Germany: New Swift fields for the exercise of tradeable rights

Further to Announcement D22050, Clearstream Banking1 informs clients on an update of the Corporate Action Reporting in MT564 in accordance with the Corporate Action Joint Working Group (CAJWG) Standard as of

20 November 2023

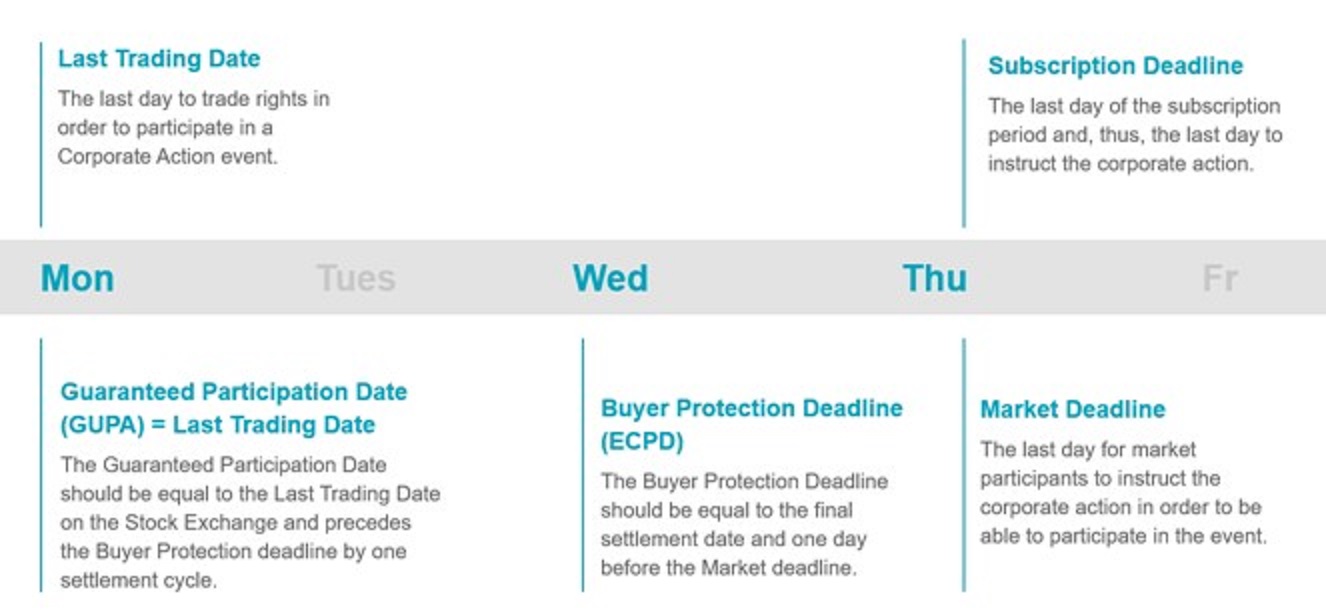

The change relates to the exercise of tradeable rights in the German Market, the Buyer Protection. This is a process where a buyer who has yet to receive the underlying securities from an elective corporate action, instructs the seller to receive the outturn of their choice.

With the OneCAS November Release, the Buyer Protection Deadline (Election to Counterparty Market Deadline, ECPD) and the Guaranteed Participation Date (GUPA) have been introduced to ensure reporting in compliance with the CAJWG Standard.

Click to enlarge image

Impact on clients

Clearstream Banking reminds all issuers and agents that the standard has to be complied with according to German market practice:

- Event data must be set up as shown hereafter;

- The legal minimum duration of the subscription period (14 calendar days) has to be considered;

- Data shall be published to the market accordingly.

Buyer Protection Deadline (ECPD)

The Buyer Protection Deadline is equal to the final settlement date and is one day before the Market Deadline.

The ECPD is calculated upon receipt of a corresponding event notification (VOLU/CHOS) based on the Market Deadline (T-1) and is reported to the clients in the MT564 as follows:

Optional Sequence D

Format:

:98C::ECPD//YYYYMMDDHHMMSS

(Time equals the time mentioned in the Market Deadline in Optional Sequence E).

Example:

:16R:CADETL

:98A::ANOU//20231102

:98C::ECPD//20231109100000

:98A::GUPA//20231107

:16S:CADETL

For reference see the Market Deadline in Optional Sequence E:

:98C::MKDT//20231110100000

Guaranteed Participation Date (GUPA)

The Guaranteed Participation Date is equal to the Last Trading Date and precedes the Buyer Protection Deadline (ECPD) by one settlement cycle.

The GUPA is calculated upon receipt of a corresponding event notification (VOLU/CHOS) based on the Market Deadline (T-3) and is reported to the clients in the MT564 as follows:

Optional Sequence D

Format:

:98A::GUPA//YYYYMMDD

Example:

:16R:CADETL

:98A::ANOU//20231102

:98C::ECPD//20231109100000

:98A::GUPA//20231107

:16S:CADETL

For reference see the Market Deadline in Optional Sequence E:

:98C::MKDT//20231110100000

Further information

For further information, please contact Clearstream Banking Client Services or your Relationship Officer.

------------------------------------------

1. Clearstream Banking refers collectively to Clearstream Banking S.A., registered office at 42, avenue John F. Kennedy, L-1855 Luxembourg, and registered with the Luxembourg Trade and Companies Register under number B-9248, and Clearstream Banking AG, registered office at 61, Mergenthalerallee, 65760 Eschborn, Germany and registered in Register B of the Amtsgericht Frankfurt am Main, Germany under number HRB 7500.