SCoRE standards: TEFRA D changes to processing - Update III

Note: This announcement, originally published on 17 June 2024 and updated on 25 July 2024 and 14 October 2024, has been further updated with additional details on the MT599 content. Changes have been highlighted.

As part of its continuous improvement to comply with the Securities Market Practice Group (SMPG) standards and in anticipation of the future implementation of the new European Collateral Management System (ECMS platform) and the Single Corporate Action Rulebook SCoRE, Clearstream Banking1 will change the TEFRA-D processing for German domestic securities and the securities safekept by CBF via its investor CSD link, including U.S. and Swiss securities. This change will be effective

18 November 2024

Background

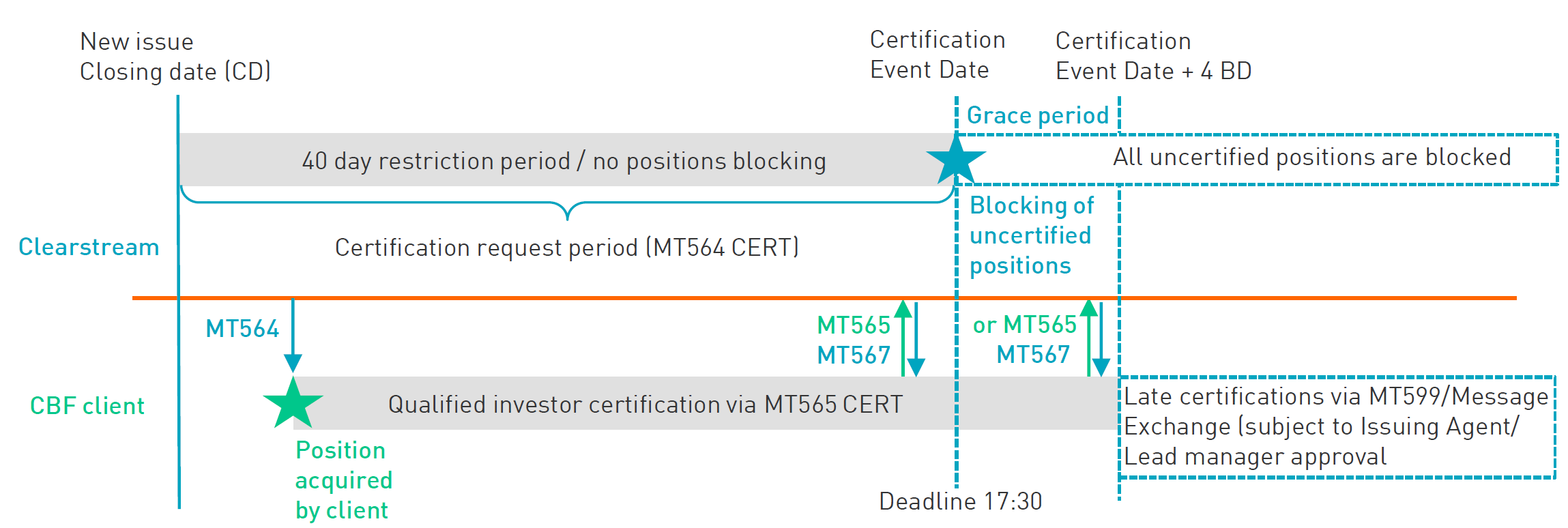

Securities under TEFRA-D regulations are subject to investment restrictions and cannot be held on behalf of a U.S. resident (as final beneficiary) for a period of 40 days after the issue date.

For these securities Clearstream Banking must obtain a certification for any position held on behalf of non-U.S. resident or qualified investor. Failure to receive the requested certification before the deadline will imply the blocking of the uninstructed position.

Impact on clients

The current "strict" and "flexible" TEFRA D procedure will no longer be offered to clients. The handling of the TEFRA D event will move from a full settlement processing to an asset servicing processing.

Clients will be notified via MT564 Corporate Action Notification with an event type Certification (Swift qualifier is CERT).

The MT564 Corporate Action Notification (CERT) will contain the following structured fields in Sequence E:

- :22F::CETI//NDOM for option “QINV”;

- :94C::NDOM//US for options “QINV”;

- :98C::MKDT// for options “QINV” and “NOQU”;:98C::RDDT// for options “QINV” and “NOQU”.

Clients will be required to instruct Clearstream Banking and certify whether their holdings are held by qualified (QINV) or unqualified (NOQU) beneficial owners. Reminders for uninstructed position are sent ten and two business days before the Certification Date.

Clients are requested to reply via MT565 or Xact Web Portal. Any certifications provided via Xact Web Portal or Swift message shall have the same effect as a signed certificate.

Clients must send an MT565 instruction specifying the relevant instruction quantity, corporate action reference ID and the corporate action option code.

Note: Please refer to the Xact via Swift User Guide for more details about the structured fields.

A securities position held by a Qualified TEFRA Investor will not be blocked and will receive entitlements.

After the grace period of four business days, the MT565 will automatically be rejected. All late instructions must be sent by MT599/Xact Web Portal Message Exchange and unblocking will be handled via settlement instruction.

The MT599/Xact Web Portal Message Exchange should be sent to the attention of "OCA" with the following details:

"These are the details of our late TEFRA-D instruction, could you please instruct with the following details agreed with the agent:

- MT564 Corporate Action Reference (:20C: Corporate Action Reference)

- ISIN

- Trade date

- Intended settlement date

- Agent account and sub-account to instruct

- Quantity to instruct

- ‘The above instructed quantity is certified as QINV.‘

- Client contact details"

The final execution will happen only once the Issuing Agent/Lead Manager has accepted the delivery and the instruction has settled on the agent account (XXXX-670).

Certification handling in case of income payment due before the certification event date

In order to obtain payment of an income event due before the certification event date, an instruction to certify the entitled position should be sent before the income payment date to ensure a timely payment.

Reporting

The positions are visible and kept on the client 7-digit account on which the securities were bought or are held. The positions will no longer be blocked on sub-account XXXX-671.

Note: Sub-account XXXX-671 will be closed after migration is fully completed.

Uncertified position at the certification date is blocked by transferring this position via semt.013 from AWAS to the RSTR position type and will be visible on client sub-account XXXX-851.

Clearstream Banking will enhance its reporting for the coupon payment (INTR event) on securities subject to TEFRA D.

MT564 IPAR will contain the following information in the ADTX field:

- Deducted quantity (being the quantity deducted from the eligible quantity reported in field :93B::ELIG of MT564 Corporate Action Notification).

- Missing TEFRA D certification (being the reason for having a deducted quantity visible on the report).

- Not delivered EUR amount (being the amount not paid due to the deducted quantity).

In addition, an MT599 will be sent on payment date -3 business days to notify clients of an upcoming INTR event requiring an early certification of the positions to ensure a timely payment.

A new reminder is sent via MT568 on payment date -1 business days; except for currencies AUD, CNY, HKD, JPY, SGD and NZD for which the reminder (MT568) is sent on payment date -2 business days.

In case of Early Redemption event (MCAL) announced on the market on Payment Date or Payment Date -1 Business Day, an MT568 is also sent to clients who have not certified their position by these dates to ensure a timely payment.

Billing

The formatted TEFRA D instruction will be charged at the cost of a standard corporate action instruction fee. Please refer to the Fee schedule for further details.

Migration

The below table describes the various migration steps. Possible actions to be taken by the clients have been highlighted in bold.

Date | Impacted ISIN | STRICT Option | FLEXIBLE Option |

Friday 15 November 2024 | CERT date is on or after Monday 18 November 2024 | CBF will move positions from account xxxx 671 to main account xxxx 000 with position type AWAS | Positions remain on account xxxx 000 |

Friday 15 November 2024 | CERT date is before Monday 18 November 2024 | Positions remain blocked on account xxxx 671 until client certifies | |

Monday 18 November 2024 | CERT date is on or after Monday 18 November 2024 | Even If clients have certified such positions before the migration weekend, these positions must be recertified by using the new asset servicing model (MT565 instructions). If not certified, these positions will be blocked on CERT date. | Positions will be blocked on CERT date for the first time and the position will be visible with position type RSTR, on the account where the position was originally held. |

Wednesday 20 November 2024 | CERT date is before Monday 18 November 2024 | Last grace period of legacy TEFRA D process ends, including any possible late certification using the legacy lead manager process. | |

Thursday 21 November 2024 | CERT date is before Monday 18 November 2024 | Legacy TEFRA D certification process is no longer offered. Client must certify by using the new asset servicing model (MT565 instructions) for such ISINs. | |

December 2024 | N/A | All xxxx 671 client accounts will be progressively closed by CBF. | |

Further information

For further information please contact ECMS.programme@clearstream.com, Clearstream Banking Client Services or your Relationship Manager.

------------------------------------------

1. Clearstream Banking refers collectively to Clearstream Banking S.A., registered office at 42, avenue John F. Kennedy, L-1855 Luxembourg, and registered with the Luxembourg Trade and Companies Register under number B-9248, and Clearstream Banking AG, registered office at 61, Mergenthalerallee, 65760 Eschborn, Germany and registered in Register B of the Amtsgericht Frankfurt am Main, Germany under number HRB 7500.