Xact Web Portal: Enhanced Asset Liability Analyser

Clearstream Banking1 informs clients about the launch of an enhanced version of the Asset Liability Analyser, effective

29 March 2025

Background

As Clearstream Banking continues its journey to empower our clients to use data as a growth driver, we are pleased to announce that the Asset Liability Analyser has been upgraded.

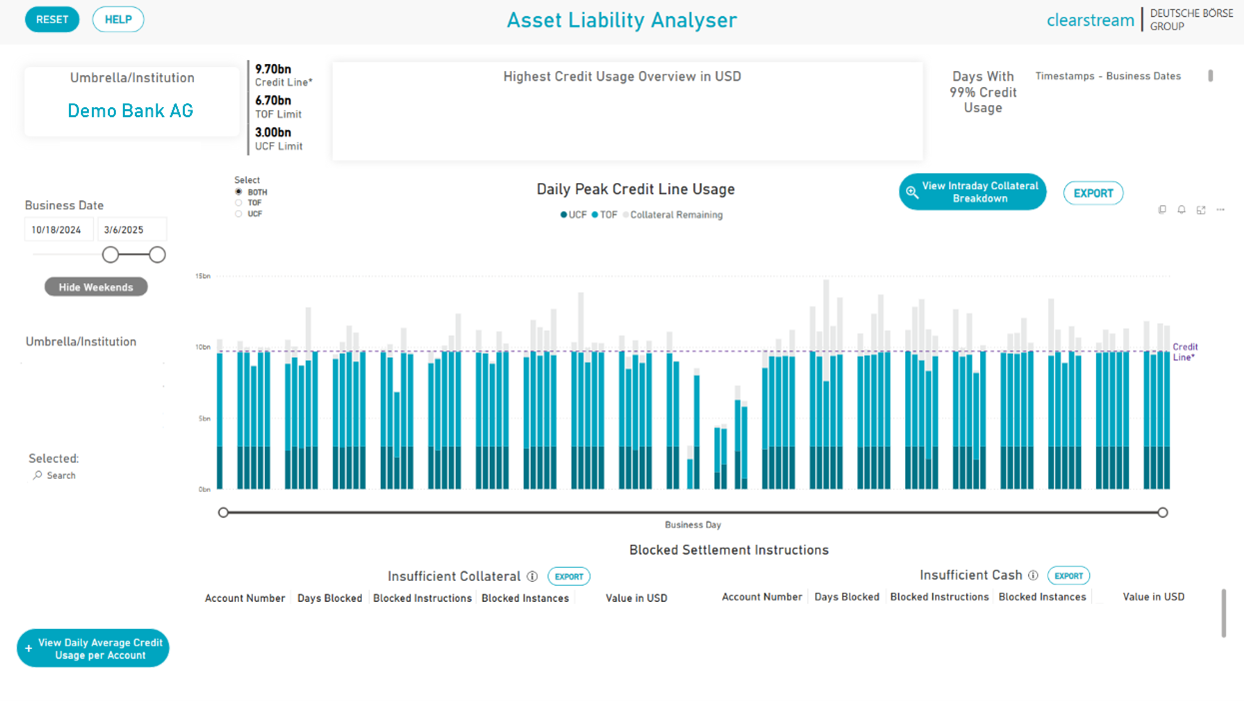

The enhanced Asset Liability Analyser offers clients deeper insights about credit usage and collateral consumption with a detailed breakdown of failed settlement instructions, enabling more effective credit planning and collateral pool management.

Asset Liability Analyser

Clearstream Banking's Asset Liability Analyser helps clients to visualise historical credit surges and collateral usage down to 10-minute intervals, allowing them to identify bottlenecks and acting on those insights in real time to effectively managing credit utilisation and collateral availability. The tool is accessible for clients via the Data and Analytics Module in Xact Web Portal.

The dashboard provides several benefits to the users including:

- Increased Operational Efficiency

- Optimised Credit Consumption Management

- Data-Driven Decision Support

- Enhanced Risk Mitigation

Detailed instructions on how to use the tool can be found in the Xact Web Portal User Manual.

Further information

For further information, please contact the Clearstream Banking Client Services, your Relationship Manager. Questions related to the technical connection can be addressed to Connectivity Support at connect@clearstream.com.

1. Clearstream Banking refers collectively to Clearstream Banking S.A., registered office at 42, avenue John F. Kennedy, L-1855 Luxembourg, and registered with the Luxembourg Trade and Companies Register under number B-9248, and Clearstream Banking AG (for clients using Creation accounts), registered office at Mergenthalerallee 61, 65760 Eschborn, Germany and registered in Register B of the Amtsgericht Frankfurt am Main, Germany under number HRB 7500.