr/DlvrgSttlmPties/Pty1/PrcgId / or SctiesSttlmTxInstr/RcvgSttlmPties/Pty1/PrcgId - Status reporting (sese.024)

SctiesSttlmTxStsAdvc/DlvrgSttlmPties/Pty1/PrcgId / or SctiesSttlmTxStsAdvc/RcvgSttlmPties/Pty1/PrcgId - Settlement confirmation (sese.025)

SctiesSttlmTxConf/DlvrgSttlmPties/Pty1/PrcgId / or SctiesSttlmTxConf/RcvgSttlmPties/Pty1/PrcgId

Like this, it will be possible in the OneClearstream and in the T2S reporting to find the self-assigned order reference of the instructions sent as ICP3. The aim is to offer a seamless reconciliation of the settlement feedback for instructions set up in T2S by CBF (DAKVDEFFXXX as "Instructing Party") and hence with a CBF reference. These are the following types of instructions:

Type AA | Text | Meaning |

01 | WP-UEBERTRAG/REPO-AUFTRAG (securities transfer/repo-order), AA01 B | Securities transfer free of and against payment/repo-order against payment, in this case only Registered shares account transfer |

03 | SV-UEBERTRAG (SV TRANSFER) | BSV/LSV transfer |

16 | EINLIEFERUNG (Deposit) | Deposit |

18 | AUSLIEFERUNG (Withdrawal) | Withdrawal |

MT548 reporting for opt-out/cum-ex unmatched transactions

Along with the Swift release, which will be implemented contemporarily with T2S R2024.NOV and the CBF 24.11 release, CBF will align its MT548 reporting (Settlement Status and Processing Advice) with the current Swift standards.

When using the CASCADE match error functionality to let the counterparty know about a mismatching in the settlement instruction field :22F::TTCO//4!c (Trade Transaction Condition Indicator), the following codes will be used:

- NOMC for an opt-out

(excluding the transaction from market and reverse claims and transformations) - XCPN for ex coupon and CCPN for cum coupon

(trade price excluding or including the coupon payment)

MT548 messages currently show the following details:

:16R: REAS

:24B: :NMAT/DAKV/TTCO

:70D: :REAS///SETS 000/MATS 075 or 076/PROS 413/PEND FUTU

:16S: REAS

The codes correspond to:

- 075: Deviating opt out flag

- 076: Deviating cum/ex flag

After the release, MT548 messages will report a opt-out/cum/ex mismatching as follows:

:16R: REAS

:24B: :NMAT/DMCT

:70D: :REAS///SETS 000/MATS 075/PROS 413/PEND FUTU

:16S: REAS

and

:16R: REAS

:24B: :NMAT//DCMX

:70D: :REAS///SETS 000/MATS 076/PROS 413/PEND FUTU

:16S: REAS

The new codes correspond to:

- DMCT: Disagreement on automatic generation of market claim or transformation (CASCADE matching error message code 075)

- DCMX: Disagreement if trade was executed cum or ex (CASCADE matching error message code 076).

The values in field

:70D: :REAS///SETS 000/MATS 075 or 076/PROS 413/PEND FUTU

are not affected.

Reporting of transformations for corporate actions processed by KADI

With the Swift release in November 2024, Swift will decommission the ATXF indicator (subject to transformation) in field 22F::ADDB// of Sequence C in MT566 (Corporate Action Confirmation) messages, because a corporate action reporting of transformations is not in line with the requirements of the „Corporate Actions Joint Working Group" (CAJWG, the committee developing corporate actions processing standards).

Consequently, KADI will also decommission MT566 messages for transformations in cash or securities resulting from reorganisations (event types TA13x/22x/23x), for example for Swiss or U.S. securities. However, CBF clients will still be informed about detected transformations by MT564 REPE messages (Corporate Action Notifications indicating the eligible balance). Transformation bookings will only be reported via cash and settlement messages, that is, settlement confirmation messages MT544-47.

Already today, transformations due to reorganisations in securities subject to OneClearstream Asset Servicing (OneCAS) are confirmed by standard cash and settlement reporting.

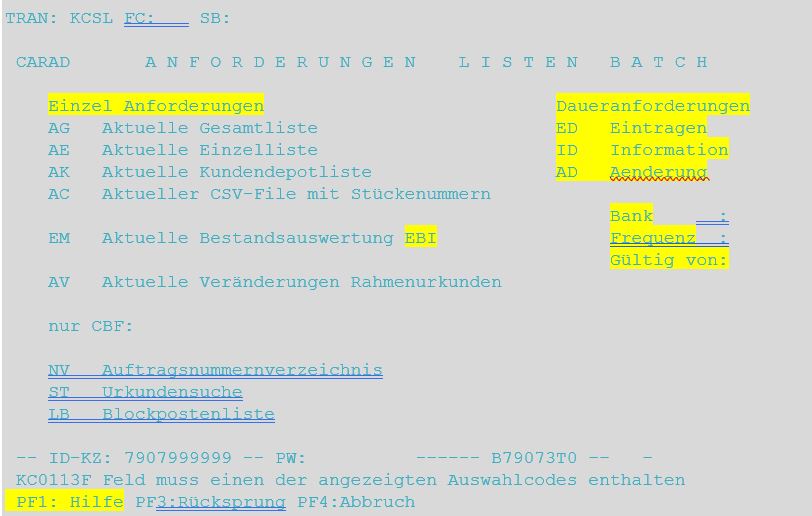

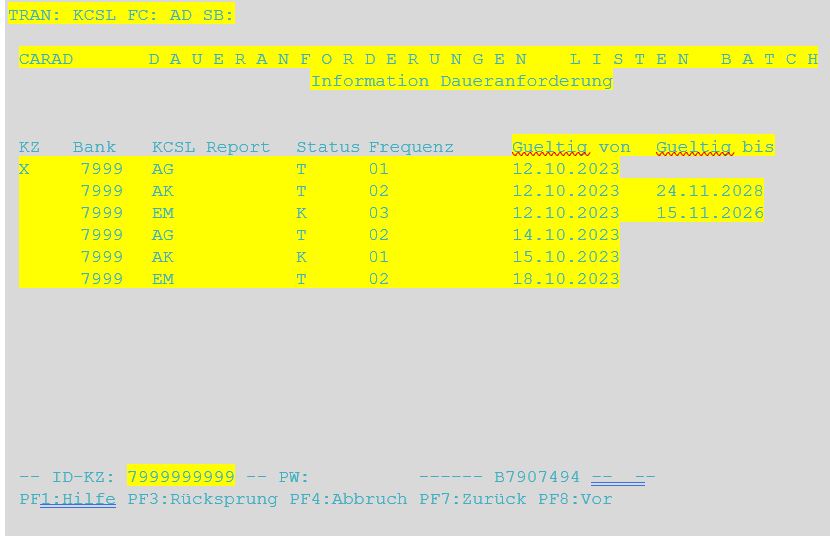

CARAD - Issuing Agent recurring report orders

With the CBF release in November 2024, issuing agents ("emissionsbegleitende Institute", EBIs) will be given the opportunity to set up standing orders for the following lists:

- List of all certificate numbers ("Gesamtlisten", AG);

- Current holdings evaluation of issuing bank ("Bestandsauswertungen", EM); and

- Changes to global certificates ("Veränderungen von Rahmenurkunden", AV).

(in brackets the German definition and the functional code used in the KCSL menu to request the one-time lists).

The lists will be delivered with the following frequency to Xact Web Portal:

- Daily (code 01);

- Monthly (code 02); or

- Quarterly (code 03).

The content and format of the lists will not change compared to the one-time lists that are currently available. The lists can be generated for all T2S settlement days (details of the "T2S Holiday Calendar are available under T2S and T2 downtimes on public holidays). Clients can set up standing orders in the enhanced CARAD menu KCSL under the functional codes:

- ED (setup);

- ID (information); and

- AD (change).

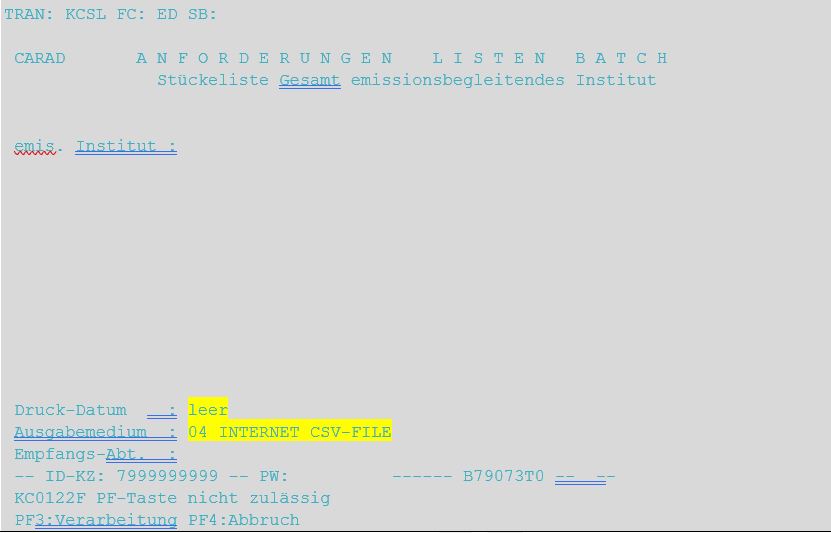

For this purpose, the KCSL screen mask is adjusted as follows:

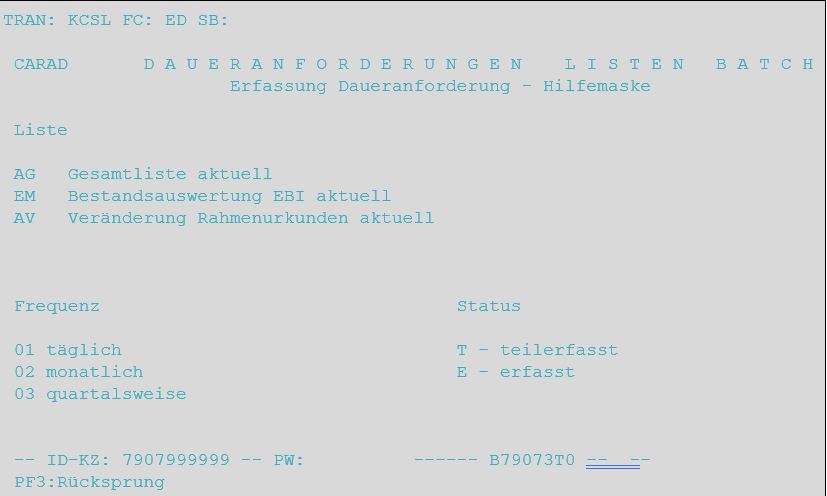

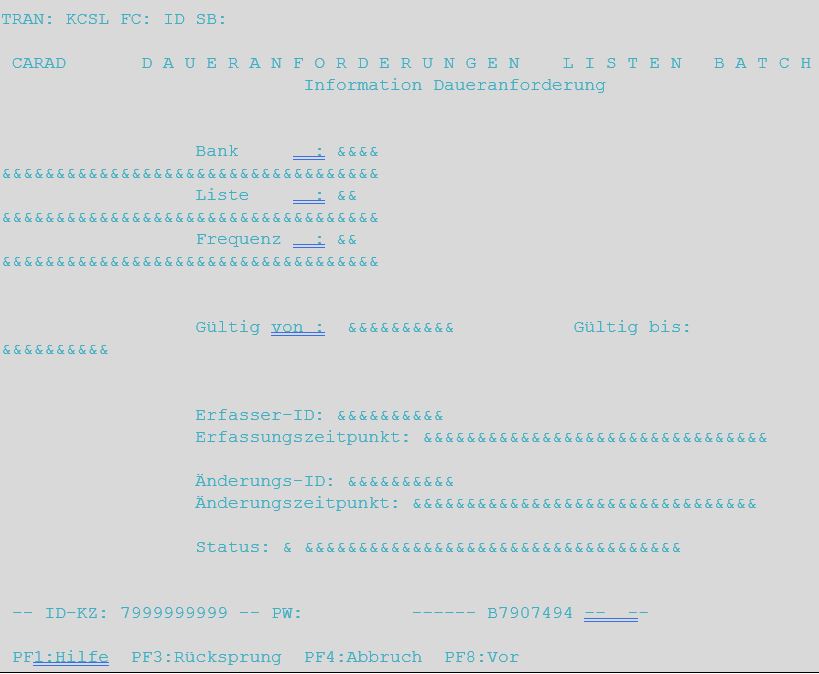

The "Bank:" field is pre-filled with the master account of the logged-in CARAD user (corresponding to digits 1-4 in the "ID-KZ:" field). The "Frequenz:" (see codes 01-03 above) and "Gültig von:" fields can only be filled in for the function codes ID and AD. The PF1 button opens the following help menu:

The status "T - teilerfasst" refers to standing orders where not all mandatory fields filled and are therefore only temporarily recorded. If not completed, these orders will be deleted after three T2S settlement days.

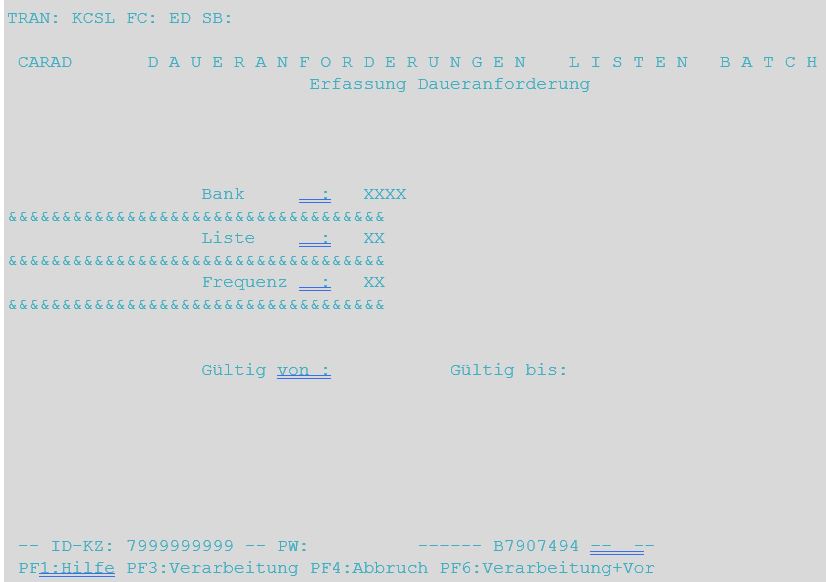

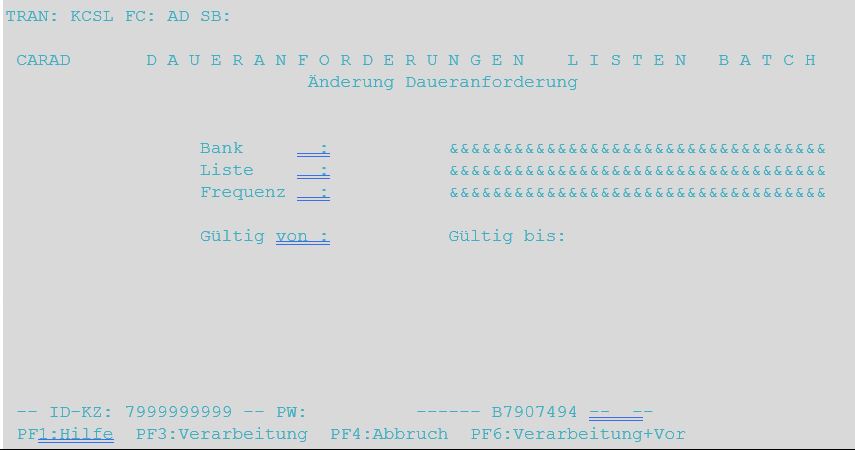

The new menu for entering standing orders will look like this:

The "Bank:" and "Gültig von:" fields are pre-filled with the master account of the logged-in CARAD user (according to digits 1-4 in the field 'ID-KZ:') and with the next T2S settlement day. The list and frequency selection is displayed on the help screen (see above: AG, EM and AV or 01-03).

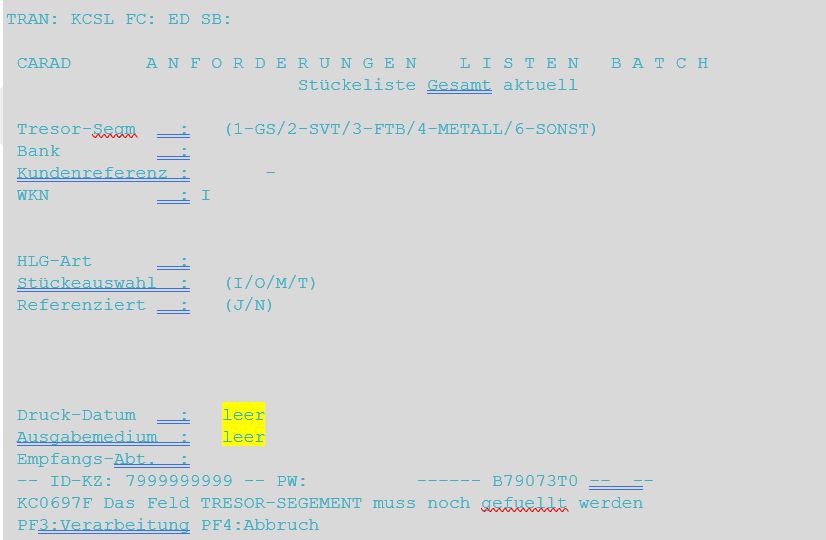

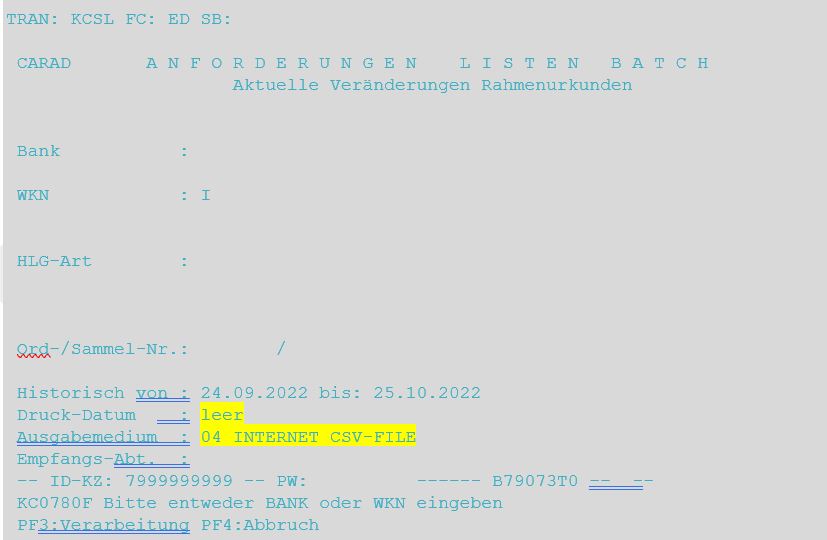

The PF6 function key is used to save the previous entries and displays the following screens, depending on the subselection (AG, EM or AV):

- List selection AG

- List selection EM

- List selection AV

Except for the "Druck-Datum:" (date of print) and "Ausgabemedium:" (output channel) fields, the same validation rules apply as for the previous one-time orders. For standing orders, the "Druck-Datum" field is left blank because it is defined by the frequency of the standing order. The "Ausgabemedium" field is pre-filled with "04 INTERNET CSV-FILE" for the selection EM or AV, whereas the list of all certificate numbers ("Gesamtlisten", AG) can be provided as a list (selection 03) or in CSV format (selection 04).

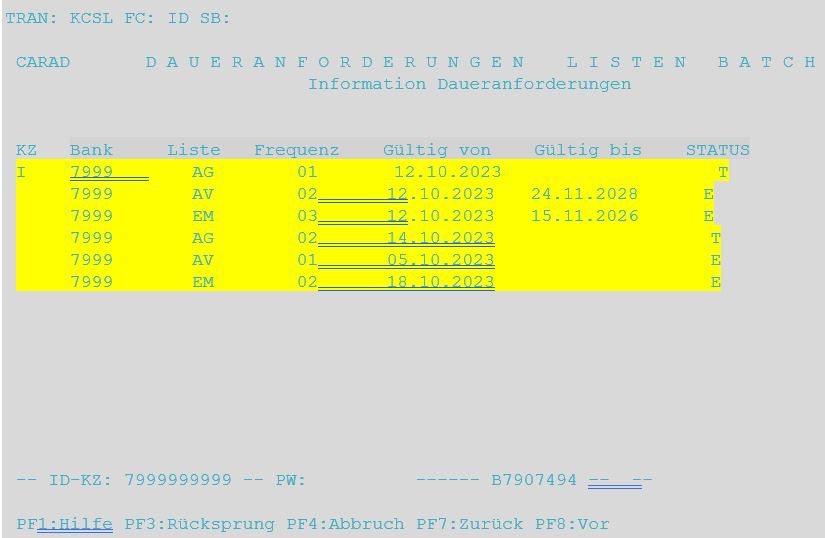

In the KCSL menu with function code ID, clients can check all existing standing orders:

Details can only be visualised with the indicator I for completely entered standing orders:

In menu KCSL under the functional code AD, standing orders can be changed:

The standing order to be changed is marked with an "X" and opens by clicking PF3:

If the date in the field:

- 'Gültig von:" (valid from) has not yet been reached, all fields of the request can be changed;

- "Gültig von:" (valid from) has been reached reached, only the field ‘Gültig bis:’ (valid until) can be changed;

- "Gültig bis:" (valid until) is filled and the date has not yet been reached, it can be changed;

- "Gültig bis:" (valid until) has been reached, no more changes are possible.

The changes are saved with the PF3 key. With the PF6 key, the return is not made to the general KCSL menu, but to the result list of the KCSL query under function code AD.

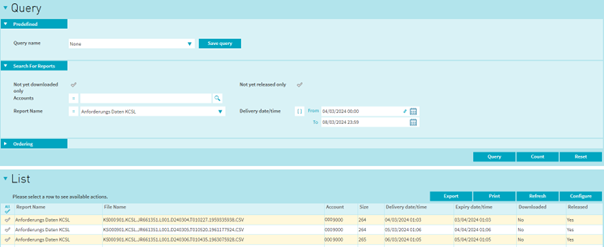

The lists generated based on the standing orders will be displayed in Xact Web Portal in the menu "Reporting & Monitoring / CBF File Service / Download Reports" similar to the one-time orders (example):

The fees for the generation of each list will not change.

Enhancements with own publications

Further CBF service enhancements are outlined in the following publications:

- Eurosystem Collateral Management System (ECMS) and Single Collateral Management Rulebook for Europe (SCoRE) Implementation;

- Announcement D24027 "SCoRE standards: TEFRA D changes to processing";

- General Meeting Service;

- Announcement D24035 "Slovenia: OneClearstream service activation";

- Announcement D24036 "Ireland: Opening of a direct link to Euroclear Bank and OneClearstream service activation";

- Announcement D24045 "Cyprus: Government debt securities eligible in CBF CASCADE and T2S";

- eMission (available for registered users in the Deutsche Börse Member Section).

Further information

For further information, clients may contact Clearstream Banking Client Services or their Relationship Officer. Questions related to the technical connection can be addressed to Connectivity Support. Particular questions related to the production launch in November 2024 will be routed to the experts of the T2S Release Management.

------------------------------------------

1. This Announcement is published by Clearstream Banking AG (CBF), registered office at Mergenthalerallee 61, 65760 Eschborn, Germany, registered with the Commercial Register of the District Court in Frankfurt am Main, Germany, under number HRB 7500.

2. Details about the scope elements of T2S Release R2024.NOV are published on the ECB’s website.

3. Instructions sent via LIMA in ISO15022 format (Swift or File Transfer) or alleged in the CASCADE or Xact Web Portal.