Settlement services – U.S.A.

Pre-matching service

The table below summarises CBL’s pre-matching service for external settlement instructions, as well as the pre-matching method and start time in the market. For details of CBL’s pre-matching services, see Pre-matching services for external settlement instructions.

| Service offered | Method employed | Start (local time) | |

| DTC settlement | |||

Transmission of allegement | MT578 a | Upon receipt of the counterparty delivery instruction in DTC | |

| FED settlement (FOP receipts only) | |||

Transmission of allegement | MT578 a | Upon receipt of the counterparty delivery instruction in FED | |

a. Eligible customers receive these messages in accordance with the frequency option to which they have subscribed.

Description of the CB affirmation service

In the U.S. market, affirmation equals pre-matching, a trade affirmation is an acknowledgement to the parties to the trade confirming that the reporting of the trade conforms to the trade details and the settlement instructions.

T+1 requirements

The following three SEC rules are impacted by T+1 and bring the following requirements:

- Amended Exchange Act Rule 15c6-1(a): T+2 shall move to T+1 settlement cycle.

- Amended Advisors Act Rule 204-2: Registered Investment Advisors (RIAs) that are parties to contracts under Rule 15c6-2 shall be obliged to keep on record confirmations received, as well as allocations and affirmations sent – each with a date and time stamp.

- New Exchange Act Rule 15c6-2: Broker-dealers and counterparties shall be required to complete allocations, confirmations, affirmations no later than trade date. This shall also apply to RIAs.

Broker-dealers and RIAs shall consequently affirm transactions.

Same-day trade allocations, confirmations and affirmations are required before settlement can take place.

The following three steps must be taken:

- Trade allocation: The counterparty to the trade provides allocation details to the broker-dealer.

- Trade confirmation: The broker-dealer submits a trade confirmation to DTCC to allow for matching between both parties. Please note that the confirmation is a critical step to allow the trade to be affirmed. Without this confirmation, the affirmation cannot take place.

- Trade affirmation: The affirmation of the trade confirmation is performed either by the counterparty to the trade or the delegated custodian. Affirmation under T+2 life cycle was not a regulatory requirement but will be one under the T+1 regime.

Note: Affirmation at DTCC is a process separate from settlement at DTC.

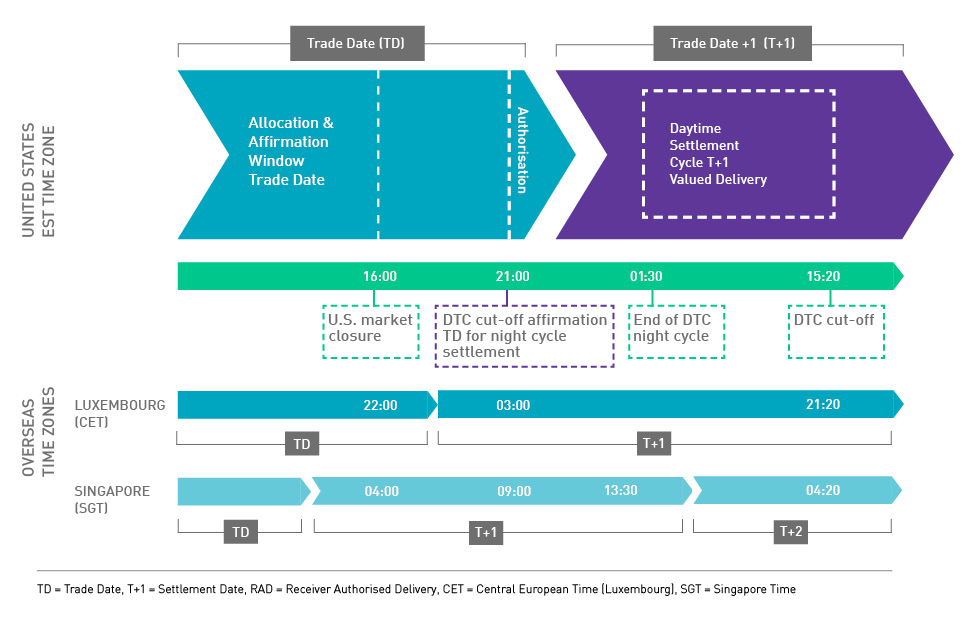

Allocation and affirmation cut-offs on the U.S. market

The following deadlines are applicable:

The Depository Trust Company's (DTC's) “allocation” cut-off deadline is 19:00 EST/01:00 CET on trade date (T).

The DTC “affirmation” cut-off deadline is 21:00 EST on trade date (SD-1)/03:00 CET on T+1 (SD).

The Clearstream Banking S.A.(CBL's) “affirmation” cut-off deadline, as defined with Citi US, is 20:45 EST on trade date (SD-1)/2:45 CET on T+1 (SD).

CBL’s confirmation/affirmation service

Clearstream Banking S.A. (CBL) has a TradeSuite ID® Number (TSID 64005) linked to its omnibus account held with its custodian: DTC participant 908/Citibank, Agent ID 57569.

The TradeSuite ID Number is an identifier used in the TradeSuite ID system to distinguish between parties on a trade confirmation.

The ALERT platform is an industry database for maintenance and communication of account and standing settlement instructions (SSIs).

Please note that Citi US has a real-time connectivity with DTCC to affirm confirmations defined by the U.S. broker.

High level process view

Allocation process

Allocation of the trade is performed by CBL’s clients and its U.S. broker/counterparty.

Confirmation process

- The U.S. broker confirms to enable the affirmation process.

- Upon receipt, the CBL client Swift instruction will be matched to the U.S. broker’s confirmation and affirmed.

If no broker confirmation is available, the CBL client Swift instruction will be leveraged for settlement and sent to DTC.

Please note that the initiation step of providing the confirmation remains with the U.S. broker, not with the CBL clients. Trades can be affirmed only if a broker confirmation is present.

Detailed process view

Allocation process

Both counterparties define and allocate trade details.

Such trade details are used for matching in DTCC’s Central Trade Matching (CTM) or equivalent system.

Confirmation process

The client provides the CBL TSID (64005) or, alternatively, their own TSID as part of the SSIs to the U.S. broker.

The client, the investment manager and the U.S. broker are responsible to update ALERT with the following values:

- Fields under “Depository/Clearing/Settlement Agency Data”:

- Inst/Broker ID: 64005 (CBL TSID) or client's own TSID;

- Agent ID: 57569 (Citi Agent ID);

- DTC #: 908 (Citi DTC participant number).

- Fields under “Settlement Party Data – Local Clearing Agent Data”:

- A/C # at Local Agent: 089154 (CBL omnibus account at Citi);

- Local A/C ref: CSCxxxxx (xxxxx being CBL 5-digit account number). Please ensure that the content of “Local A/C ref” is indicated within the dedicated field and is not attached to CBL omnibus account in the field “A/C# at Local Agent” to avoid rejection of the confirmations at Citi’s level;

- Local Agent Bic: CITIUS33XXX.

The U.S. broker uses the CBL TSID or the client's own TSID to issue the confirmation in TradeSuite to allow matching in the CTM or equivalent system.

The confirmation is a critical step to allow the trade to be affirmed; without this confirmation, the affirmation cannot take place.

Affirmation process

The client is requested to:

- Send the Swift MT541/543 settlement message by CBL’s “affirmation” cut-off deadline of 20:45 EST on trade date (SD-1)/2:45 CET on T+1 (SD) (15 minutes prior to market affirmation cut-off deadline);

- Ensure that its CBL account is duly funded with cash or provisioned with the securities by this affirmation cut-off.

Based on the client Swift instructions received by CBL and broker confirmations present, Citi US affirms the confirmations set up against CBL or client TSID by the new affirmation deadline of 20:45 EST on trade date (SD-1)/2:45 CET on T+1 (SD).

Settlement is processed separately at DTC; the affirmation neither triggers nor guarantees settlement. However, affirmation increases the probability of settlement during the night-time cycle of DTCC and reduces the risks of failed transactions. With the affirmation process, both parties are effectively in agreement with the trade details.

If, for any reason, the affirmation cannot take place, settlement can still be processed in accordance with the market settlement validation rules.

The following table shows the high-level process flow of the affirmation for clients using CBL’s TSID or their own TSID:

Data | |

TSID in use | Data under “Depository/Clearing/Settlement agency":

Data under "Settlement Party/Local clearing agent":

|

Responsible party | Process step |

Investment manager and U.S. broker | Define and allocate agreed trade for matching via Central Trade Matching (CTM) system or equivalent. |

CBL client |

|

U.S. broker | Initiate “Confirm” by the affirmation deadline, 21:00 EST on trade date (SD-1)/3:00 CET on T+1 (SD). |

CBL client | Send appropriate MT541/543 by Citi's deadline, 20:45 EST on trade date (SD-1)/2:45 CET on T+1 (SD). |

Citi US | Upon receipt of valid MT541/543 from CBL's client: Affirm the Confirmation. The affirmation is performed based on the following matching criteria:

|

Citi US | Upon positive matching:

|

DTC/Citi US | Upon settlement completion: Send MT54X confirmation to CBL. |

CBL | Upon receipt of MT54X confirmation from DTC/Citi US: Settle internally to reflect finality of the transaction. |

CBL’s affirmation alternative service

CBL clients favouring the Self- or Auto-Affirmation processes offered by DTCC must engage with DTCC via this link and obtain their own TradeSuite ID® Number and accesses to CTM/Mi2 or alternative platforms in order to manage the affirmation directly by themselves.

The following table shows the high-level process flow of the Self-/Auto-Affirmation for clients using their own TSID:

Data | |

TSID in use | Data under “Depository/Clearing/Settlement agency":

Data under "Settlement Party/Local clearing agent":

|

Responsible party | Process step |

Investment manager and U.S. broker | Define and allocate agreed trade for matching via Central Trade Matching (CTM) system or equivalent. |

CBL client |

|

U.S. broker |

This will trigger the following: Matching occurs in CTM. |

CBL client | Enrich the trade with details in ALERT. This will trigger the following:

|

Citi US | Receive an affirmed confirmation from DTCC. |

CBL client | Send appropriate MT541/543 by the settlement date (S). |

Citi US |

Note:

|

DTC/Citi US | Upon settlement completion: Send MT54X confirmation to CBL. |

CBL | Upon receipt of MT54X confirmation from DTC/Citi US:

|

CBL is not involved in the affirmation process. However, CBL conveys the Swift instruction for settlement upon receipt from its clients.

In this scenario, CBL U.S. standard settlement deadlines remain unchanged as well as the provisioning and cash deadlines.

Please refer to the Settlement times – U.S.A. page of the Market Link Guide – U.S.A. or the Cash Timings Matrix.

CBL provisioning period

Please refer to Settlement times – U.S.A. for details.

If CBL clients opt for CBL’s affirmation service, they shall provision their account with cash or securities during the following provisioning period from 21:30 CET SD-1 to 2:45 CET SD. This offers a period of 5 hours 15 minutes for CBL clients to send the necessary cash/settlement instructions to CBL.

CBL settlement deadline

Please refer to Settlement times – U.S.A. for details.

If CBL clients opt for the CBL’s affirmation proposition, they shall send their Swift settlement instructions by CBL affirmation cut-off deadline of 20:45 EST on trade date (SD-1)/2:45 CET T+1 (SD).

Penalties/charges for non-compliance of T+1 in the U.S. market

The U.S. market is not subject to the EU Central Securities Depositories Regulation (CSDR), there are no penalties applying from DTC or CBL's U.S. agent.

However, if a failure in the U.S. market leads to a fail in Clearstream Banking AG/TARGET2-Securities (CBF/T2S) or CBL settlement, penalties are calculated for the fail in CBF/CBL, as it is already the case if the respective ISIN falls within the scope of the EU Settlement Regime Regulation (SDR).

Cash funding and foreign exchange

If CBL clients opt for CBL’s affirmation proposition they must fund the CBL cash account by the CBL affirmation cut-off deadline of 20:45 EST on trade date (SD-1)/2:45 CET T+1 (SD).

Reporting on settlement

CBL transmits Swift MT548 MTCH/NMAT and MTCH/MTCH near real-time once the CBL client settlement instruction has been affirmed to the counterparty’s confirmation:

- The Swift MT548 MTCH/NMAT status represents CBL client instructions which are not affirmed.

- The Swift MT548 MTCH/MTCH status represents CBL client instructions which are affirmed.

The matching process takes place between TD and the affirmation cut-off.

CBL transmits Swift MT578 messages to clients near real-time once the CBL custodian validates that a CBL client has not yet sent the corresponding instruction to affirm the counterparty’s confirmation.

The Swift MT578 messages remind clients to send their instructions.

The table below describes the scenarios that need to be considered and the corresponding reporting that is provided.

Securities delivery by CBL customers

Delivery status for instructions | Message/Field/Value | Meaning |

Delivery awaiting approval | MT548 :24B::PEND//NCON | Confirmation not received from counterparty/awaiting counterparty approval. |

Delivery approved: settled | MT54x confirmation | Delivery has been executed and confirmed. |

Delivery approved: not settled in DTC on SD | No specific reporting | Delivery instruction will be automatically resubmitted by CBL’s depository for 30 days, unless cancelled by the customer or settled. |

Delivery refused by the receiving counterparty | MT548 :24B::NMAT//DTRA | Delivery will be cancelled by DTC. |

Delivery with no action taken by the counterparty by the end of SD and dropped by DTC | MT548 | Delivery has been cancelled by DTC. |

Securities receipt by CBL customers

No Clearstream Banking customer receipt instruction in place

Receipt status | Message/Field/Value | Meaning |

DTC counterparty’s delivery instruction received on the market | MT578 NEWM | A new allegement is reported where there is no receipt in place from Clearstream Banking’s customer or where the instruction of the DTC counterparty does not match the instruction of Clearstream Banking’s customer. From there, there are two possible options:

|

DTC counterparty’s allegement cancelled before matching at Clearstream Banking’s depository | MT578 REMO | Transmitted if the U.S. counterparty cancelled the allegement before the receipt of Clearstream Banking’s customer instruction. |

Clearstream Banking customer receipt instruction in place

Upon receipt of Clearstream Banking customer instruction | MT578 REMO | REMO will be reported upon receipt of a Clearstream Banking receipt instruction. |

Clearstream Banking customer’s instruction has been matched with counterparty’s delivery by Clearstream Banking’s depository | MT548 :24B::NMAT//DTRA | This status will be transmitted only if the counterparty cancelled its instruction. The counterparty could cancel the transaction:

|

Confirmation that our clients transaction matched the counterparty’s affirmation | MT548 | |

Counterparty’s delivery approved but not settled in DTC | MT548 :24B::PEND//NCON | Clearstream Banking depository being the receiving counterparty approved the transaction in DTC but DTC did not provide the final approval for settlement. |

Counterparty’s delivery approved in RAD | MT545 confirmation | Receive instruction has been settled. |

Procedures for domestic counterparties - Book-entry transfers

Receipts in CBL (general, for free of and against payment)

Note: Please ensure that "CSC" is in capital letters to avoid settlement delays.

Securities allocated to Citibank must be delivered as follows:

Through DTC

RECV-PT: 0908

RCVR-ACCT: 089154 CSCxxxxx

or

RECV-PT: 0908

RCVR-ACCT: 089154

First comment line: CSCxxxxx

Through FBE

CONTRA: CITIBANK NYC/CUST ABA 021000089

INF1 line: 089154 CSCxxxxx

where 64005=CBL’s Institution ID number; 57569=Citibank’s Agent ID number; 089154=CBL Agent’s internal account number; xxxxx=5-digit CBL account number.

If the securities are being transferred physically (see “Procedures for domestic counterparties - Physical transfers” below), please deliver to Citibank (address in “Depository” under General information). The delivering party must specify that the securities are in favour of 089154 CEDELBANK CSCxxxxx (where xxxxx=5-digit CBL account number).

Receipts in CBL (specific, for free of payment only)

Receipts free of payment in CBL from a U.S. counterparty require a receipt instruction from our customer.

Note: No DK (Don’t Know) will be initiated by CBL on its behalf, bearing in mind that the delivery could be DK'ed in turn by the U.S. counterparty in the absence of appropriate communication between said counterparty and our customer.

Our customers are also recommended to request timely instructions from their underlying clients for entries of securities free of payment in order to allow our customers to send in turn timely receipt free of payment instructions to CBL. This should further improve the booking process of security receipts free of payment and limit the risk of wrong allocation.

Deliveries from CBL and risk of DK

Local market practice allows the receiving party to reverse a receipt (under the “Don’t Know” - DK - procedure). If this happens, the securities are re-credited (and any sales proceeds are re-debited value settlement date) for same-day DKs on SD+1 and for later DKs as soon as the reversal has been processed. The reason of the DK is passed on from the counterparty to the customer in field :70D: of MT548 and MT537. The quality of the DK information depends on what the U.S. counterparty has input in its DK DTC ticket.

The risk of DK is limited to transactions that are not subject to RAD approval in DTC.

Transactions that are subject to RAD approval are as follows:

- All against payment deliveries of DTC-eligible securities where the countervalue is greater than USD 0.01;

- Free of payment deliveries of DTC-eligible MMIs.

To avoid DK (Don’t Know) settlement failures, counterparties receiving securities from a CBL customer must instruct their U.S. or Canadian custodian by its agreed deadline to accept securities delivered by CBL’s depository Citibank via FBE, DTC, CDS or by physical delivery, as appropriate.

Procedures for domestic counterparties - Physical transfers

Deposit procedure for physical securities

N.B.: No certificate should ever be sent to CBL or to Citibank if the security is not eligible in CBL.

Transfer of physical securities requires the intervention of a transfer agent that ensure either the registration in case of bearer securities or the re-registration of securities in the appropriate nominee name in case of registered securities.

Bearer securities

In most cases, physical securities that are delivered to CBL are in registered form. For bearer securities, the procedure depends on the requirements set by the concerned transfer agent. We therefore recommend you contact your CBL Client Services officer to determine the course of action.

Registered securities

The signed transfer documents - the Stock/Bond Power and the Corporate Resolution (see Forms to use in the U.S. market) - are to be sent by registered mail to the Settlement department in Frankfurt (address: Clearstream Banking AG, Settlement Global, OAA / EA.08.301, 60485 Frankfurt am Main, Germany).

- The customer signatures are authenticated by CBL.

- The transfer documents are posted back to the customer.

- The customer sends the certificates as well as the transfer documents authenticated by CBL to the Citibank mail address (see “Depository” under General information).

Citibank re-registers the certificates:

- In the nominee name of the Central Security Depository (CSD), if the securities are eligible for deposit in DTC or in the FBE; or

- In Citibank’s own nominee name (Gerlach & Co.).

CBL blocks the position in its customer account during the registration period and reports it as unavailable in its Statement of Holdings. When the nominee of Citibank (Gerlach & Co.), or the nominee of the DTC or the nominee of the FBE confirms to Citibank that the re-registration process has been completed, CBL unblocks the corresponding position in its customer’s account and makes the position available.

The re-registration process usually takes several weeks to complete.

In order for Citibank to execute the re-registration, the CBL customer must send the following documents:

- A covering letter including the name of the registered holder, the investor ID (found on the registered account holder’s statements), the quantity, the ISIN, the CBL account 089154 in Citibank, the 5-digit customer account in CBL and the contact name and address of the sender to enable Citibank to return securities that are not in good order;

- The physical certificates;

- The transfer forms in the form of a Stock/Bond Power (see Forms for use in the U.S. market) signed by the registered holder (or his authorised officer in the case of a corporation). This signature will be guaranteed by the CBL customer, whose own signature will then be guaranteed by CBL;

- For a corporation registered holder: a Corporate Resolution (see Forms for use in the U.S. market), which certifies that the two persons signing the transfer form (the assigning officers as indicated on the form) are authorised to do so on behalf of the corporation. This certification must be granted by two authorised persons of this corporation (the certifying officers (who must be different from the assigning officers) as indicated on the form);

- Additional documentation might be required by the Transfer Agent on a case by case basis (depending on the issue) in the course of the re-registration process.

The customer should only use separate forms, and not the reverse of the original certificates.

No original certificates should ever be sent to Clearstream Banking even as an attachment to the transfer documents.

Impact on corporate action and income collection

CBL is not responsible for corporate actions and income payments with respect to physical certificates that have not been re-registered and returned by the transfer agent to Citibank.

Entitlement will be passed to CBL’s Depository if the certificates are re-registered not later than the record date of a corporate action or income collection event. Corporate action proceeds and income will be processed on an “as received basis”.

Withdrawals and deliveries procedure for physical or DRS securities

Most U.S. equities are available in physical form, unless there are specific reasons (for example, an ongoing corporate event, Chapter 11 bankruptcy, DTC “chill” initiated by the issuer, securities eligible in the Direct Registration System (DRS) etc.). For “chill” time frames, “chill” removals or other specific details customers must contact the issuer or transfer agent in charge.

Physical deliveries

Physical deliveries are usually processed within four to six weeks depending on the transfer agent in charge. The completion is always dependent on the transfer agent. CBL has no impact on the actual completion time frame and therefore cannot be held liable in the event of delays.

Deliveries of DRS eligible securities

Any withdrawal request for securities participating in the DTC DRS will be processed into DRS statement form. On receipt of a withdrawal request, the position will be updated in the transfer agent books and the new registered holder will receive a DRS statement only.

If the registered holder wants to exchange the DRS statement into a physical certificate, the registered holder must send the request directly to the transfer agent; CBL is not legally entitled to send the request on behalf of the registered holder. Customers must be aware that the request may be rejected if the issuer does not permit the exchange. Impact on corporate action and income collection

CBL is not responsible for corporate actions and income payments with respect to DRS statement holdings as well as physical certificates withdrawn from Citibank.

Allowed countervalue difference

In transactions with domestic counterparties for standard DTC and FED transactions, a maximum difference in countervalue of USD 25 is allowed. Please note that decimals for the cash amount are not taken into account.

Where there is a difference in the settlement amount within this limit for standard DTC and FED transactions, the cash amount of the delivering party will prevail.

Summary of available services by security type and customer category

All security types can be held in custody for non-U.S. customers and for U.S. customers.

Settlement services vary according to security type and category of customer, as follows:

Note: In ther following table, I=Internal, E=External, B=Bridge.

| Security type | Settlement | |||||||

| Non-U.S. customers | U.S. customers | |||||||

| I | E | B | I | E | B | |||

| Central Securities Depository - FBE | ||||||||

- | U.S. Treasury bills, bonds and notes (Fedwire-eligible) | Y | Y | Y | Y | Y | Y | |

- | U.S. Agency securities (Fedwire-eligible) (for example, FNMA, GNMA, FHLMC) | Y | Y | Y | Y | Y | Y | |

| Central Securities Depository - DTC | ||||||||

- | Non-U.S. issuers’ foreign (Yankee) bonds or other debt transactions securities distributed in the U.S.A. (SEC registered or 144A placement) | Y | Y | Y | Y | Y | Y | |

- | U.S. issuers’ bonds or other debt securities distributed outside the U.S.A. (Regulation S, TEFRA D separate note) | Y | Y | Y | Y | Y | Y | |

- | Depository Receipts (ADRs, GDRs) distributed outside the U.S.A. (Regulation S, separate note) | Y | Y | Y | Y | Y | Y | |

- | U.S. issuers’ bonds or other debt securities distributed in the U.S.A. (SEC registered or 144A placement) | Y | Y | Y | Y | Y | Y | |

- | U.S. local authority bonds, for example, municipals | Y | Y | Y | Y | Y | Y | |

- | U.S. Depository Receipts (ADRs, GDRs) distributed in the U.S.A. (SEC registered or 144A placement) | Y | Y | Y | Y | Y | Y | |

- | U.S. equitiesa and equity products (for example, closed-end mutual funds) | Y | Y | Y | N | Y | N | |

a. Book-entry DTC settlement may not be possible due to a DTC “chill” initiated by the issuer of the security. For “chill” time frames, “chill” removals or other specific details, customers must contact the issuer or transfer agent in charge.

Transfer of shares in open-end mutual funds

Transfers of shares in open-end mutual funds eligible on Vestima can be instructed via standard SWIFT MT540/542 message formats. These instructions should be alleged against a receiving/delivering agent REAG/DEAG 50613 and contain the counterparty’s standard settlement instructions (SSIs) in the BUYR/SELL field as described below:

- PSET// CEDELLUXXX

- DEAG/REAG// 50613

- BUYR/SELL// Counterparty BIC

- SAFE// Account of the counterparty at their custodian

In addition, the customer must send to the counterparty the number of CBL’s account in the register of the mutual fund. Customers who do not have this detail on file are advised to contact Clearstream Banking Investment Funds Client Services.

Change of distribution option on open-end mutual funds

The customer instructs a change of distribution option on open-end mutual funds eligible on Vestima by means of SWIFT MT540/542 message.

Customers who wish to amend their dividend option should instruct via a transfer out (MT542) of the common code/ISIN linked to their current holding and to the common code/ISIN of the new distribution option (MT540).

Holding restrictions on Canadian securities held in the U.S. market and applying to beneficial owners resident in Canada

Please refer to the Holding restrictions described in the Market Link Guide - Canada.

Back-to-back processing

Back-to-back processing is available for transactions in all DTC-eligible equities and bonds as well as in FBE-eligible U.S. treasuries and agency securities in this market. If both the customer and the domestic counterparty meet their settlement obligations and fulfil the market's back-to-back requirements within the relevant deadlines, the linked receipt and the linked delivery will settle with same-day value.

To benefit from this functionality, customers must ensure that their back-to-back instructions are formatted as follows, according to the connectivity medium used:

| Connectivity medium | Pool ID format | Field(s) to be used |

Xact via SWIFT and Xact File Transfer | :POOL//16x a and :SETR//TURN | Field :20C: sequence A1 Field :22F: sequence E |

a. The reference (16x) must neither start nor end with a single slash (/) character nor must it contain two consecutive slash (//) characters.

Management of failed instructions

Receipt instructions remain in suspense until they settle or until they are cancelled. CBL reserves the right to cancel an instruction with a domestic counterparty that has not settled by the 30th domestic business day after the contractual settlement date or the instruction date, whichever is later.

Delivery instructions that have not settled by the requested settlement date are cancelled and the securities are re-credited to the customer’s account in the night-time processing for the following settlement date (SD+1 (n)).

To avoid settlement failure of DWAC instructions (withdrawals and deposits) due to delays caused by a failure to complete and return the necessary documents in time, these instructions will be re-submitted during each of the five business days following the requested settlement date if they are formatted as specified in the relevant instruction specifications.

New issues settlement

If the distribution of a new issue is confirmed by DTC before 18:00 CET, the distribution of that issue will be settled in CBL during the overnight processing following the closing date in the U.S.A. Cash will be debited in the same processing with back value to closing date.

MMI new issues are subject to an earlier cutoff time in DTC and are exclusively settled via the DTC - Receiver Authorised Delivery (RAD) function.

The MMI valued new issuance (DTC reason code 82 - issuance DO) submission DTC cutoff is changed to 14:00 EST from 15:20 EST for settlement on the current date.

All Reg S issues held in DTC are subject to a “chill period” of 40 days after issuance. During that period, these issues cannot be moved in DTC nor transferred to the corresponding 144A tranche through a regular delivery. Nevertheless, it will still occasionally be possible to transfer securities via DWAC. It is the agent’s responsibility to request DTC to lift the chill after the 40 days have elapsed.

All TEFRA D issues are subject to a restricted period of 40 days after issuance, during which period certification of beneficial ownership will be requested from customers.

- Customers will be responsible for informing CBL of U.S. non-qualified holder positions, which will be blocked to allow for the exchange of the temporary global note for definitive notes or for a permanent global note.

- Non-U.S. and qualified U.S. holder positions will not be blocked and will be eligible for exchange of the temporary global note for definitive notes or for a permanent global note.