Summary

The Tax Refund query allows you to retrieve the related data.

You can refine your query by specifying particular parameters.

By default, the returned list view is in ascending order

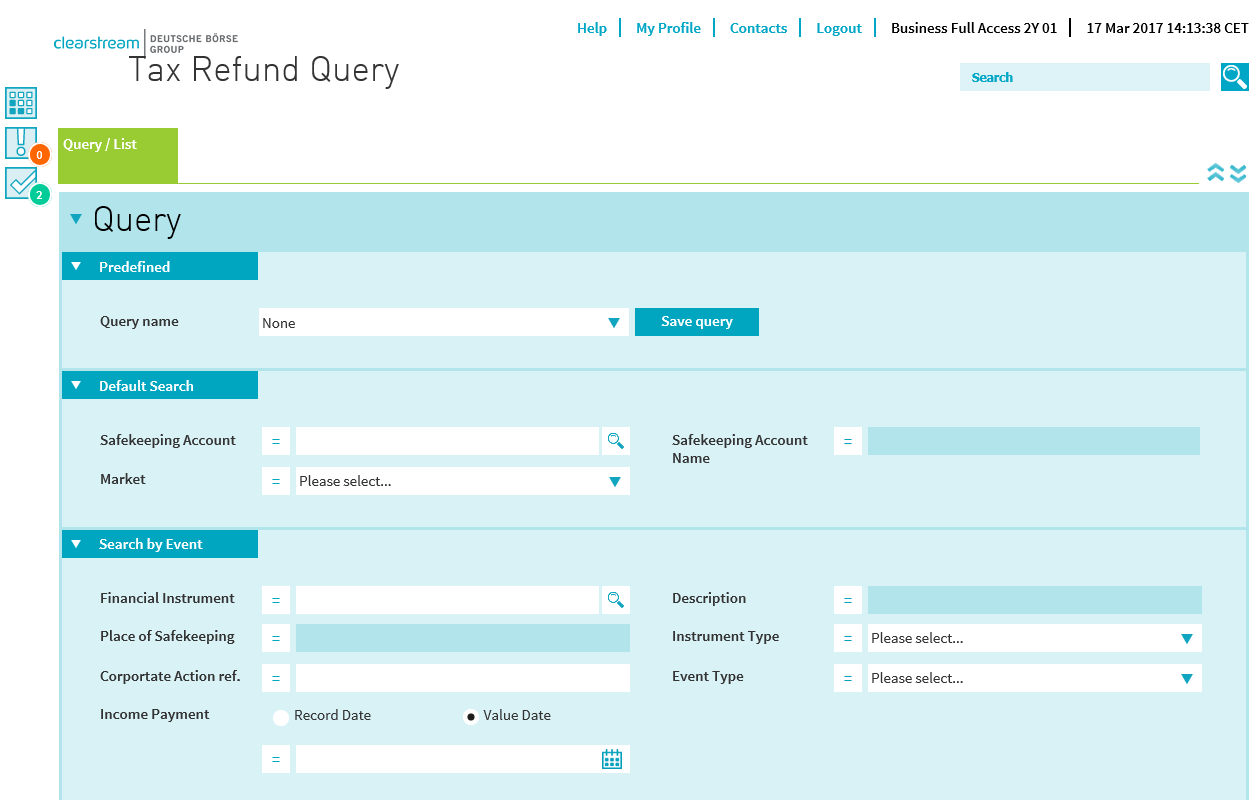

Tax Refund Query

The Predefined section in the US Tax query gives the ability to save and manage your own queries.

Field Description

| Filed Name | Field Type | Description |

| Query name | Drop Down (simple select) | This field contains all saved queries name that you are able to select. |

Predefined Actions Description

| Action Name | Action Type | Description |

| Save query | Button | When clicking on the action button, a pop up will appears asking you to provide a name and description to the query that you are saving. All the query parameters takes into account in the query saved. |

| Delete query | Button | This will allows you to delete your saved queries. |

| Set as default | Button | Once clicking on this button action, you will set the query, specified in the "Query name" field, will execute by default when you land the US Tax query. The query executes automatically. |

Field Description

| Filed Name | Field Type | Description |

| Query name | Select one menu | Any |

| Safekeeping Account | Input text | Contains the account id input by the user or selected via the lookup. |

| Safekeeping Account Name | Output text | Contains the name of the account selected. This field is not editable. |

| Market | Select many list box |

The list will contain the markets (countries names) activated in Tax Application:

|

| Financial Instrument | Input text |

Contains the ISIN of the instrument input by the user or selected via the lookup (to access to all financial instruments). Input of multiple Financial instruments is allowed. |

| Description | Output text | This non editable field displays the instrument's description, once a selection has been made via the financial instrument lookup or manually. |

| Place of Safekeeping | Output text | This non editable field displays the place of safekeeping related to the Financial Instrument ID selected, once a selection has been made via the financial instrument lookup or manually. |

| Corporate Action ref. | Input text | Any (16 character maximum). |

| Event Type | Select many list box |

Drop down list containing the event type codes valid for Tax Refunds:

|

| Instrument Type | Select many list box |

Breakdown of instruments categories. The following decodes will be shown in the drop down list:

|

| Income Payment | Radio button (group) |

Group of two radio buttons:

Record Date = The date at which, after the daytime processing, Clearstream Banking records holdings in the security as being an entitled position. Value Date = Value date applied to the proceeds |

| Income Payment | Date picker | Search on date type selected. |

| Refund Procedure Type | Select many list box |

Drop down list of types of refund procedures:

|

| Reference | Radio button (group) |

A radio button group to determine whether customer wants to use Clearstream reference or his own reference to query. The group has the following values:

|

| Reference | Input text |

This can be either the Customer reference, either the Clearstream reference depending on the radio button selected by the user. This field supports only the exact reference. This means that no wildcard must be implemented by the backend for this field. |

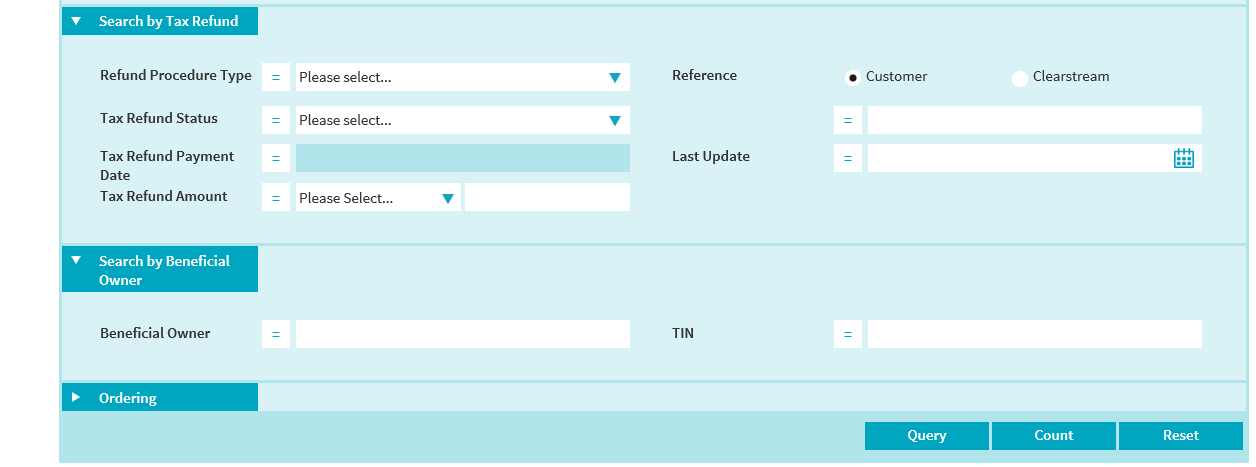

| Tax Refund Status | Select many list box |

Drop down list of Refund Status. The list will contain the following values :

|

| Last Update | Date picker |

Allows the end-user to query in “a delta mode” i.e. to query Tax Refunds that have had their status changed within the requested time interval. |

| Tax Refund Payment Date | Date picker | Date format |

| Tax Refund Amount | Select one menu | Drop-down list of valid currencies. |

| Tax Refund Amount | Input Text 15d (max. 2 decimals allowed) | |

| Beneficial Owner | Input text (wildcard, at least 3 alphanumeric characters must be entered.) |

The search of the beneficial owner must be limited to the beneficial owners linked to the Account(s) and Market(s) selected. |

| TIN | Input text |

The Taxpayer Identification Number. This number can be a social security number assigned to individuals by the Social Security Administration or an Employer Identification Number assigned to businesses and other entities by local fiscal authorities. An exact value must be typed in by the end-user. |

Field Description

| Filed Name | Field Type | Description |

| Sort by | Select one menu | It contains the complete list of visible columns in the specific List view. |

| Then by | Select one menu | It contains the complete list of visible columns in the specific List view. |

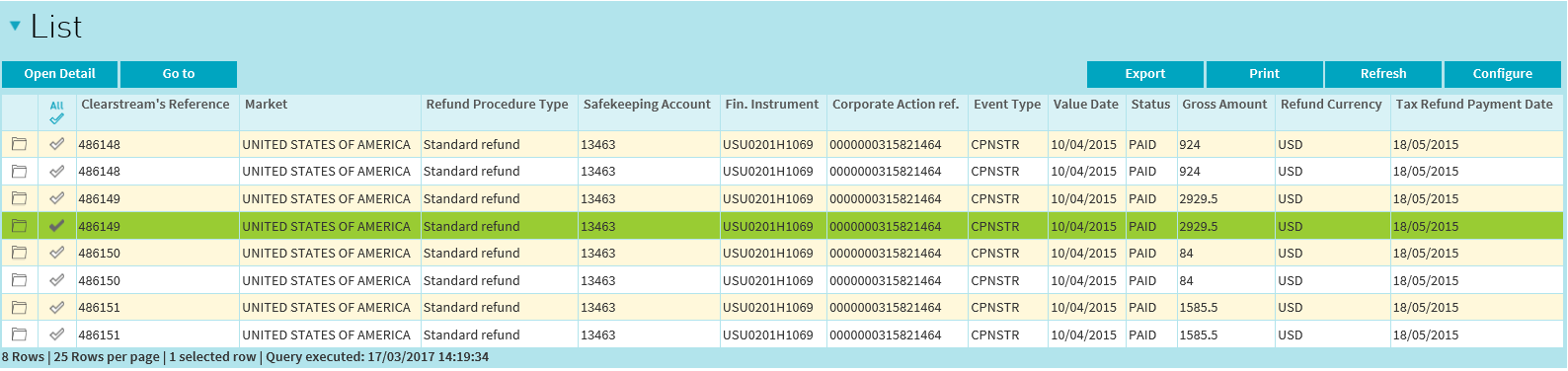

Once the query has executed, you are prompted with the list of US Tax related to the query parameters provided.

The list view is composed with:

Fields Description

Below is the list of fields displayed (by default or by adding them with the “Configure” option to add more fields):

| List View Field Name | Fields displayed by default or configured |

| Clearstream’s Reference | Default field |

| Market | Default field |

| Refund Procedure Type | Default field |

| Safekeeping Account | Default field |

| Fin. Instrument | Default field |

| Common Code | Configure List |

| Instrument Type | Configure List |

| Place of Safekeeping | Configure List |

| Corporate Action ref. | Default field |

| Event Type | Default field |

| Value Date | Default field |

| Status | Default field |

| Reclaim Holding | Configure List |

| Holding Currency | Configure List |

| Gross Amount | Default field |

| Payment Currency | Configure List |

| Refund Rate | Configure List |

| Tax Refund Amount | Configure List |

| Refund Currency | Default field |

| Tax Refund Payment Date | Default field |

| Beneficial Owner | Configure List |

| TIN | Configure List |

| Customer Reference | Configure List |

List View Actions Description

| Action Name | Action Type | Description |

| Export - all | Button | it will export all the rows returned by the query (whatever if selected or not). |

| Export - list | Button | it will export the current list displayed at the screen. |

| Export - selected | Button | it will export the selected rows |

| Print - all | Button | it will print all the rows returned by the query (whatever if selected or not). |

| Print - list | Button | it will print the current list displayed at the screen. |

| Print - selected | Button | it will print the selected rows |

| Refresh | Button | it will re-execute the current query and will refresh the rows displayed. |

| Configure | Button | it will allow you to configure the column that you want to display in the list view |

Open Details

When the user click on one line then another button is displayed, i.e. “Open Details” which brings you to the full detail view of that selected item

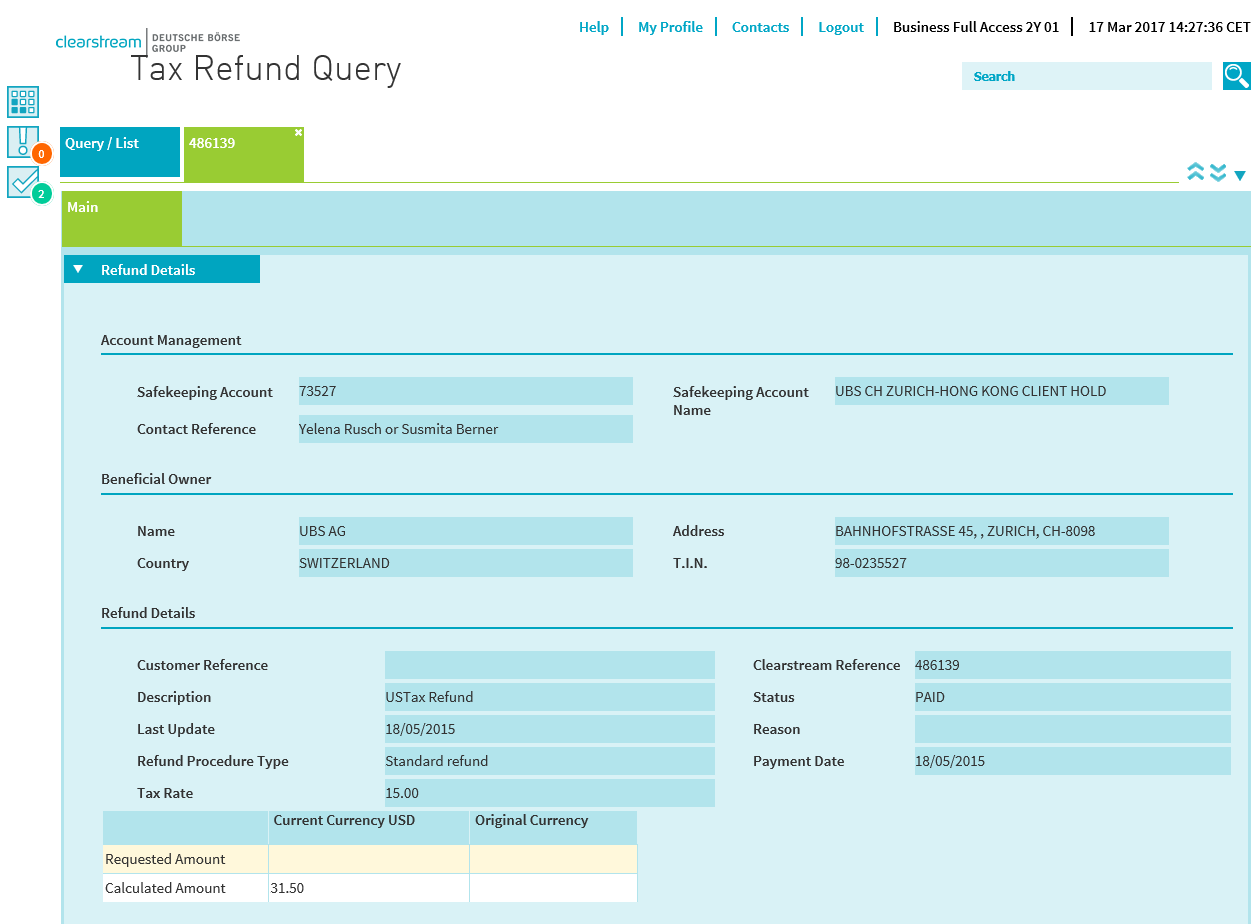

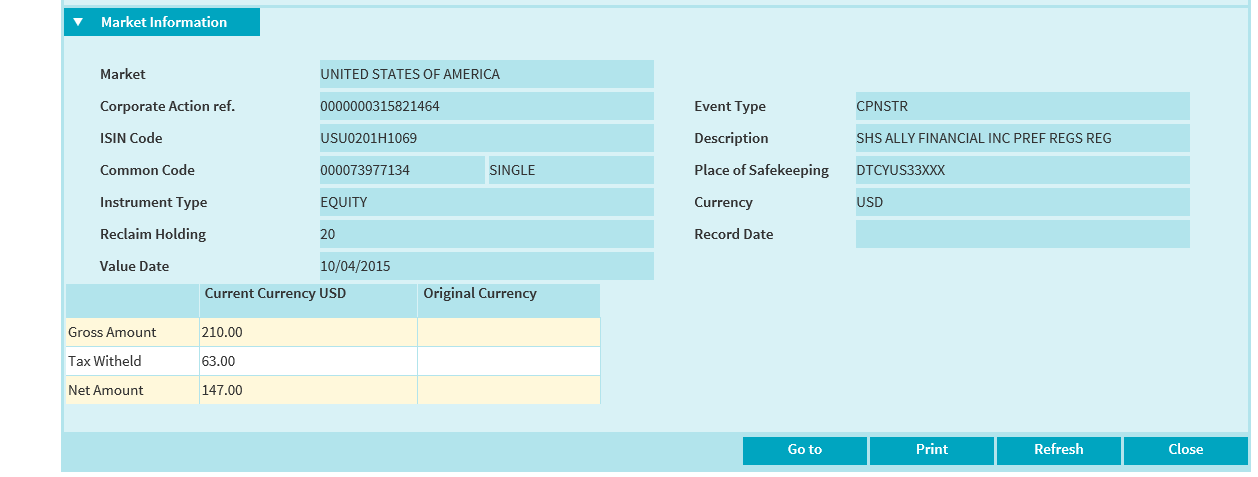

Tax Refund details view:

| List View Field Name | Description |

| Safekeeping Account | The Clearstream Account Number Associated with the Tax Refund |

| Safekeeping Account Name | The Safekeeping Account Name Associated with the Tax Refund |

| Contact Reference | Name of the contact people for this Refund |

| Name | Name of the Beneficial Owner |

| Address | Address of the Beneficial Owner |

| Country | Country of the Beneficial Owner. Decoded |

| T.I.N. | Tax Identification Number of the beneficial |

| Clearstream Reference | Clearstream's reference of the Refund |

| Customer Reference | Customer's reference of the refund |

| Description | Description of the refund |

| Status | Status of the Refund |

| Last Update | Date of the last change of Status. |

| Reason | Status reason chosen from reason list by the user. |

| Refund Procedure Type | Type of procedure used for the refund |

| Payment Date | Value Date of the Tax Refund. Null if not refunded yet. |

| Tax Rate | The applicable reclaim rate of the refund, which is function of the applicable double tax treaty. |

|

Columns names

|

XXX the Currency of the refunded amount and the requested amount. YYY the Currency of the original amount and the original requested amount. If populated, that means the Refund Details Amount Currency is EUR. |

| Requested Amount – Current Currency | Amount that the customer estimates to be credited. |

| Requested Amount – Original Currency | Amount that the customer estimates to be credited in original currency (if it is an ex-EURO currency) |

| Calculated Amount – Current Currency | Amount effectively credited, net of fees charged by the market but does not include Clearstream fees. |

| Calculated Amount – Original Currency | Amount effectively credited, net of fees charged by the market but does not include Clearstream fees. credited in original currency (if it is an ex-EURO currency) |

| Market | Country Name of the Market. Decoded in full name. Please refer to section 10.3.2. |

| Corporate Action ref. | Corporate action reference associated to this refund. |

| Event Type | Type of event associated to this refund. Please refer to Section 10.3.1 for list of codes and decodes. |

| ISIN Code | Identification of the financial instrument using the ISIN Code |

| Description |

Description of the financial instrument Will be “UNPUBLISHED” for unpublished securities. |

| Common Code | Identification of the financial instrument using the Common Code |

| Common Code (Type) | The type (i.e. ‘Single’, ‘Home’ or ‘Remote’) of the Common Code of the Financial Instrument |

| Place of Safekeeping | The BIC + the name of the place of safekeeping of the financial instrument. |

| Instrument Type | Type of the financial instrument. Decoded in full name |

| Currency | Currency of the financial instrument |

| Reclaim Holding |

Holding Quantity of the beneficial Owner or of the Account if no beneficial owner specified. |

| Record Date | Record Date = The date at which, after the daytime processing, Clearstream Banking records holdings in the security as being an entitled position. |

| Value Date | Value Date = Value date applied to the proceeds |

|

Columns names

|

XXX which is always the currency of the security. YYY the Currency of the original amount if ex-EURO. |

| Gross Amount – Current Currency | Holding Quantity * Income amount/Rate |

| Gross Amount – Original Currency | Holding Quantity * Income amount/Rate. In ex-EURO Currency |

| Tax Withheld – Current Currency | Gross Amount * Tax Rate |

| Tax Withheld – Original Currency | Gross Amount * Tax Rate. In ex-EURO Currency |

| Net Amount – Current Currency | Gross Amount – Tax. In ex-EURO Currency |

| Net Amount – Original Currency | Gross Amount – Tax. In ex-EURO Currency |