Summary

The US Tax query allows you to retrieve the related data. You can refine your query by specifying a particular parameters. By default, the returned list view is in ascending order

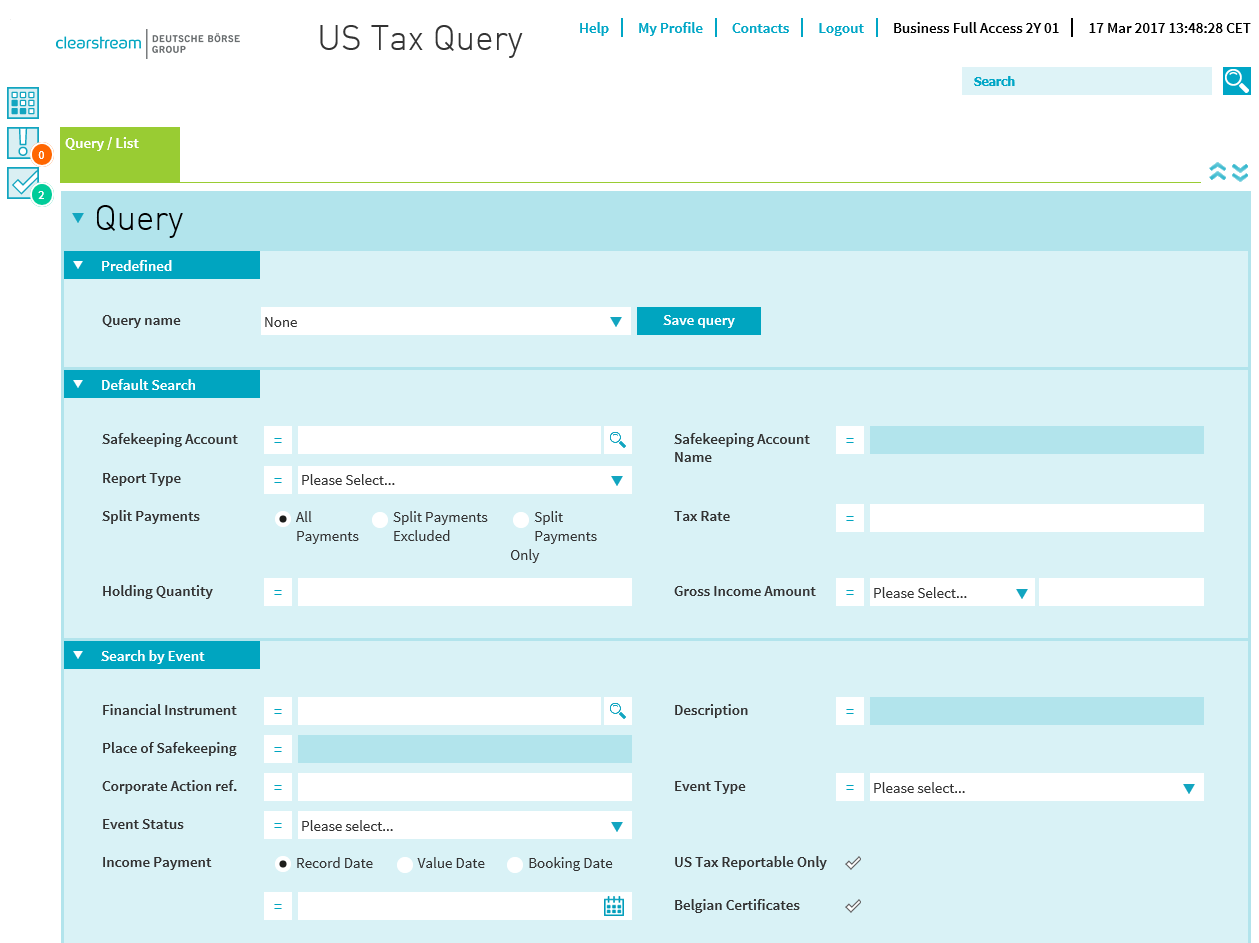

US Tax Query

The Predefined section in the US Tax query gives the ability to save and manage your own queries.

Field Description

| Filed Name | Field Type | Description |

| Query name | Drop Down (simple select) | This field contains all saved queries name that you are able to select. |

Predefined Actions Description

| Action Name | Action Type | Description |

| Save query | Button | When clicking on the action button, a pop up will appears asking you to provide a name and description to the query that you are saving. All the query parameters takes into account in the query saved. |

| Delete query | Button | This will allows you to delete your saved queries. |

| Set as default | Button | Once clicking on this button action, you will set the query, specified in the "Query name" field, will execute by default when you land the US Tax query. The query executes automatically. |

Field Description

| Filed Name | Field Type | Description |

| Query name | Select one menu | Any |

| Safekeeping Account | Input text | Contains the account id input by the user or selected via the lookup. |

| Safekeeping Account Name | Output text | Contains the name of the account selected. This field is not editable. |

| Report Type | Select one menu |

The Report Type must be a dynamic list from the USTAX database. It contains a drop down list with the following values:

|

| Split Payments | Radio button group |

Consists of three radio buttons. Only one of the three buttons can be selected at any one time (as is the nature of radio buttons):

|

| Tax Rate | Input text |

Allows the user to select a tax rate (percentage) in green: EXEMPT 0 N/a 30 TAX10 10 TAX15 15 TAX20 20 TAX30 30 BACKUP 30.5 USNOTEXM 30.5 TAX25 25 BACKSOID 30.5 TAX17.5 17.5 UNDOC 30 N/a US 30.5 BACKUP1 31 BACKUP2 30 N/a US1 31 N/A US2 30 FATCA30 30 FATCA-QI 30 Note that one rate may correspond to more than one description. Limited from 0 to 100. |

| Holding Quantity | Input text |

The customer’s holding or the Beneficial Owner(s) holding in the underlying securities. Holding quantity: maximum number of digits allowed by Clearstream applications are kept at 20 digits (leading zeroes, sign or comma not included): integer + decimal parts or integer part of nominal quantities (if no decimal part in the nominal quantity), Maximum length for the decimal part is 6 digits. |

| Gross Income Amount – Currency list | Select one menu | Drop-down list of valid currencies. |

| Gross Income Amount | Input text | The customer’s income amount before tax or the Beneficial Owner(s) tax amount before tax in the underlying securities |

| Financial Instrument | Input text |

Contains the ISIN of the instrument input manually or selected via the lookup. Input of multiple Financial instruments is allowed. |

| Description | Output text | This non editable field displays the instrument's description, once a selection has been made via the financial instrument lookup or entered manually. |

| Place of Safekeeping | Output text | Contains the place of safekeeping related to the Financial Instrument ID selected. |

| Corporate action ref. | Input text | Corporate action reference |

| Event Type | Select many list box |

Drop down list containing the event type codes valid for the US Tax Report:

|

| Event Status | Select many list box |

The current payment processing status of a taxable or reportable income event. Drop down list containing the possible Event Statuses (Please Select…, PAID, REPAID, REVERSED)

|

| Income Payment | Radio button |

A group of three radio buttons: Record Date, Booking Date and Value Date.

|

| Income Payment | Date picker | Record Date or Value date or Booking date |

| US Tax Reportable Only | Checkbox | Filter US Tax reportable only securities (not taxable). |

| Belgian Certificates | Checkbox | Filter Belgian certificates of US securities. |

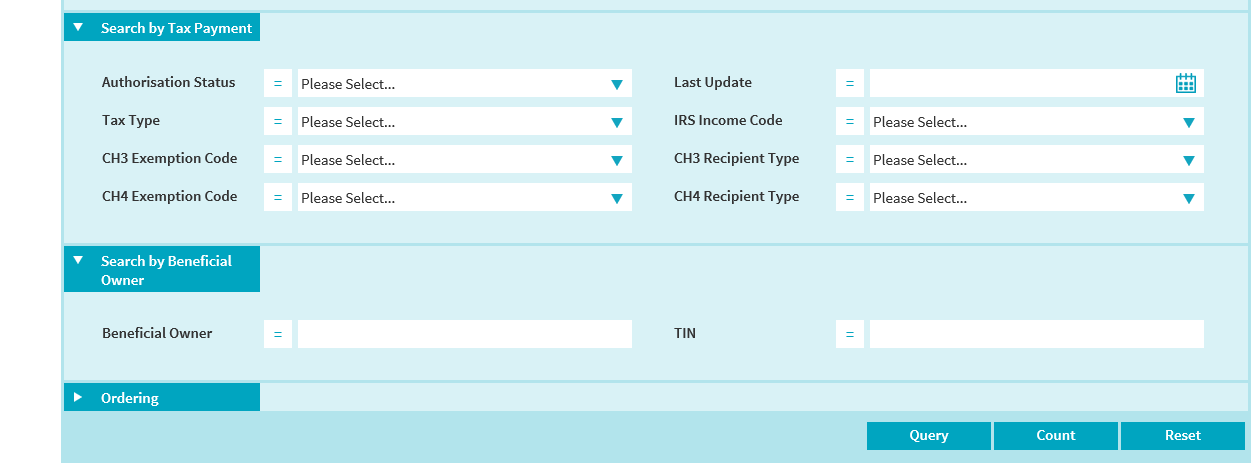

| Authorisation Status | Select one menu |

The status of a taxable or reportable payment in the tax reporting database. Drop down list of reportable status codes in US Tax Application : • All, excluding deleted • Authorised • Re-Authorised • Deleted AUTHORISED: The taxable or reportable payment has been split to the underlying beneficial owners and the appropriate withholding tax rate and report type have been assigned per beneficial owner, according to customer certification. RE-AUTHORISED: A payment has been authorised more than once and has been adjusted during the authorisations. DELETED: A previously authorised or re-authorised payment has been removed from the US tax reporting database All, excluding deleted: All the valid not deleted payments. (RS has to extract this way) |

| Last Update | Date picker |

Allows the end-user to query in “a delta mode” i.e. to query US Tax payments that have had their status changed within the requested date interval. The “Last Update” parameter is related to the “Payment”, i.e. the reported payment will be the one with the last update payment and with latest splits and beneficial owner. |

| Tax Type | Select one menu |

The drop down list will display the tax type:

Allows the user to enter the query based on the coding defined by the Internal Revenue Service (IRS). |

| IRS Income Code | Select one menu |

With FATCA, a validity period for a code and decode was introduced. The list of IRS (Internal Revenue Service) income codes must be a dynamic list from the USTAX database. Drop down list of codes. The drop down list will display the decode value next to the code. (e.g. “06 Dividends paid by U.S. corporations-general”):

|

| CH3 Exemption Code | Select one menu |

With FATCA, a validity period was introduced for a code and decode. The list of CH3 Exemption codes must be a dynamic list from USTAX database. Drop down list of codes. The drop down list will display the decode value next to the code. (e.g. “01 Effectively connected income”):

|

| CH3 Recipient Type | Select one menu |

Allows the user to enter the query based on the classification of the recipient of a specific income payment. With FATCA, a validity period was introduced for a code and decode, the list of CH3 Recipient Types must be a dynamic list from USTAX database. Drop down list of codes. The drop down list will display the decode value next to the code. (e.g. “01 Individual”):

|

| CH4 Exemption Code | Select one menu |

With FATCA, a validity period was introduced for a code and decode, the list of CH4 Exemption Codes must be a dynamic list from USTAX database. Drop down list of codes. The drop down list will display the decode value next to the code. (e.g. “13 Grandfathered payment”):

|

| CH4 Recipient Type | Select one menu |

With FATCA, a validity period was introduced for a code and decode, the list of CH4 Recipient Types must be a dynamic list from USTAX database. Drop down list of codes. The drop down list will display the decode value next to the code. (e.g. “01 U.S.Withholding Agent-FI”):

|

| Beneficial Owner | Input text (wildcard, at least 3 alphanumeric characters must be entered.) |

The search of the beneficial owner must be limited to the beneficial owners linked to the Account(s) selected. |

| TIN | Input text | The US Taxpayer Identification Number. This number can be a social security number assigned to individuals by the Social Security Administration or an Employer Identification Number assigned to businesses and other entities by the Internal Revenue Service. |

Field Description

| Filed Name | Field Type | Description |

| Sort by | Drop down (single select) |

You will be able to sort the query by the below list: ICSD/CSD Identification Party Identifier Name Country City |

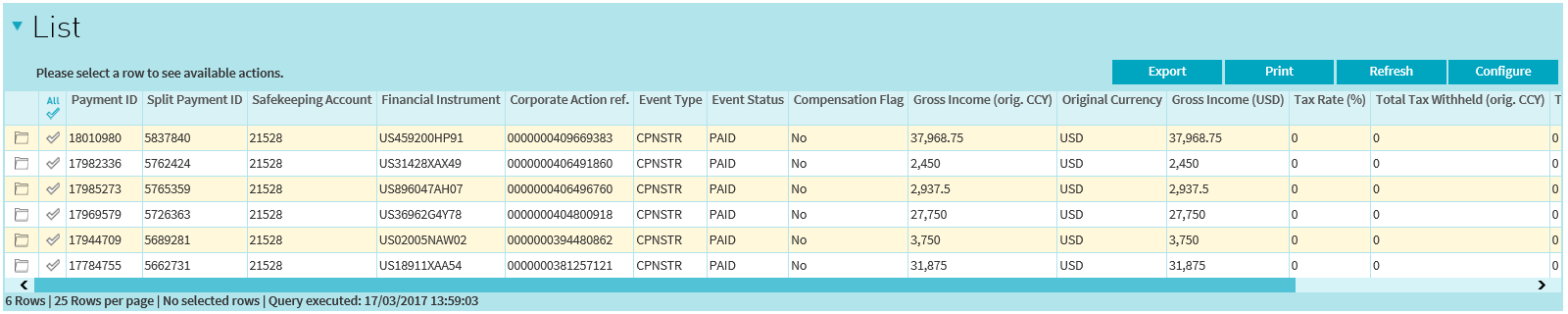

Once the query has executed, you are prompted with the list of US Tax related to the query parameters provided.

The list view is composed with:

Fields Description

Below is the list of fields displayed (by default or by adding them with the “Configure” option to add more fields):

| List View Field Name | Fields displayed by default or configured |

| Payment ID | Default |

| Split Payment ID | Default |

| Safekeeping Account | Default |

| Financial Instrument | Default |

| Common Code | Configure List |

| Common Code Type | Configure List |

| Place of Safekeeping | Configure List |

| Corporate Action ref. | Default |

| Event Type | Default |

| Event Status | Default |

| Holding Quantity | Configure List |

| Compensation Flag | Default |

| Gross Income (orig. CCY) | Default |

| Original Currency | Default |

| Gross Income (USD) | Default |

| Tax Rate (%) | Default |

| Total Tax Withheld (orig. CCY) | Default |

| Total Tax Withheld (USD) | Default |

| Exch. Rate | Default |

| Record Date | Default |

| Value Date | Configure List |

| Booking Date | Configure List |

| IRS Income Code | Configure List |

| Tax Type | Configure List |

| CH3 Exemption Code | Configure List |

| CH3 Recipient Type | Configure List |

| CH4 Exemption Code | Configure List |

| CH4 Recipient Type | Configure List |

| US Tax Reportable Only | Configure List |

| Belgian Certificate | Configure List |

| Beneficial Owner | Configure List |

| QI TIN | Configure List |

| FATCA TIN | Configure List |

| Report Type | Configure List |

| Instrument Name | Configure List |

| Instrument Description | Configure List |

| Safekeeping BIC | Configure List |

List View Actions Description

| Action Name | Action Type | Description |

| Export - all | Button | it will export all the rows returned by the query (whatever if selected or not). |

| Export - list | Button | it will export the current list displayed at the screen. |

| Export - selected | Button | it will export the selected rows |

| Print - all | Button | it will print all the rows returned by the query (whatever if selected or not). |

| Print - list | Button | it will print the current list displayed at the screen. |

| Print - selected | Button | it will print the selected rows |

| Refresh | Button | it will re-execute the current query and will refresh the rows displayed. |

| Configure | Button | it will allow you to configure the column that you want to display in the list view |

Open Details

When the user click on one line then another button is displayed, i.e. “Open Details” which brings you to the full detail view of that selected item

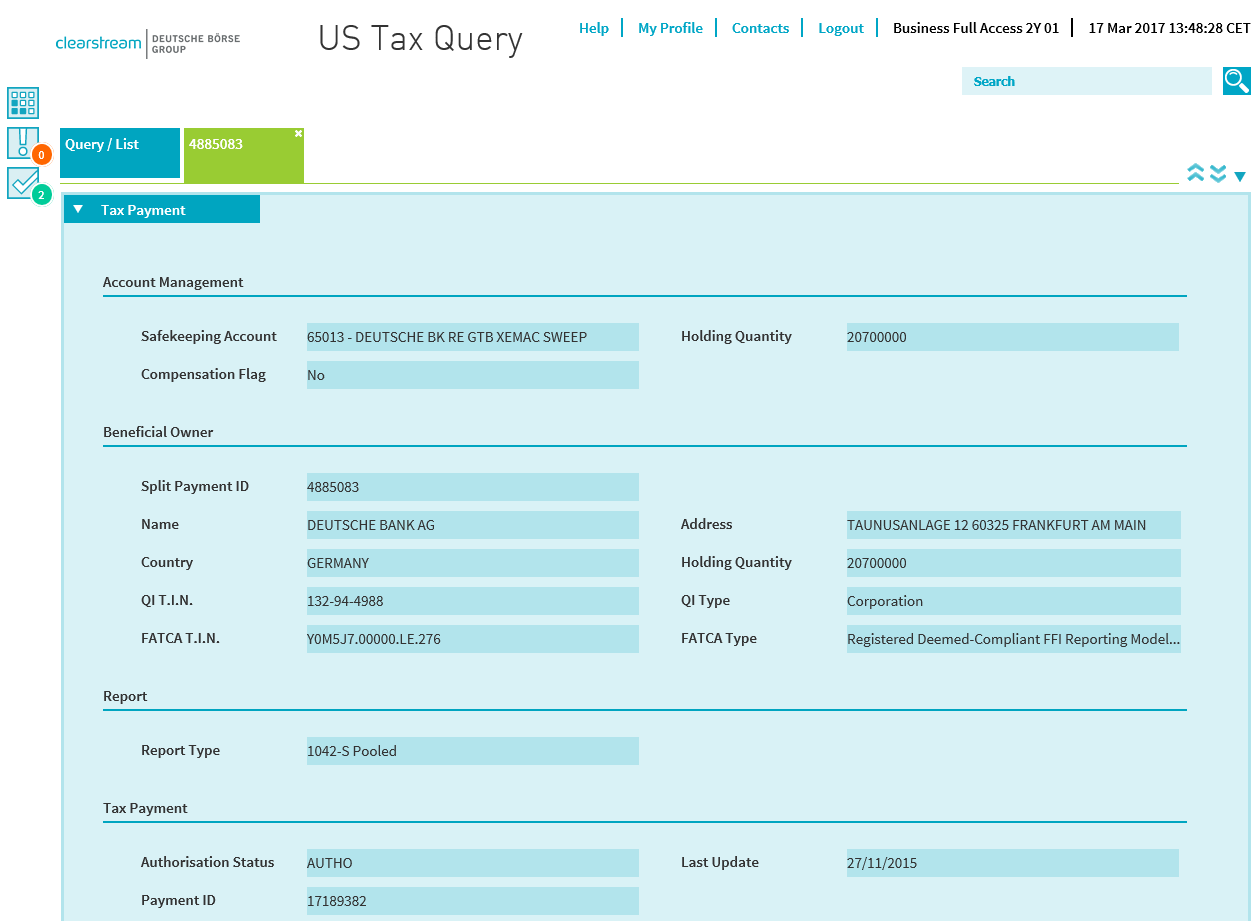

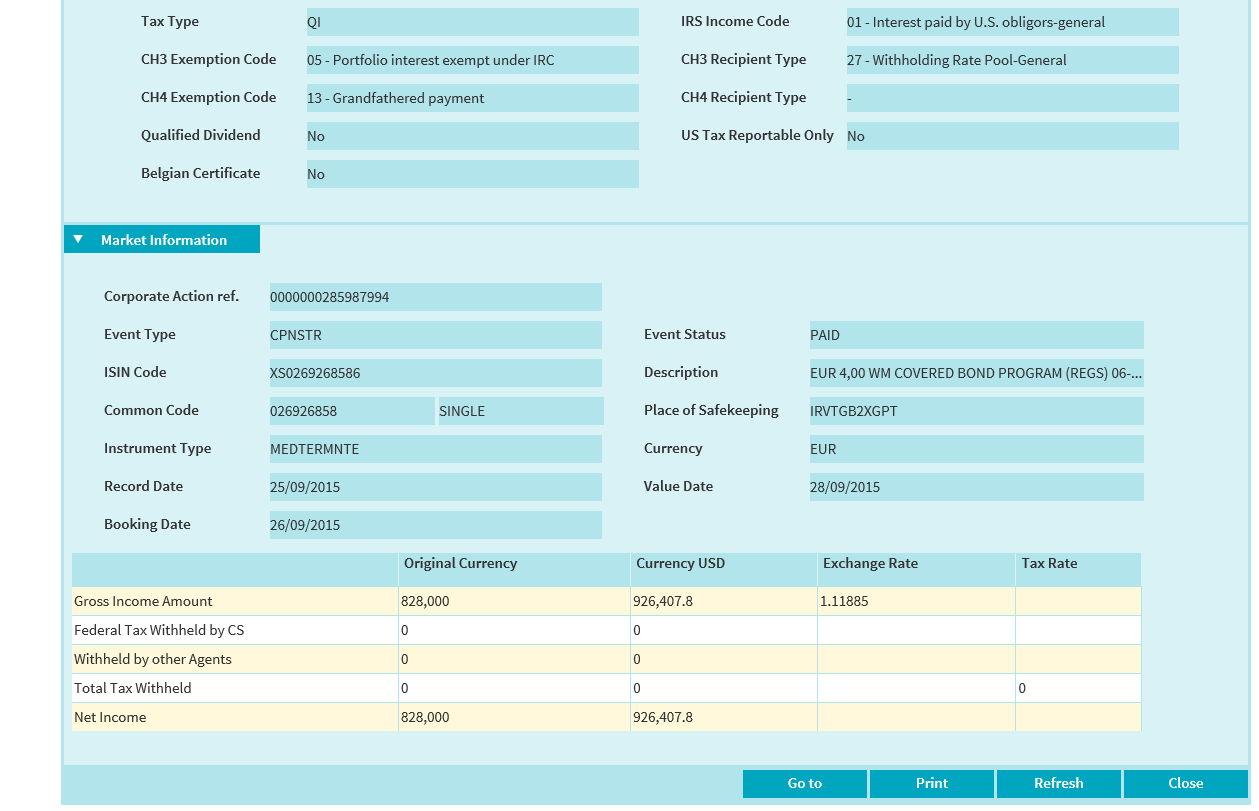

US Tax details view:

| List View Field Name | Description |

| US Tax Reportable Only | Indicates whether the tax payment is reportable to US tax authorities or not. |

| Belgian Certificate | Indicates whether the tax payment is related to a Belgian certificate of a US security or not |

| Corporate Action ref. | Corporate action reference |

| Event Type | Event type |

| Event Status | Event status[1] |

| ISIN Code | Identification of the financial instrument using the ISIN Code |

| Description |

Description of the financial instrument Will be “UNPUBLISHED” for unpublished securities. |

| Common Code | Identification of the financial instrument using the Common Code |

| Common Code (Type) | Home, Remote or Single |

| Place of Safekeeping | |

| Instrument Type | Type of the financial instrument. Decoded in full name |

| Currency | Currency of the Financial Instrument |

| Record Date | Event record date |

| Value Date | Income payment value date |

| Booking Date | Payment booking date |

|

Columns names

|

XXX the Currency of the payment |

| Gross Income Amount – Original Currency | Gross income amount in the original currency |

| Gross Income Amount – Currency USD | Gross income amount in USD |

| Gross Income Amount – Exchange Rate | Foreign exchange rate |

| Federal Tax Withheld by Clearstream – Original Currency | Amount of tax withheld in original currency by Clearstream |

| Federal Tax Withheld by Clearstream – Currency USD | Amount of tax withheld in USD by Clearstream |

| Withheld by Other Agents – Original Currency | Amount of tax withheld in original currency by Clearstream |

| Withheld by Other Agents – Currency USD | Amount of tax withheld in USD by Clearstream |

| Total Tax Withheld - Original Currency | Amount of tax withheld in original currency |

| Total Tax Withheld - Currency USD | Amount of tax withheld in USD |

| Total Tax Withheld - Tax Rate | Tax rate |

| Net Income – Original Currency | Net income amount in the original currency |

| Net Income – Currency USD | Net income amount in USD |