How our Securities Lending solutions pave the way for a smooth move to T+1 settlement cycle

Reference

From 28 May 2024, the U.S. standard settlement cycle for DTC eligible securities will be shortened to one business day after the trade date (T+1). Due to their proximity to the U.S. market, the Canadian and Mexican markets have decided to follow the move (27 May 2024).

Transition to T+1 is intended to reduce systemic risk associated with the use of capital and reduced inefficiency, improving the process across trading and post trading in securities subject to changes. During the settlement cycle, the time between trade execution and settlement is considered as a risk for a trading counterparty to potentially become insolvent i.e. the longer the settlement cycle, increased risk of credit and operational is attached to that trade.

Shortening of the securities settlement cycle could have a significant impact on several trade processing areas, such as timing of various lifecycle events i.e. buy and sell detail confirmations, notifications and recalls for securities on loan.

How securities lending will be impacted by the move to T+1

The shortening of the securities settlement cycles across different markets is expected to compress the timeframes for the identification and recall of securities. Recall process shall be aligned more to the market settlement cut-off timelines.

Market participants are advised to work closely with their service and solution providers to accommodate and align to the compressed recall timelines, across the industry participants such as lenders, custodians, vendors, and market infrastructures.

One of the Industry associations has advised the change of lending recall cutoff time from 15:00 EST on T+1 to 23:59 EST on trade date. Others are looking at issuing best practices more aligned with the market closing timelines however these are considered on best effort basis. Operational and technology-driven enhancements considering automation via internal systems or vendor solutions to existing loan recall process are required to avoid processing breaks, to avoid an increase in settlement fails and cash penalties.

How Clearstream’s Securities Lending & Borrowing solutions will be enhanced

Our securities lending solutions are designed to support our clients both for strategic lending (ASLplus) and fails coverage (ASL and ASL principal) activities. With the move to T+1 settlement cycle in U.S.A., Canada and Mexico, the recall process across all products shall be enhanced.

How the move to the shorter, T+1 settlement cycle will effect our current process

There shall not be any changes to the operational model of our lending solutions other than improving our availability and service level. As of today, our lending solutions operate a fully automated recall process in case of recalls due to the market sale of the loaned securities. In case of recalls, triggered on a voluntary basis, the communication shall be further supported by our Operations teams, in line with the indicated settlement dates.

In case of the identification of a security on loan, the system initiates the process of calculating required position to be recalled and lender substitution preferably, across the available lendable pools. This is designed to minimise the impact on borrowers in case the liquidity could be sourced from alternative lenders. If no lender substitution is possible, the system creates an automated recall notification to borrowers, via SWIFT messaging (MT599) and / or an e-mail to a dedicated team depending upon the lending product involved. Please note that Clearstream operates on a real-time basis during the settlement window.

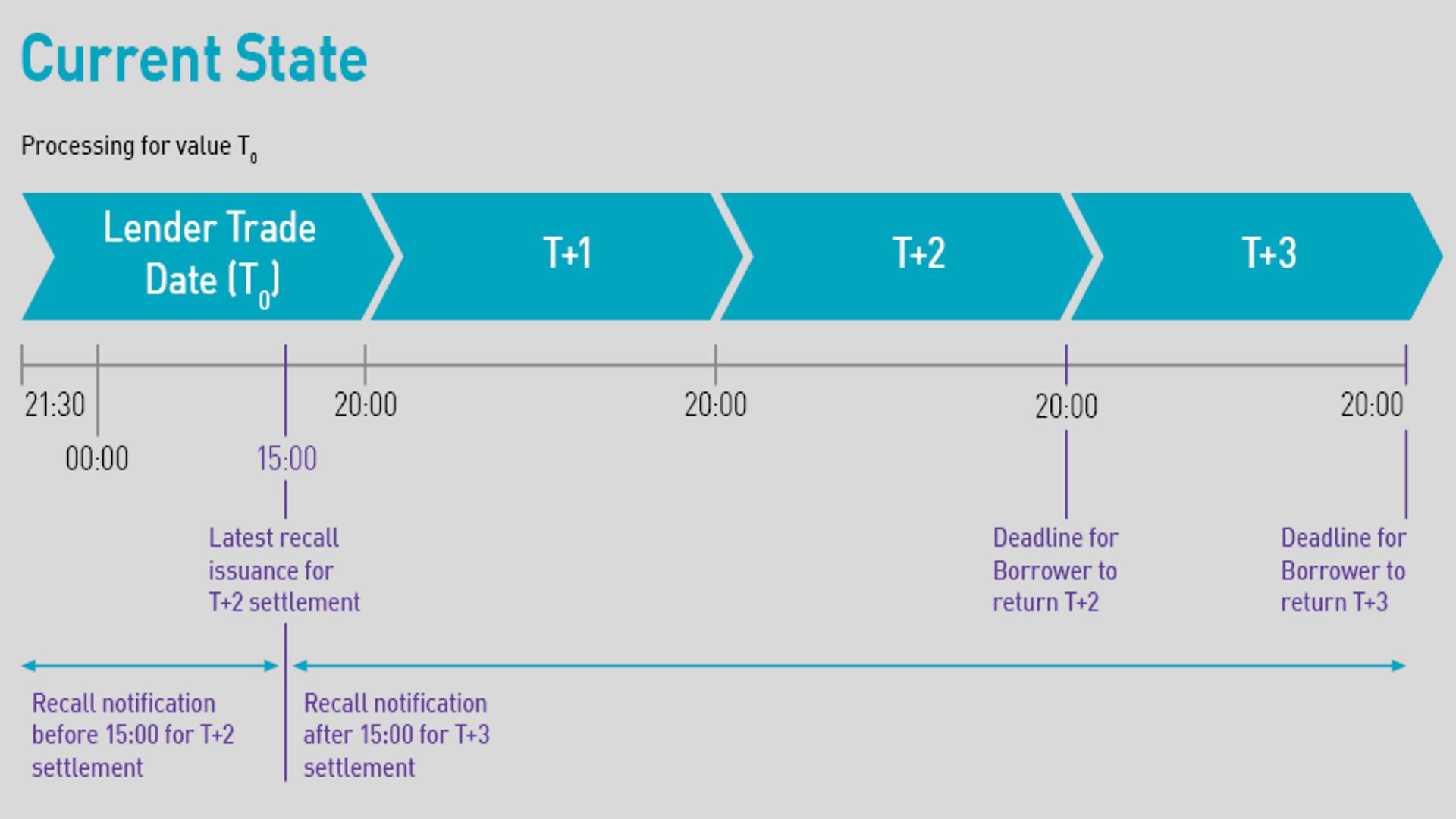

Our current recall times for U.S. securities (not including U.S. treasuries) are as follows:

A recall is triggered by the lender’s notification to Clearstream by authenticated means of communication, upon the lender’s matched/unmatched delivery instruction or the receipt instruction for the lender’s counterparty (no earlier than three business days before the requested settlement date of the instruction).

The recall period starts as follows:

- Recalls triggered before 15:00 CET start on the same day and settle on T+2

- Recalls triggered after 15:00 CET start on the following Business Day and settle on T+3

The recall period terminates at the end of day processing on the End Date.

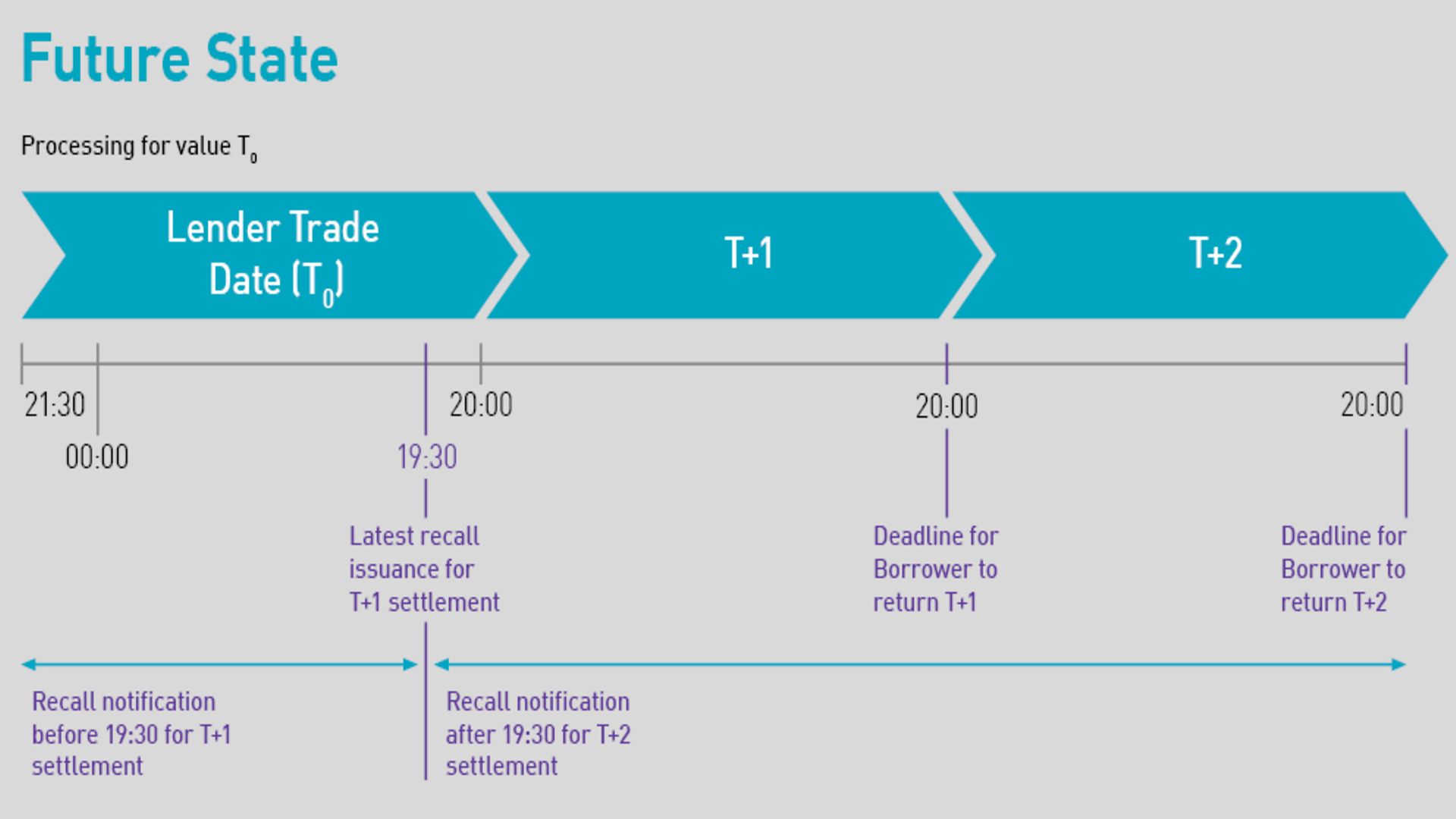

To facilitate the timely settlement for U.S. securities (not including U.S. treasuries), Canadian and Mexican Securities where the settlement is due to follow T+1 settlement cycle, Clearstream shall enhance the recall window from 15:00 CET to 19:30 CET on trade date and automated processing of the recalls by shortening of the settlement duration by 1 day. This shall be available as of 8 June 2024.

The recall period starts as follows:

- Recalls triggered before 19:30 CET start on the same day and settle on T+1

- Recalls triggered after 19:30 CET start on the following Business Day and settle on T+2

The recall period terminates at the end of day processing on the End Date.

As a consequence of the shortened settlement cycle, the borrowers shall be required to return securities the following day before the last settlement batch coverage in the market (20:00 CET).

At this moment, no additional penalties have been announced other than existing ones.

How our Securities Lending & Borrowing team is preparing for the move to T+1

- Industry and client engagement

Our Securities Lending & Borrowing team is participating in various industry working groups and association discussions. Our product experts and relationship managers are in continuous touch with clients, monitoring the impact of developing market practices such as SIFMA, ISLA.

- Technology investment

Our settlement platform operates on a real-time basis. Considering the developing market guidance, Clearstream is enhancing the recall timelines to be more aligned with market requirements through the extension of STP recall issuance communication. Our product platform enhancement shall address the recall timelines across all Lending solutions, both strategic lending (ASLplus) and fails coverage solutions (ASL and ASL principal), to support T+1 accelerated settlement move.

- Dedicated team

Our Securities Lending & Borrowing team is part of a wider team within Clearstream looking at the impact of the T+1 move to identify the dependencies and share experiences to service our clients.

- Leverage fails coverage programmes

In case of delayed delivery/return of specific securities, clients can also leverage our integrated fails coverage solutions (ASL and ASL principal) to increase the settlement efficiency in the system.

Our recommendation to clients regarding their Securities Lending activities and the move to T+1

In a nutshell, we would advise our clients to review their securities lending activity considering the shortening of settlement cycle, familiarise with the industry working groups and associations developing best practices. In light of the changing recall timelines, clients are advised to have a plan to comply with the suggested best practices and Clearstream’s enhanced timelines.

For any further questions, please contact your Relationship Manager or Sales contacts.

Additional information on technical details when doing business with the U.S. market, please refer to Clearstream dedicated FAQ or join our dedicated webinar.