Digitise your issuance portfolio

Building the digital asset ecosystem

The digital asset evolution in the financial services industry is progressing rapidly. Digital securities services ecosystems enhance market efficiency by bridging the gap between issuers and investors, moving towards instant securities services.

Market leader in digital issuance and post-trade

D7, Deutsche Börse’s next-generation digital issuance platform, provides a fully digital alternative to conventional physical issuance and processing of securities. Market participants can issue electronic securities within seconds with enhanced speed, transparency and flexibility.

30,000digital security issuances processed weekly | 550,000+digital securities | €20+ billiondigital issuance |

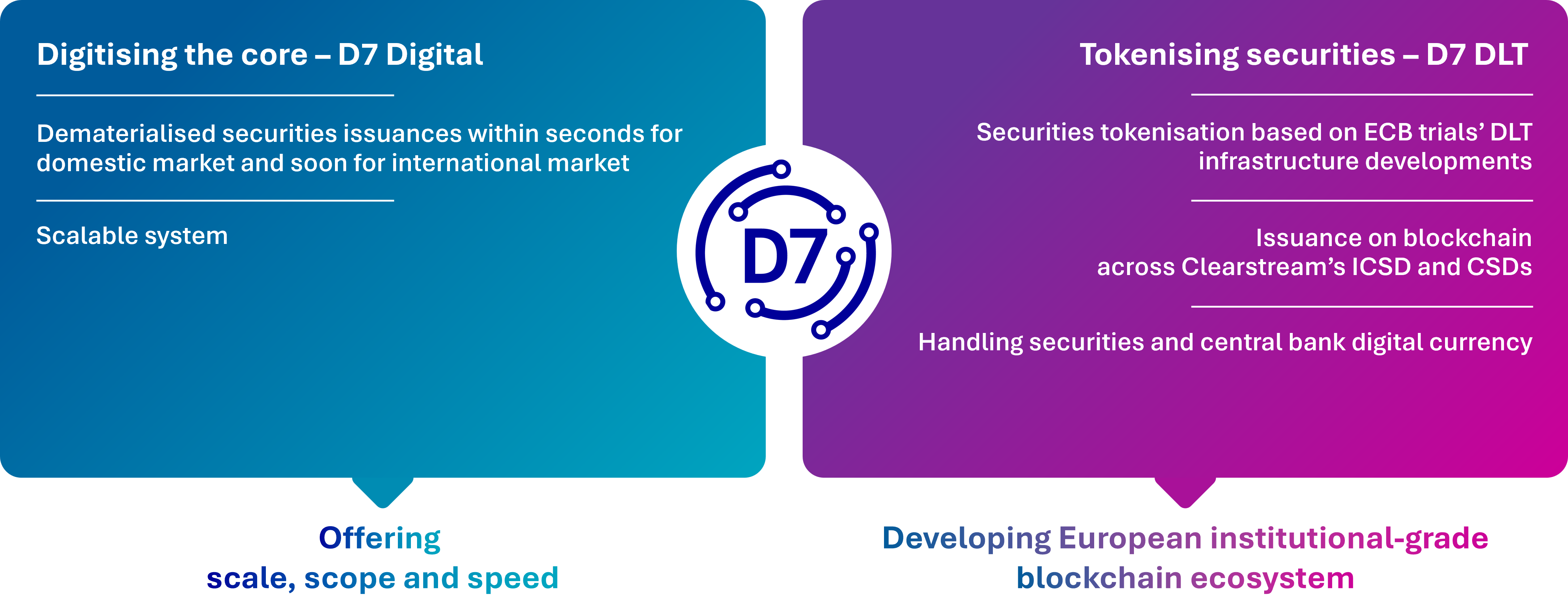

Digitising the core: D7 Digital

Developed in collaboration with Google Cloud, D7 is a scalable and digital system looking to handle the majority of digital issuances for Germany, Luxembourg and the international market. To date, it has processed over 550,000 issuances worth more than EUR 20 billion, enabling securities to be issued in seconds.

D7 covers all retail structured products (RSPs) issued in Germany, enabling clients to migrate their existing business from eMission to D7. The platform also supports a range of debt capital market (DCM) products, with international capabilities and further product expansions to follow in the course of 2025.

Tokenising securities: D7 DLT

The set-up is complemented by a Distributed Ledger Technology (DLT)-based architecture to enable seamless tokenisation of securities. The solution was launched as part of the ECB trials conducted in 2024. D7 DLT demonstrated its ability to issue securities on blockchain, handling both securities and central bank digital currency, with a vision to further scale these capabilities in the future.

Did you know?

Operating as market DLT operator – The ECB trials have successfully demonstrated seamless exchanges of cash and securities across diverse use cases, including issuances, collateral management and financing transactions such as centrally cleared intraday repos. This was achieved with native digital issuance of DE, XS and LU ISINs on a digital ledger. For more information, visit the dedciated webpage.

Further information

For more information, please contact your Relationship Manager or visit the D7 Navigator (available to Premium Users only).