Operational Information

Equities – rates, eligibility, availability of relief etc. – Romania

Tax | Romania

Reference

Service level

CBL | 6-series account

Last Updated

21.02.2025

Withholding tax

Standard rate of withholding tax: | 10% a | Holding requirements/restrictions: | No |

a. 8% until 31 December 2024

Availability of relief

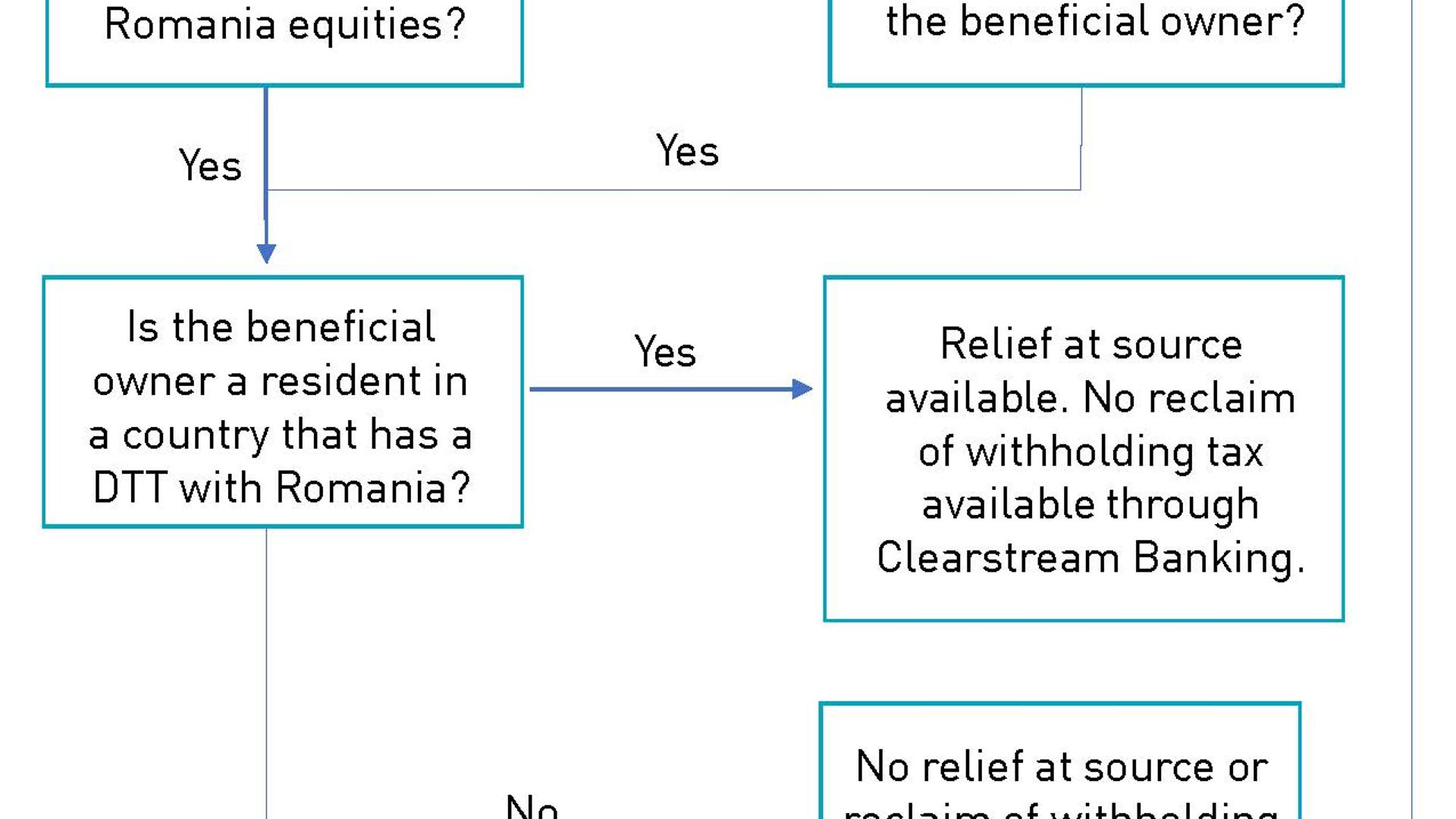

Click on the image to view the diagram showing the availability of relief at source and/or quick reclaim of withholding tax on income from Romanian equities.

Eligible beneficial owners | Relief at source | Quick refund | Standard refund |

Residents of Double Taxation Treaty (DTT) countries | Yes | No | No |

Related Links

Further Romania Tax information

Market Taxation Guide – RomaniaGeneral information - types of securities, deadlines, other market specifics - RomaniaBeneficial owners - RomaniaDebt securities - rates, eligibility, availability of relief etc. - RomaniaRelief at source - eligibility, documentation, deadlines – Romanian bondsEquities – rates, eligibility, availability of relief etc. – RomaniaRelief at source - eligibility, documentation, deadlines – Romanian equitiesForm descriptions – Relief at source – Romanian bondsForm descriptions - Relief at source - Romanian equities Tax Forms to use - Romania

Related Romania information