Settlement processing in T2S at Easter and 1 May in 2019

In Announcement D18069 Clearstream Banking AG, Frankfurt1 informed customers about the general regulation for the CASCADE and Creation systems on public holidays.

In this complementary announcement, further information on securities settlement on the public holidays Easter Friday, Easter Monday and Labour Day, 1 May 2019 is outlined.

Effective 2019, T2S will modify the holiday calendar for the settlement days. In future, no settlement will be executed on Good Friday and Easter Monday. The T2S settlement platform and CBF applications will be closed.

As in the previous years, the TARGET2-Cash system will be closed on 1 May, whereas TARGET2-Securities (T2S) will be open for free of payment (FoP) settlement activities and instruction management in Danish Kroner (DKK).

On 1 May 2019, the settlement procedure will be conducted similarly to the T2S processing in 20182. CBF requests customers who maintain delivery against / with payment (DvP3) instructions in Euro to be prepared for a particular liquidity management procedure described below related to this public holiday.

General framework for the processing on 1 May

T2S is open for settlement on the public holiday 1 May. The platform processes free of payment instructions and DvP instructions in Danish Kroner (DKK4). The T2S connectivity channels for T2S In-CSDs and customers acting in DCP mode are available. Instructions can be sent to the T2S settlement platform and T2S provides the reporting according to the T2S Operational Day. Following this approach, the CBF systems are available for customers and CBF’s real-time and standard reporting is transmitted.

Delivery against / with payment instructions (DvP) in Euro for ISINs in collective safe custody (CSC) will not be executed as TARGET2-Cash (T2) is closed on Labour Day, 1 May. Therefore, T2S will reject DvP instructions that indicate this day as Intended Settlement Date (ISD). T2S will transmit the rejection code “MVSD403 – The Intended Settlement Date of the Settlement Instruction against payment is not a T2S Settlement Date for the Currency”. DvP instructions submitted to CBF with ISD 1 May will also be rejected. The error message “KV6128F The settlement day is not a business day in TARGET2/ T2S” will be shown to customers.

Although T2 is closed on 1 May, DvP instructions in Euro can settle if partial settlement has been agreed and the required settlement amount is offset by the T2S optimisation procedure. However, T2S Auto-Collateralisation functionality will not be executed on 1 May.

On 1 May 2019, CBF will be open for FoP settlement. As Clearstream Banking S.A., Luxembourg (CBL) will also be open on these public holidays, there can be settlement of DvP instructions in non-EUR currencies and / or in ISINs in non-collective safe custody (NCSC). Detailed information on CBL’s Settlement timings is available on the Clearstream website.

The following sections provide the details for the CBF services on 1 May (Labour Day):

- Liquidity management activities in Euro and DKK;

- Processing of settlement instructions in the domestic market;

- Processing of settlement instructions with CBL;

- Custody processing;

- Collateral management services (Xemac®);

- Lending management services (LMS);

- CBF applications and reporting;

- Processing with stock exchange locations / service providers;

- Availability of Client Support.

Liquidity management activities in Euro

The liquidity management procedures outlined by CBF in Announcement D18009 remain valid on 2 May. T2S and CBF will provide the cash forecast reporting as usual on business days. Customers can retrieve the CBF Cash Forecast via the CASCADE Online functionality (TRAN: KUCF, FC: CF). Due to the closing of TARGET2-Cash (T2) the content of the cash forecast cannot provide the totals requested for the day after the public holiday, 1 May. For this reason, CBF recommends customers to review the liquidity needs for 2 May on the basis of the cash forecast and determine the liquidity requirements. Below the generic approach related to content of the CBF Cash Forecast reporting is described:

- On the business day before 1 May, the “Current Day T2S Cash Forecast (“Abwicklung Pending”)” will cover pending DvP instructions with an ISD before the public holidays.

- 1 May is not a cash settlement day. Therefore, no T2S figures will be available in the T2S “Following Day T2S Cash Forecast (“Abwicklung nächster Tag”)”. Independent from T2S and T2, the CBF Cash Forecast will already consider the CBF custody payments and instructions from Eurex Clearing AG for 2 May. Hence, the amounts in the cash forecast reporting can change if DvP instructions are newly entered or cancelled during the public holiday.

- On 1 May the “Current Day T2S Cash Forecast (“Abwicklung Pending”)” will cover pending DvP instructions with an ISD before 2 May. This amount might change from the previous reporting as outlined above. The “Following Day T2S Cash Forecast (“Abwicklung nächster Tag”)” will cover pending DvP instructions with ISD 2 May. The CBF cash forecast will still show the CBF custody payments and instructions from Eurex Clearing AG on the business day before the public holiday. The CBF Cash Forecast Report on 1 May can be considered as complete.

According to the CBF cash management service, for the business day after 1 May, existing standing orders will be considered by CBF. The predefined values will be used to generate a liquidity transfer based on the cash forecast before the public holiday. Hence, CBF customers using a standing order based on the CBF cash forecast must either enter a single liquidity transfer on their demand via the CBF CASCADE Online functionality (TRAN: KNEE, FC: EL) or use the functionality provided by their national central bank (NCB).

CBF will initiate the liquidity transfer requests towards T2 during the end of day processing on 30 April. In T2 the liquidity transfers will be executed on the value day 2 May and posted on the related business day in T2S. The respective NCB will manage the liquidity injections towards the related T2S Dedicated Cash Account (DCA) according to their processing timelines.

Liquidity management activities in Danish Kroner (DKK)

Since 29 October 2018, T2S supports DvP settlement in Danish Kroner. The settlement of DKK is offered by CBF via CBL. This means that settlement will also be possible on 1 May 2019 using 6-series accounts. Therefore, pending instructions out of corporate actions with a cash leg (market claims and transformation) can settle if the CBF customer and its counterparty have agreed such action. The provision of DKK is subject to the regular settlement conditions issued by CBL. The cash deadlines for 1 May related to the settlement in foreign currencies are available on the Clearstream website.

Processing of settlement instructions in the domestic market

In line with T2S Operational Day schedule, CBF will be open for FoP settlement activities on 1 May. The related settlement reporting is provided as on any other business day. Neither CASCADE nor T2S will allow to store 1 May as Intended Settlement Date (ISD) in DvP instructions with a cash leg in Euro. Such instructions entered in ICP mode will be rejected by CASCADE with the error message “KV6128F Settlement-Day ist kein T2- / T2S-Business-Day // The settlement day is not a business day in TARGET2 / T2S”. Hence the instructions will not be forwarded to T2S. Customers acting in DCP mode will receive the rejection from T2S “MVSD403 – The Intended Settlement Date of the Settlement Instruction against payment is not a T2S Settlement Date for the Currency”.

CBF instruction types that are designed for FoP can be transmitted in ICP or DCP mode. CBF supports, for example, transfers to the German Federal Debt Administration (AA03), usage of pledge instructions (AA04 / 05), GBC instructions (AA07 / 09) and bond stripping (AA14 / 15). Also, the reinstruction procedure for Stock Exchange trade (AA10, LION) is supported. That is, CBF will consider the T2S rejection code “MVSD403” as an additional value for the automated reinstruction procedure. CBF will flag such LION instructions as rejected (“RJ”) and reinjects them for the upcoming business day (2 May).

The CASCADE Registered Shares functionality for registration and de-registration will also be available. CBF will inform the registrars about the holidays in 2019 and expects that – like in the past - responses and feedback for such instructions will be given in time.

Processing of settlement instructions with CBL

CBL will be open for OTC and stock exchange instructions in non-collective safe custody (NCSC) securities. These instructions can be settled via the Creation platform on 1 May 2019.

The Creation platform will be open to settle DvP instructions of CSC and NCSC ISINs in foreign currencies based on the regular service levels. The securities leg of CSC ISINs will settle on T2S as T2S conducts for such instructions the FoP settlement procedure even though the instructions are entered as DvP instructions in CASCADE.

Custody processing

CBF will conduct custody processing according to the “KADI event schedule”. Announced events with an entitlement date on 1 May will be executed. In general, the securities leg will settle on the value date at T2S as CBF generates its corporate actions instructions (AA01 and AA13) as FoP only. Also, market claims and transformation without a cash leg can settle on 1 May, upon successful settlement on the underlying instruction defined in the event details. With regard to the TEFRA D certification period, at the end of the 40 days the positions will be moved into the respective CBF sub-account (xxxx 671).

Euro cash legs resulting from custody events will settle on 2 May using CBF’s cash processing cycle “DD1”, because TARGET2-Cash (T2) is closed during the public holidays. CBF will transmit the corporate actions confirmation (MT566) as soon as T2S or T2 provide the settlement results. Cash legs in a foreign currency will be executed on the Creation platform on value day.

For all CBF eligible ISINs issued by ESES, LuxCSD, Monte Titoli, NBB or OeKB5 that are held in collective safe custody (CSC) and are part of the OneClearstream service offering, the Euro cash leg of a custody event will be processed via T2S using RvP, DvP or PFoD6 instructions. This means, that if the expected value date is 1 May, the payment will be initiated with the Intended Settlement Date (ISD) 2 May. Comparable to the processing of KADI, market claims and transformation without a cash leg can settle on 1 May, upon successful settlement on the underlying instruction and the event details.

Collateral management services (Xemac®)

CBF’s collateral management services will be closed on Good Friday and Easter Monday, but available on 1 May 2019.

As T2S supports FoP settlement on 1 May, CBF customers can maintain their collateral holdings, that is, transfers of positions into and out of the Xemac pool are possible. In addition, substitutions can occur. The Xemac reporting will be transmitted as for any other regular business day.

For the calculation of the collateral value, Xemac will use the price files provided on 30 April 2019. Hence, the collateral value can be impacted by an update of the underlying securities static data. An already allocated security can become invalid. Customers should be prepared to have sufficient securities in their collateral pool.

As claim amount changes in Xemac in favour of Deutsche Bundesbank will not be considered by Bundesbank on 1 May 2019, CBF recommends that customers do not initiate such changes on this day. Customers should consider that a reduction of the claim amount towards the Bundesbank cannot be executed and will be rejected.

CBF likewise recommends customers to leave claim amounts in favour of Eurex Clearing AG unchanged. On this public holiday Eurex Clearing AG will not process any instructions. For more details please refer to the CCP processing calendar provided by Eurex Clearing AG.

Lending management services (LMS)

Lending services will be supported on 1 May 2019. That is, the respective business cases are processed as FoP instructions using the instruction types AA11 / 12. Similar to the processing in Xemac (please see previous section), no updated price files will be available, but the underlying securities static data can change. In case the collateral value decreases, customers need to be prepared.

CBF applications and reporting

On 1 May 2019, all CBF systems including the CASCADE Online functionality (HOST / PC) will be available for customers.

The CBF real-time and standard settlement reporting will be provided according to the existing CBF business day schedule. Customers who subscribed to an empty file reporting will receive such files.

Processing with stock exchange locations / service providers

CBF informed the stock exchanges, their service providers and Eurex Clearing AG about the modified T2S holiday processing on the public holidays for Easter and 1 May from 2019 onwards.

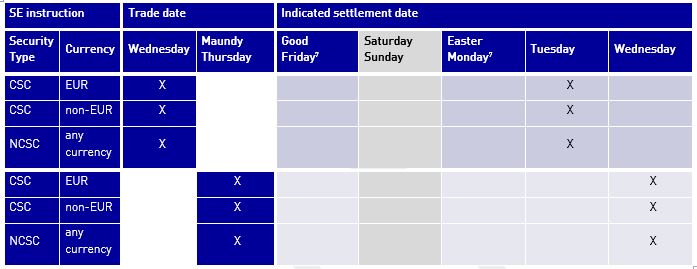

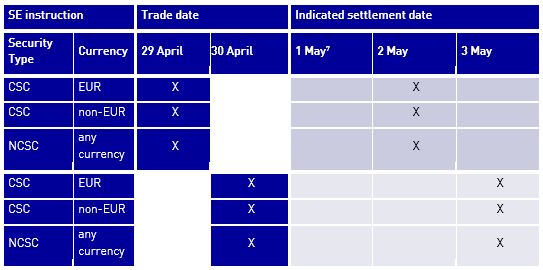

The tables below give an overview related to the processing of stock exchange (SE) settlement instructions in line with the T2S specifications and Clearstream service levels.

Table 1 - Overview processing days around Easter

(click on the graphic to enlarge)

Table 2 - Overview processing days around 1 May

(click on the graphic to enlarge)

For non-CCP trades it has been agreed with BrainTrade Gesellschaft für Börsensysteme mbH, Tradegate Exchange, Xitaro / Börse Stuttgart and Börse Frankfurt that the above-mentioned rules are generally applicable for their settlement instructions on the public holidays outlined in this announcement. The stock exchanges plan not to use the public holidays for settlement regardless of the security type and currency. Further information might be provided by the stock exchange locations and service providers. Customers are recommended to check potential additional information provided by these third parties.

In LION instructions the Intended Settlement Date (ISD) might be indicated with “Festvaluta” (fixed value date), if advised by the trading system. For non-CCP instructions that will be provided for Xetra 2 (XFRA) trades this approach will be used. Stock exchange transactions that are processed via Eurex Clearing AG (ECAG) will follow the CCP processing calendar. In principle, on Good Friday, Easter Monday and 1 May, ECAG closes the clearing system and no instructions are provided to the linked settlement systems.

Customer simulation

The T2S Service Desk informed the T2S In-CSDs that the public holiday processing can be tested on 10 January and 28 February 2019 in the T2S Pre-Production environment (UTEST). On these days, UTEST will be connected to the KRONOS2 test system and T2CUST will schedule a T2 Closing Day. In line with the CBF procedures that will be conducted in production, the CBF customer simulation environment (IMS23) will be open on this test day for FoP instructions, only. The connectivity to UTEST remains unchanged. The processing results provided by these test environments will be passed on to our customers.

During the Easter holidays (18 April to 22 April 2019) and on Labour Day (1 May 2019) IMS23 and UTEST will not be accessible. On these public holidays, no instruction management can be executed.

Availability of Client Services on public holidays

On 1 May 2019, all Clearstream Client Services teams can be reached during their regular service times.

------------------------------------------

1. This announcement is published by Clearstream Banking AG (CBF), registered office at Mergenthalerallee 61, 65760 Eschborn, Germany, registered with the Commercial Register of the District Court in Frankfurt am Main, Germany, under number HRB 7500.

2. Please refer to Announcement D18009.

3. DvP stands for Delivery versus Payment, Receive versus Payment, Delivery with Payment and Receipt with Payment instructions.

4. CBF does not maintain DvP settlement instructions in DKK via T2S, but via CBL

5. The activation of OeKB (Oesterreichische Kontrollbank) as part of the OneClearstream is scheduled on 10 December 2018.

6. PFoD = Settlement type transferring cash only on T2S platform (Payment Free of Delivery)

7. CBL will be open for settlement processing according to the announced deadlines.