German Tax Reform: ClearstreamXact enhanced tax functionality – Update

Note: This announcement, originally published on 12 July 2024 and amended on 9 September 2024, has been further updated based on the "Jahressteuergesetz 2024" which passed the Bundesrat (2nd chamber) on 22 November 2024. The newly introduced law has the effect to postpone the implementation of the German withholding tax relief reform to

1 January 2027

Background

Following the introduction of the Abzugsteuerentlastungsmodernisierungsgesetz (AbzStEntModG, German Withholding Tax Relief Modernisation Act), Clearstream Banking1 will adapt its systems to allow its clients to submit all information required by law. To facilitate this, an enhanced Xact Web Portal and Xact File Transfer tax functionality will be introduced.

New web page and email address

A new “German tax reform” section under Tax and certification has been created where all relevant information and updates related to the reform will be published on a regular basis.

List of changes

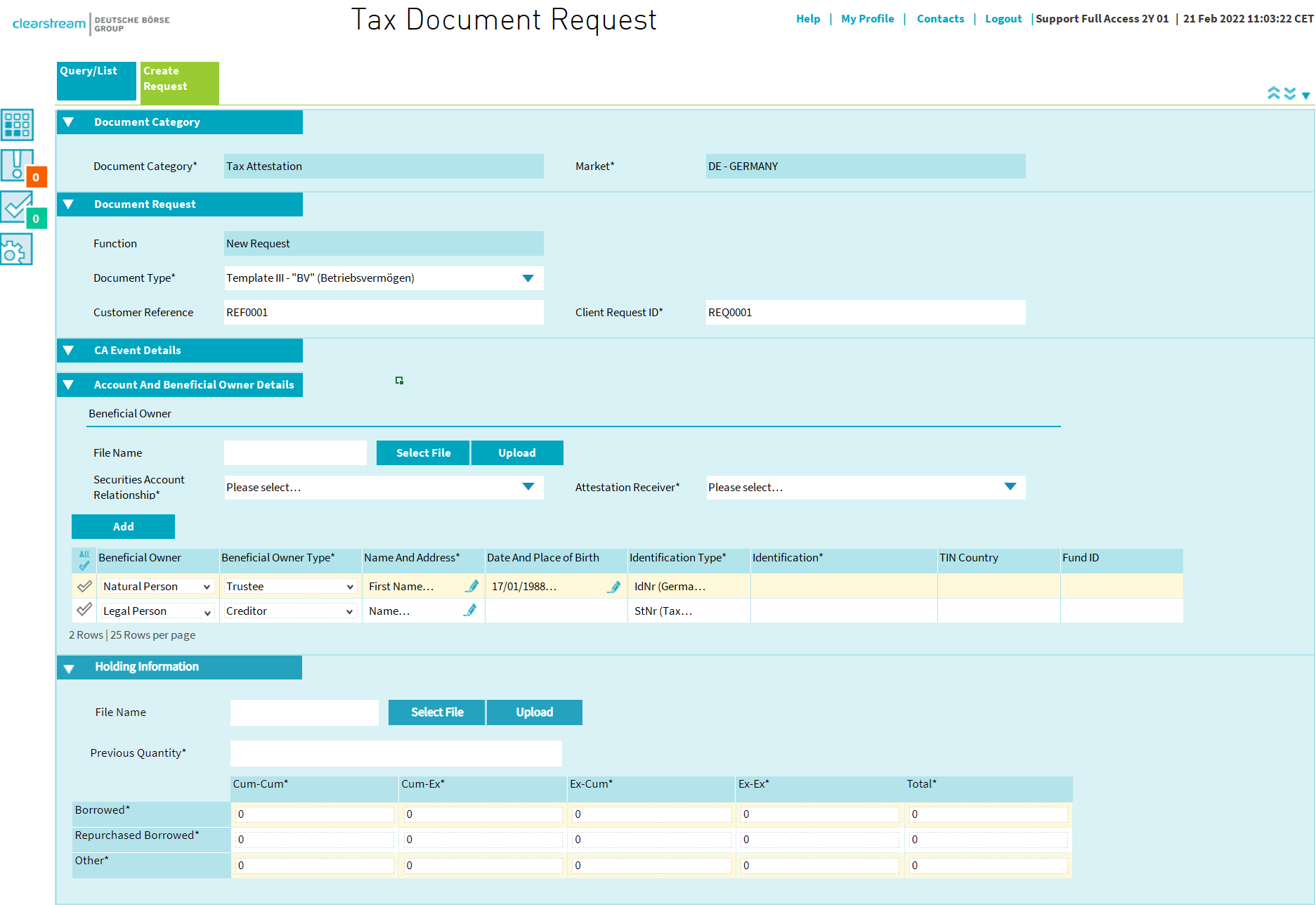

A. Additional information that must be provided for tax certification requests:

- Recipient-related data: Disclosure of the final creditor and beneficial owner of the income as well as for account representatives, if any;

- Account-related data: Disclosure of the full custody chain between the German paying agent and the final creditor;

- Income-related data: On gross income, applied tax rates and on the underlying holding as at record date;

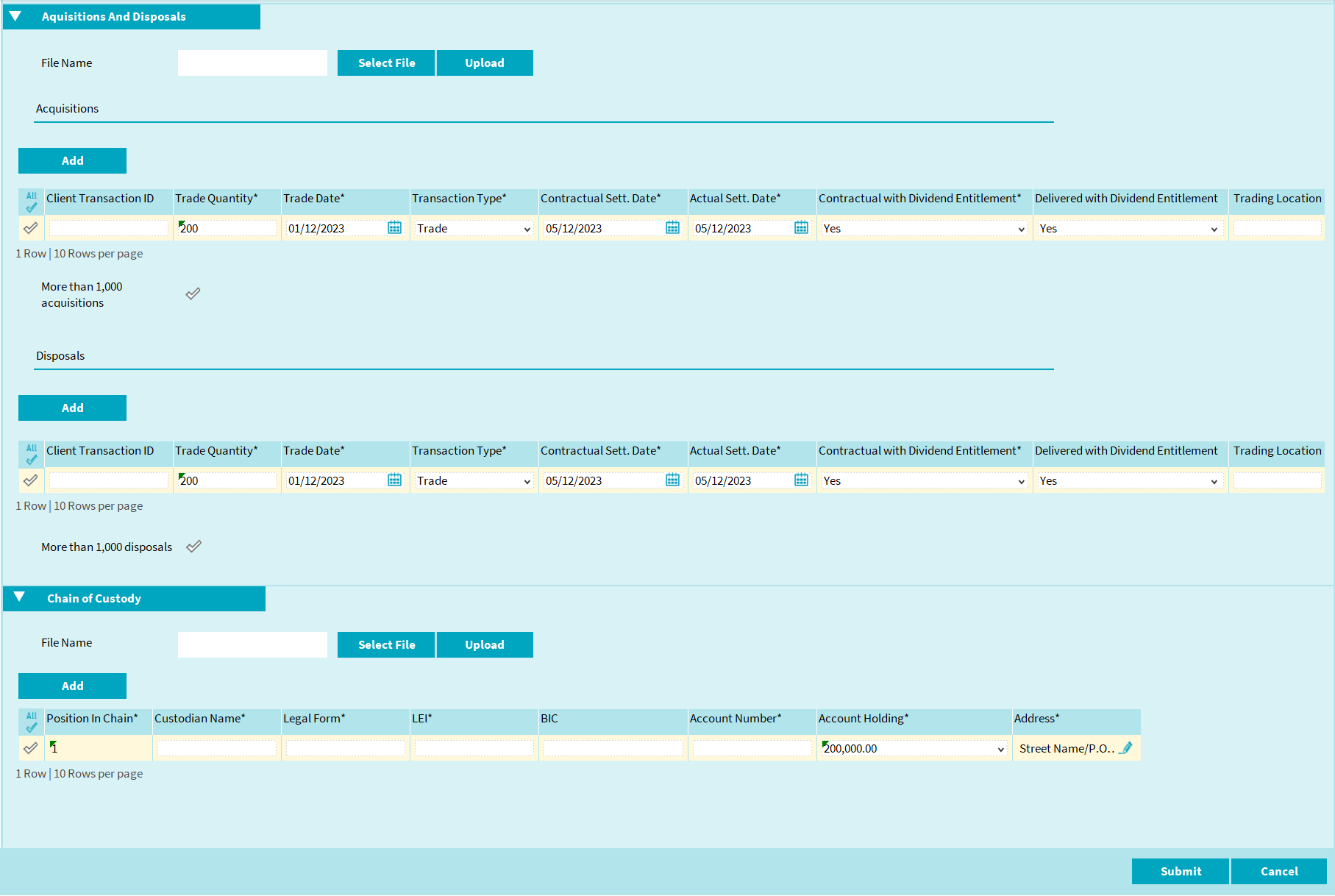

- Transaction-related data: On acquisitions and sales within a a period of 12 months prior to record date and 45 days after due date.

B. How can clients provide the required information?

Clearstream will support the following:

- New input formats via XML standard from the Foreign Banks Association (VAB) in Xact Web Portal and Xact File Transfer;

- Additional fields in Xact Web Portal to support the new functionality, including import of files (extracts prepared offline) and validation features;

- On top of existing new and cancellations of Tax voucher requests, corrections of Tax voucher requests will be introduced.

C. Tax vouchers vs Certificates of Submission

German residents will continue to receive a “tax voucher” (Steuerbescheinigung) however non-residents will now receive a “certificate of submission” (Datenübermittlungsbescheinigung)

D. Accounts with reduced tax rate according to Section 7 (1) of the Investment Tax Act

A two-step process is introduced, the disclosure of the fund (identified by the Ordnungsnummer) that exists today remains, a second step to disclose Recipient and Transaction related data within 6 months after payment will be introduced.

Further information

Further detailed information will be communicated at a later stage.

Please see the Clearstream website for more information about ClearstreamXact.

For further information, please contact the Clearstream Connectivity Helpdesk or your Relationship Manager.

-------------------------------

1. Clearstream Banking refers collectively to Clearstream Banking S.A., registered office at 42, avenue John F. Kennedy, L-1855 Luxembourg, and registered with the Luxembourg Trade and Companies Register under number B-9248, and Clearstream Banking AG, registered office at 61, Mergenthalerallee, 65760 Eschborn, Germany and registered in Register B of the Amtsgericht Frankfurt am Main, Germany under number HRB 7500.