New syndicated securities distribution service

On 14 March 2022, Clearstream will launch a new primary Delivery Versus Payment settlement service for syndicated issuances replacing the current offering where payment of issuance proceeds would flow independently from the credit of securities.

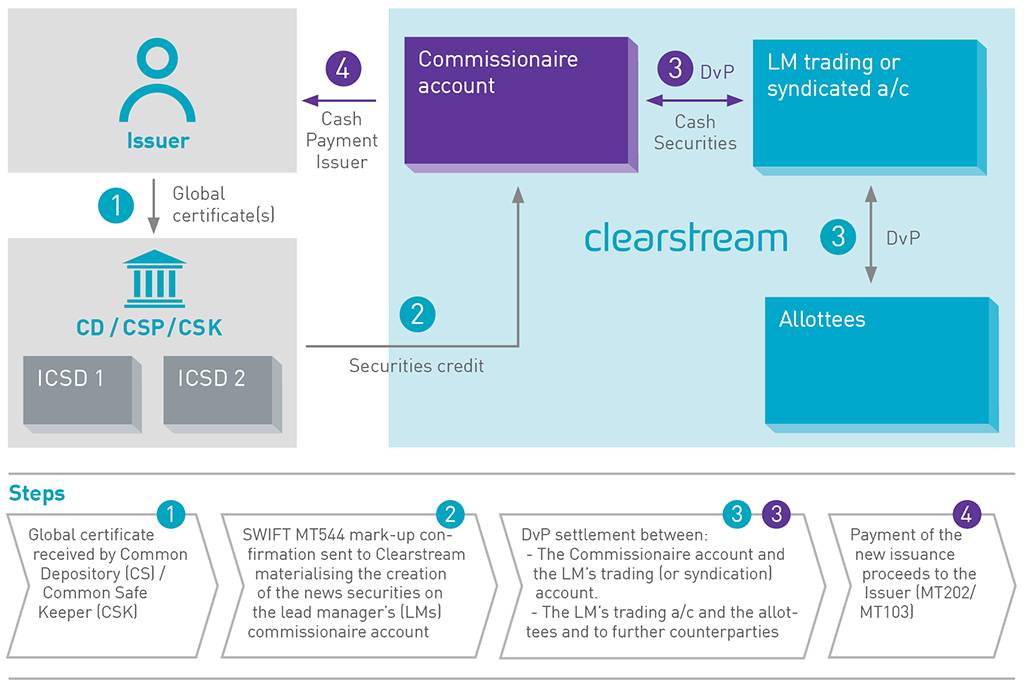

New settlement model

The syndicated securities distribution service allows true DvP settlement between the lead manager and the investors in Clearstream’s books while streamlining the payment to the issuer, thereby minimising risks between all parties and collateral consumption by lead managers. Common Depositories are now able to allow the initial deposit of the securities with Clearstream without an “irrevocable commitment to pay” which formerly had to be released by Clearstream to the Common Depository/Common Service Provider.

The new settlement model has been jointly developed with Euroclear Bank and has received support from market associations (ICMA and ICMSA) as well as market players active in syndicated issuances.

Concept of “commissionaire” account structure

In the new settlement model, Clearstream is acting in its own name, and on behalf of the lead manager.

Under Luxembourg law, the relationship between the Lead manager and Clearstream can be qualified as as a commission contract “commission”, where Clearstream is acting as commission agent “commissionnaire” and the Lead Manager is acting as principal “commettant”.

When opening a “commissionaire” account on behalf of a lead manager or a settlement agent in its own books, Clearstream is acting in two different capacities:

- as commission agent acting on behalf of the lead manager/settlement agent, and

- as depository acting on its own behalf.

Clearstream must be contractually authorised by the lead manager to act in such dual capacity. Therefore, a dedicated terms and conditions document must be signed by each lead manager for the opening of a “commissionaire” account in addition to the standard account opening form. Clearstream will delegate usage of the “commissionaire” account to the lead manager via a power of attorney.

Enhanced issuer protection

The new syndicated securities distribution service will allow the deposit of the global certificate by the Common Depository/Common Service Provider for a credit of securities on the “commissionaire” account against the assurance that:

- no settlement against the lead manager shall take place until the lead manager has the necessary cash provision on its account in the form of funds/credit (contractual requirement from Clearstream towards the lead manager); and

- the issuance proceeds, once collected on the commissionaire account, will be immediately transferred to the issuer, following the lead manager instructions.

New settlement workflow - Preparatory steps and recommended timing

- Lead Manager

- to inform Clearstream of upcoming securities distribution 3 business days in advance of settlement date;

- to input securities transaction in one single transaction between its commissionaire account and its own trading (or syndication) account;

- to send the payment instruction to pay the issuer, and

- to inform Clearstream it provided its green light to the common depository to proceed with the issuance once conditions precedents are met.

- Common Depository/Common Service Provider

- to send its mark-up instruction before 12:30 CET or at least two hours ahead of Clearstream’s cash currency deadline.

Syndicated securities distribution service - Settlement flows

Operational changes and beyond

- Payment to issuer instruction - New narrative

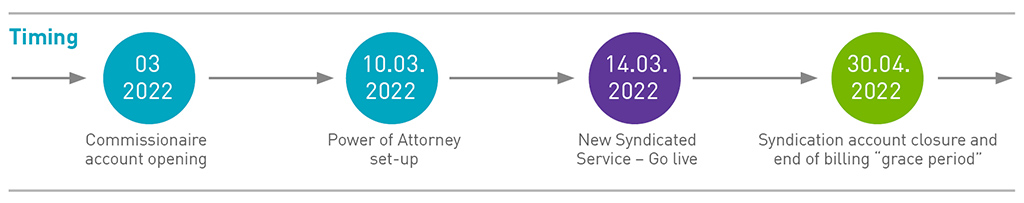

To ensure that Clearstream executes the payment to the issuer immediately after securities have been distributed, Clearstream will require that lead managers systematically mention in the narrative field :72: – of their cash instruction(s) MT202 / MT103 the ISIN code that will be settled via DvP. This ISIN code to be systematically mentioned in the payment instruction is the one mentioned in the delivery instruction (MT543 type) under field :35B:. - Upon participant’s confirmation, syndication account will be closed on 30 April 2022

- From 14 to 30 April 2022, Clearstream will not charge any fees for its new syndicated settlement service

- ICMA published on 20 October 2021 a documentation giving recommendation how to setup their transaction documentation.

Transition activities